S&P Launches Digital Markets 50 Index to Track Crypto and Blockchain Stocks

S&P Global is diving deeper into the world of digital assets with its new Digital Markets 50 Index, which tracks both cryptocurrencies and blockchain-linked stocks. The move signals growing institutional acceptance of crypto’s role in the global financial landscape.

- S&P introduces the Digital Markets 50 Index featuring 15 cryptocurrencies and 35 blockchain companies.

- Each component is capped at 5% to ensure balanced exposure.

- Partnered with Dinari, which will issue a tokenized “dShare” version of the index.

- The index could pave the way for future crypto-based ETFs.

- Marks a significant step toward merging traditional finance and blockchain technology.

S&P Global has officially unveiled the Digital Markets 50 Index, a new benchmark designed to track the performance of leading cryptocurrencies and publicly traded blockchain-related firms. Developed in collaboration with tokenization company Dinari, the index represents one of the clearest signs yet that the traditional financial sector is embracing digital assets.

The index includes 15 cryptocurrencies with a market capitalization of at least $300 million and 35 blockchain-focused stocks with a market cap of at least $100 million. No single component will account for more than 5% of the index, ensuring a diversified representation of the digital economy.

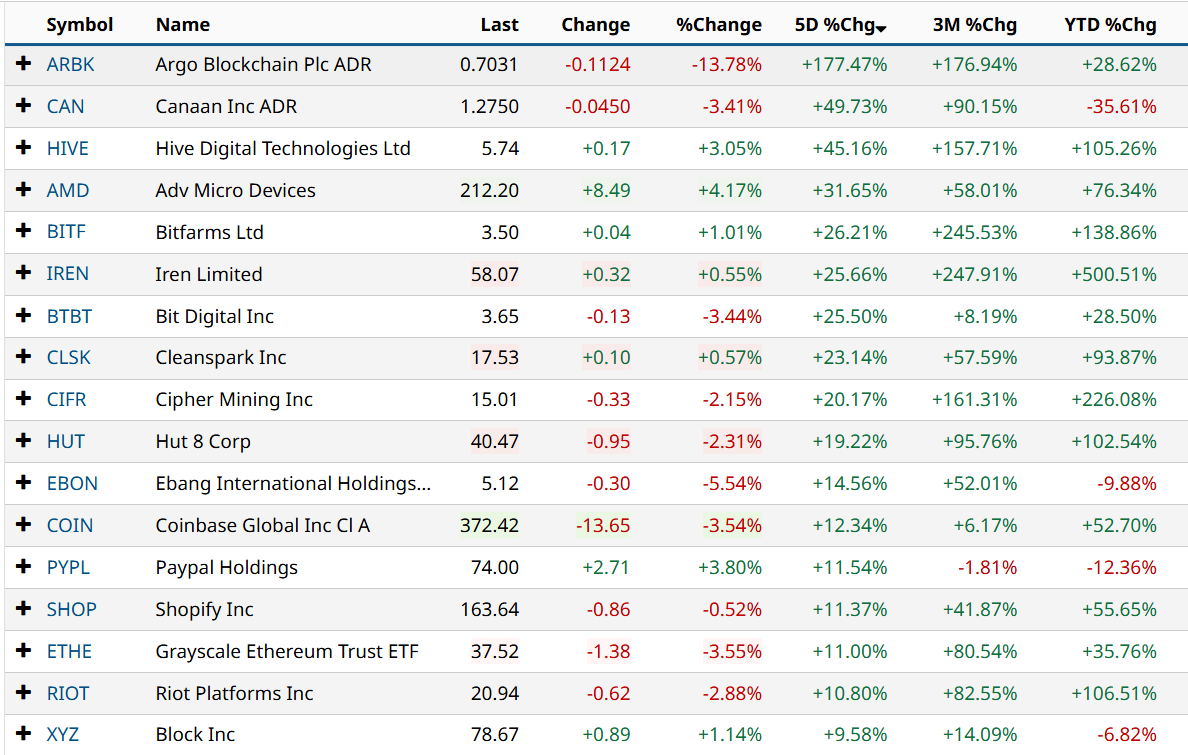

Although S&P has not yet disclosed the specific assets included, it is expected to feature major industry players like MicroStrategy (MSTR), Coinbase (COIN), and Riot Platforms (RIOT) — companies deeply tied to Bitcoin mining, exchanges, and blockchain infrastructure.

Cameron Drinkwater, Chief Product and Operations Officer at S&P Dow Jones Indices, noted that the evolution of crypto has shifted it “from the margins into a more established role in global markets.” He emphasized that the index will serve as a key benchmark for investors looking to track and analyze the growing digital asset ecosystem.

While investors cannot directly invest in indexes, they often serve as the foundation for exchange-traded funds (ETFs) and other structured financial products. Dinari plans to issue a tokenized version of the Digital Markets 50 Index, called a “dShare,” later this year. This innovation will allow investors to gain direct exposure to the index’s performance through blockchain-based instruments.

Industry experts see this as a potential precursor to a new wave of passive crypto ETFs, similar to how the SPDR S&P 500 ETF tracks traditional equities. Existing crypto index funds, such as the Bitwise 10 Crypto Index Fund (BITW) and the Hashdex Nasdaq Crypto Index ETF (NCIQ), have already shown strong investor interest, paving the way for broader adoption of diversified digital asset products.

S&P’s entry into the crypto indexing space also reflects the broader financial trend toward tokenization — converting traditional assets into blockchain-based tokens. The U.S. Securities and Exchange Commission (SEC) is reportedly exploring new frameworks that could enable tokenized trading of stocks, bonds, and other assets, signaling the continued convergence of digital and traditional finance.

Final Thought

The launch of S&P’s Digital Markets 50 Index marks a defining moment for crypto’s integration into global markets. As tokenized investment products gain traction and major institutions embrace blockchain, the lines between traditional finance and digital assets are blurring faster than ever.