SpaceX Transfers $257M in Bitcoin, Fueling Speculation About Its Crypto Strategy

- SpaceX moved $257 million worth of Bitcoin – its second major transfer in three months.

- The two transactions, totaling over $250 million, came from wallets labeled “1MDyM” and “1AXeF.”

- The move has reignited speculation about whether SpaceX is selling or repositioning its crypto holdings.

- The transfers come as SpaceX faces growing competition and pressure from NASA’s new lunar contract strategy.

- Elon Musk’s mixed relationship with Bitcoin continues to draw attention to the company’s crypto holdings.

Elon Musk’s aerospace company, SpaceX, has transferred $257 million worth of Bitcoin, marking its second large-scale wallet movement in three months. The transfers, made on Tuesday, have reignited speculation that SpaceX could be selling or repositioning its crypto assets as it faces mounting financial and competitive pressures.

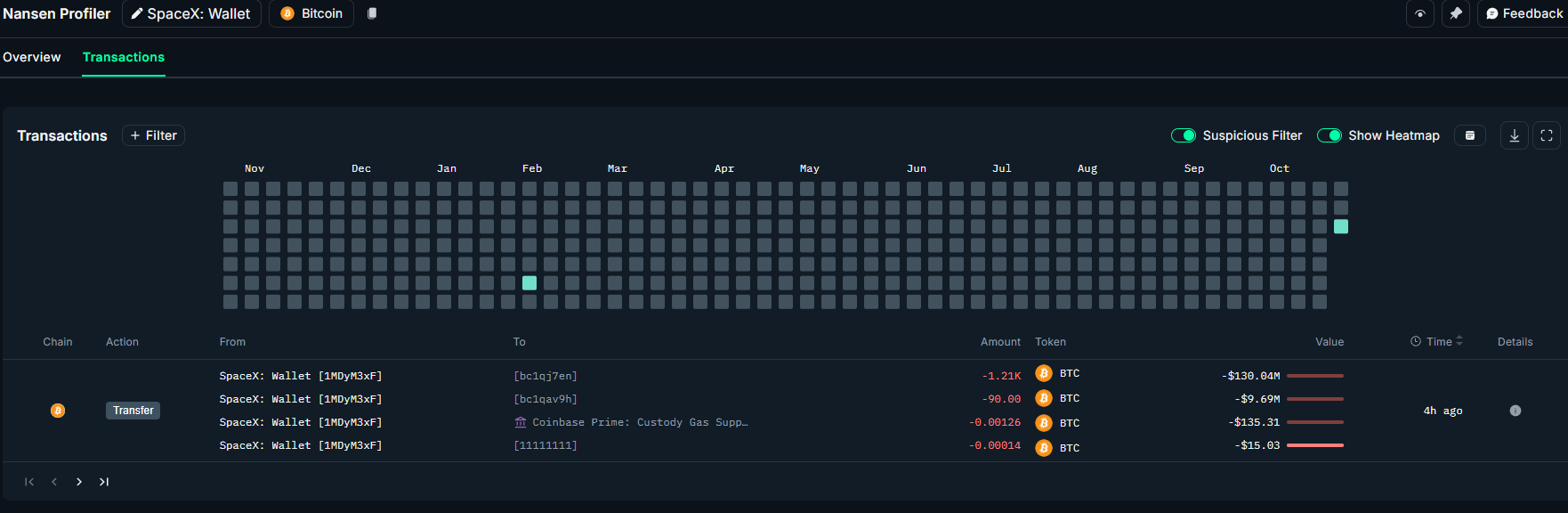

According to blockchain analytics firm Nansen, the wallet labeled “1MDyM” sent $130 million in BTC to address “bc1qj”, while another SpaceX-linked wallet, “1AXeF,” transferred $127 million to “bc1qq.” Both receiving addresses have yet to move or sell the Bitcoin, and SpaceX has not issued any official comment about the motive behind these transfers.

The move follows SpaceX’s previous transfer of $153 million in Bitcoin in July, which marked the company’s first significant onchain movement since 2022. This pattern of large, infrequent Bitcoin transactions has fueled market speculation that the firm could be liquidating or reallocating part of its treasury holdings, particularly as it prepares for new financial and engineering milestones.

Elon Musk’s relationship with Bitcoin remains complex. SpaceX first disclosed its Bitcoin holdings in July 2021, shortly after Tesla’s $1.5 billion BTC purchase earlier that year. However, in May 2021, Tesla suspended Bitcoin payments for vehicle purchases, citing environmental concerns over mining’s carbon footprint – a decision that sent Bitcoin’s price tumbling 6% in one hour. Although Tesla has held onto most of its Bitcoin, the company has not resumed crypto payments, despite Musk’s earlier pledge to reconsider once mining became more reliant on renewable energy.

Recent data from climate tech investor Daniel Batten and Bitcoin analyst Willy Woo shows that Bitcoin mining’s sustainable energy usage has surpassed 55%, its highest level to date. This milestone could renew discussions around Tesla and SpaceX’s crypto strategies, particularly if Musk views it as aligning with his renewable energy goals.

At the same time, SpaceX is under increasing competitive and political pressure. On Monday, NASA’s acting chief Sean Duffy announced that the agency will open its moon lander contract to other competitors beyond SpaceX, citing delays in the Starship lunar lander timeline. “We are competing with China, so we need the best company to let us land on the moon as soon as possible,” Duffy told CNBC.

SpaceX initially won the $4.4 billion NASA contract in 2021 to build the Human Landing System (HLS) with a target moon landing in 2027. However, delays and cost overruns have led NASA to invite bids from rivals such as Blue Origin and Lockheed Martin, intensifying competition in the space race.

The renewed scrutiny over SpaceX’s Bitcoin movements adds another layer of intrigue to the company’s financial posture. While the reason behind the transfers remains unclear, analysts suggest they could represent internal reorganization, liquidity management, or a strategic hedge amid market uncertainty. Regardless of motive, the timing – coinciding with broader geopolitical and business challenges – has fueled fresh curiosity about SpaceX’s long-term crypto strategy.

Final Thought

SpaceX’s $257 million Bitcoin transfer highlights the continued intersection between cutting-edge aerospace innovation and digital finance. Whether these movements represent simple treasury management or a more strategic repositioning, the timing has raised eyebrows across both industries. As SpaceX navigates mounting competition, financial demands, and Elon Musk’s evolving crypto stance, its Bitcoin holdings may once again play a quiet yet significant role in the company’s broader strategy.