Strategy’s Bitcoin Treasury Surpasses 660,000 BTC After New $962M Purchase

- Strategy bought 10,624 BTC for $962.7 million at an average price of $90,615

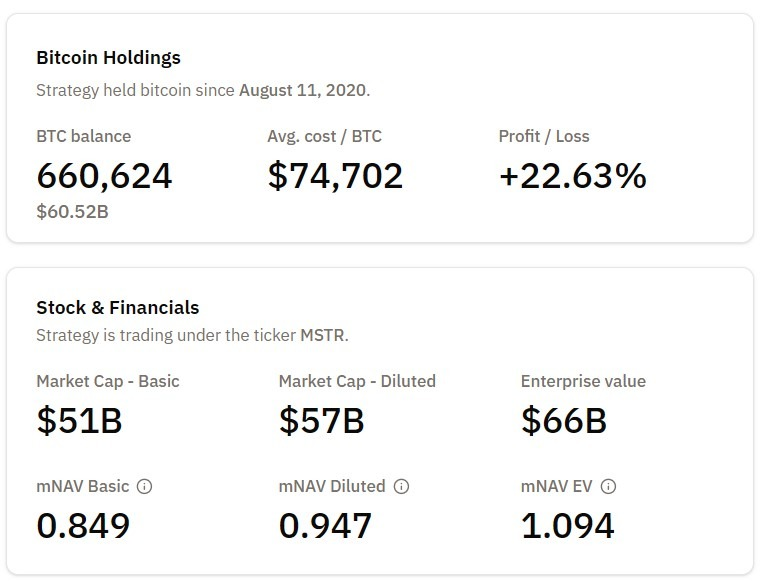

- Total holdings now reach 660,624 BTC, worth roughly $60 billion

- Despite a 51% drop in Strategy’s stock, its BTC position remains 22% above cost basis

- Saylor pitches Bitcoin to global wealth funds as “digital capital”

- Digital asset treasury inflows fell to their lowest level of 2025 in November

- BTC treasuries saw strong inflows, while ETH treasuries recorded $37M in outflows

Strategy has significantly expanded its Bitcoin reserves once again, purchasing 10,624 BTC for approximately $962.7 million. The acquisition brings its total Bitcoin holdings to 660,624 BTC, accumulated at a combined cost of $49.35 billion. Despite market volatility and a steep decline in the company’s share price over the past year, the Bitcoin position remains strongly profitable, currently valued at roughly $60 billion.

The latest purchase comes during a difficult period for Strategy’s equity performance. Shares have traded down more than 50% over the past 12 months, yet the firm continues to lean heavily into its BTC accumulation strategy, maintaining one of the world’s largest corporate Bitcoin treasuries.

Saylor promotes Bitcoin as digital capital

Speaking at the Bitcoin MENA conference in Abu Dhabi, Strategy chairman Michael Saylor said he has been meeting with sovereign wealth funds, banks, family offices and other institutional players to advocate for Bitcoin’s role as “digital capital.”

He described BTC as the foundation for a new financial category he calls digital credit, which aims to deliver yield on top of a base layer of Bitcoin while minimizing volatility. Saylor reiterated that Strategy remains committed to its long-term BTC thesis despite short-term stock fluctuations.

The company recently raised $1.44 billion to address concerns about liquidity, debt servicing and dividend coverage — issues that had generated significant FUD around its stability. According to Strategy executives, the capital raise helps shore up confidence in the company’s ability to sustain its aggressive Bitcoin strategy.

Digital asset treasuries slow sharply in November

Strategy’s latest buy also comes during the weakest month of 2025 for digital asset treasuries.

Data from DefiLlama shows:

- Total inflows into digital asset treasuries fell to $1.32 billion, down 34% from October

- Bitcoin-focused treasuries led with more than $1 billion in inflows, largely driven by Strategy

- Ether-focused treasuries recorded $37 million in outflows, signaling a shift in institutional treasury preference

Despite the slowdown, BTC remains the dominant treasury asset, with Strategy acting as the primary catalyst in November’s inflow numbers.

A shifting institutional landscape

Even with equity volatility, Strategy’s continued BTC accumulation highlights a broader trend: institutions increasingly view Bitcoin as a strategic balance-sheet asset. Rising inflation concerns, global macro uncertainty and the appeal of a non-sovereign store of value are pushing more firms toward Bitcoin reserves.

Strategy’s ongoing acquisitions and Saylor’s institutional outreach suggest that treasury adoption could accelerate as regulatory clarity improves and digital credit markets expand.

Final thought

Strategy’s purchase of nearly $1 billion in Bitcoin reinforces its role as the most aggressive corporate accumulator of BTC. With more than 660,000 BTC under management and a growing push to position Bitcoin as digital capital for global institutions, the company remains central to shaping the future of corporate treasury strategy in the digital asset era.