Standard Chartered Predicts $2 Trillion in Tokenized Real-World Assets by 2028

- Standard Chartered projects $2 trillion in tokenized real-world assets (RWAs) by 2028

- Growth driven by DeFi adoption, blockchain efficiency, and stablecoin liquidity

- Forecast includes $750B in money-market funds and $750B in tokenized US stocks

- Remaining capital to flow into private equity, commodities, and real estate

- Stablecoins hit $300B market cap, fueling a self-sustaining DeFi growth cycle

- Regulatory clarity remains the biggest hurdle for long-term expansion

Global banking giant Standard Chartered expects the value of tokenized real-world assets (RWAs) to hit $2 trillion by 2028, signaling one of the most significant transformations in finance as blockchain adoption accelerates worldwide.

In a detailed report shared with Cointelegraph, Standard Chartered explained that decentralized finance (DeFi) is evolving beyond speculation — with real-world asset tokenization becoming the next major growth frontier. By bringing traditional financial instruments like bonds, equities, and real estate onchain, the industry is setting the stage for a new era of capital efficiency and borderless liquidity.

The report highlights that DeFi’s trustless architecture — where transactions are executed via smart contracts instead of centralized intermediaries — poses a growing challenge to traditional finance (TradFi). As institutions seek transparency, faster settlement, and lower costs, the shift toward tokenization is expected to accelerate sharply in the next three years.

According to Standard Chartered’s projections, out of the $2 trillion in tokenized assets, around $750 billion will come from money-market funds, another $750 billion from tokenized U.S. stocks, $250 billion from tokenized U.S. funds, and the remaining $250 billion from less liquid assets such as private equity, commodities, and real estate.

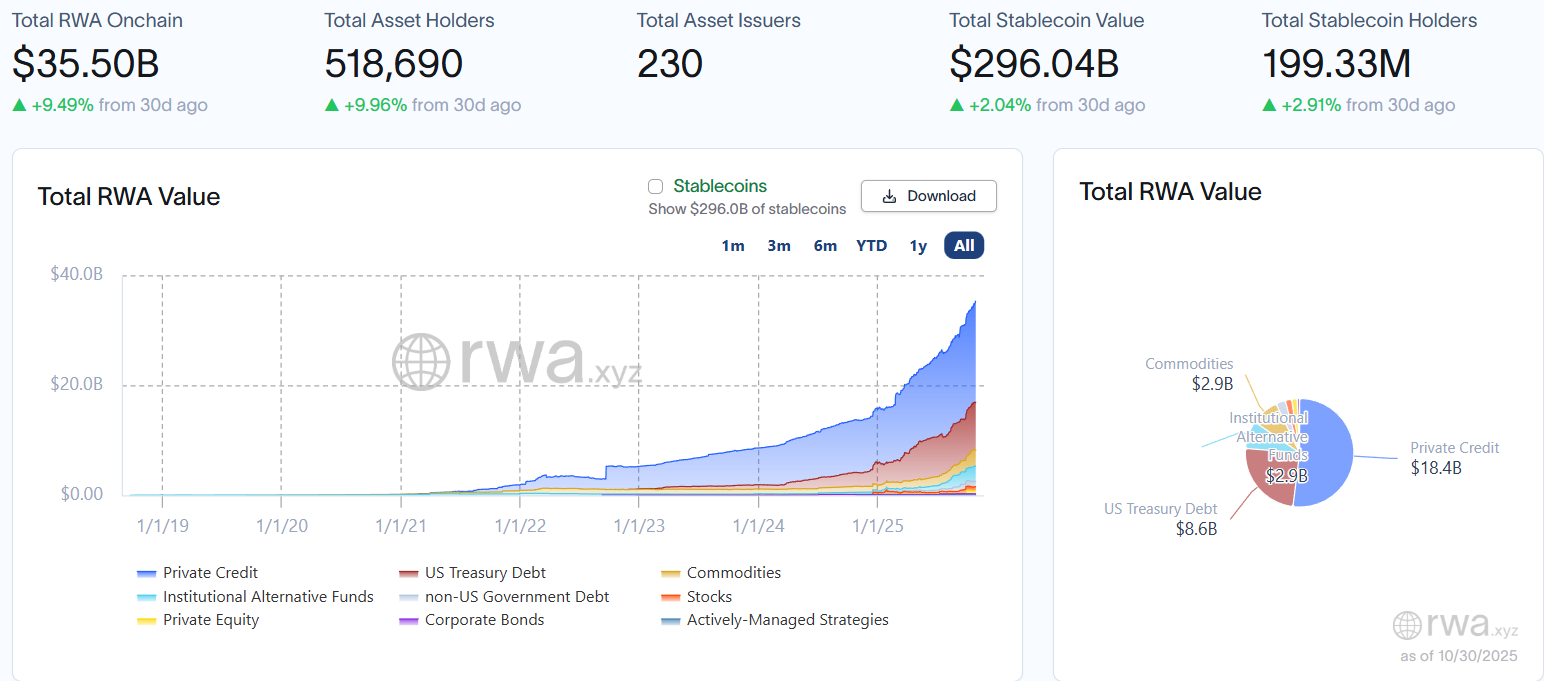

At present, the total value of tokenized RWAs is around $35 billion, according to data from RWA.xyz. If the forecast holds true, that represents a 57x increase in just three years — a clear sign of growing institutional interest in onchain finance.

The report credits much of this growth to stablecoins, which serve as the foundation of the DeFi ecosystem. As of early October, the total stablecoin supply surpassed $300 billion, a 46.8% increase since the start of the year. Standard Chartered’s head of digital assets research, Geoff Kendrick, emphasized that stablecoins are critical to DeFi’s next phase:

“Stablecoin liquidity and DeFi banking are important prerequisites for the rapid expansion of tokenized RWAs. We expect exponential growth in the coming years.”

Kendrick added that DeFi is entering a “self-sustaining growth cycle”, where liquidity drives innovation, and innovation attracts even more liquidity. This cycle, he explained, will help DeFi evolve into a mainstream financial system with real-world applications.

However, the report also warned that regulatory uncertainty remains the biggest threat to this vision. Progress could stall if the U.S. fails to deliver comprehensive crypto regulation, particularly if political shifts delay policy clarity. Standard Chartered pointed to the upcoming 2026 midterm elections as a key milestone for potential regulatory decisions that could shape the next stage of DeFi and tokenization growth.

Final Thought

Standard Chartered’s bold forecast of $2 trillion in tokenized RWAs by 2028 highlights how fast traditional finance is merging with blockchain. With stablecoins fueling DeFi’s liquidity loop and major institutions joining the race, tokenization could soon rival — or even surpass — the traditional markets it once aimed to disrupt. The key now lies in clear regulations to unlock the full potential of onchain assets.