Strategy Builds $1.4B Cash Reserve and Grows Bitcoin Holdings to 650,000 BTC

- Strategy creates a $1.44 billion USD reserve to cover at least 12 months of dividends.

- Reserve funded through rapid stock sales under its at-the-market program.

- Company buys 130 more BTC, raising its total stash to 650,000 BTC.

- The new reserve is meant to support stability during market volatility.

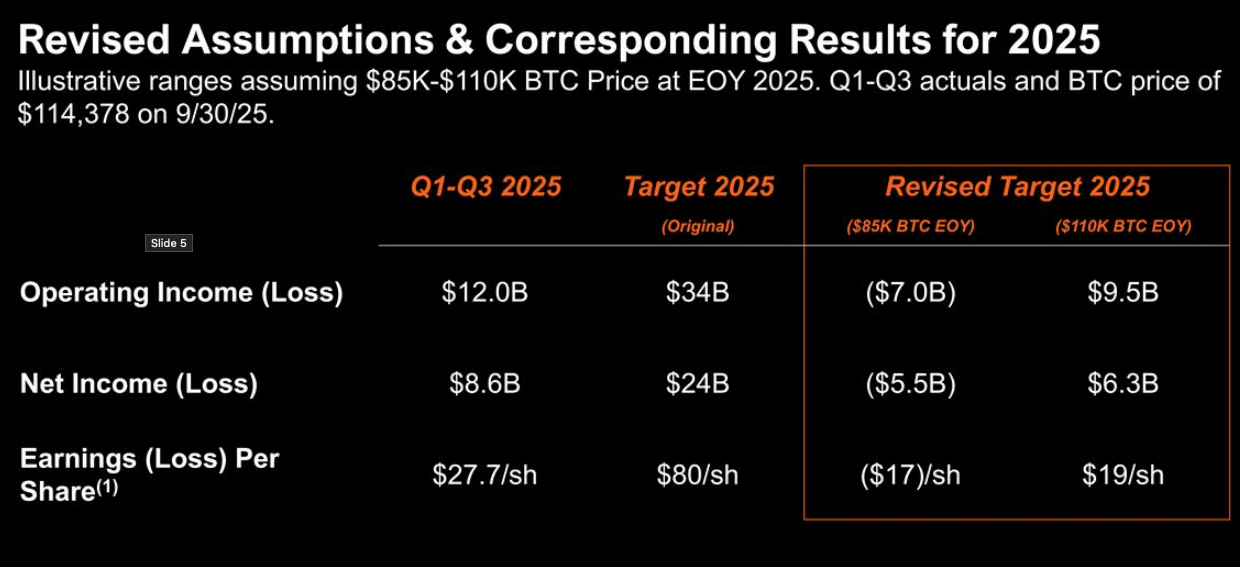

- Strategy lowers its 2025 performance targets, including BTC yield and profit expectations.

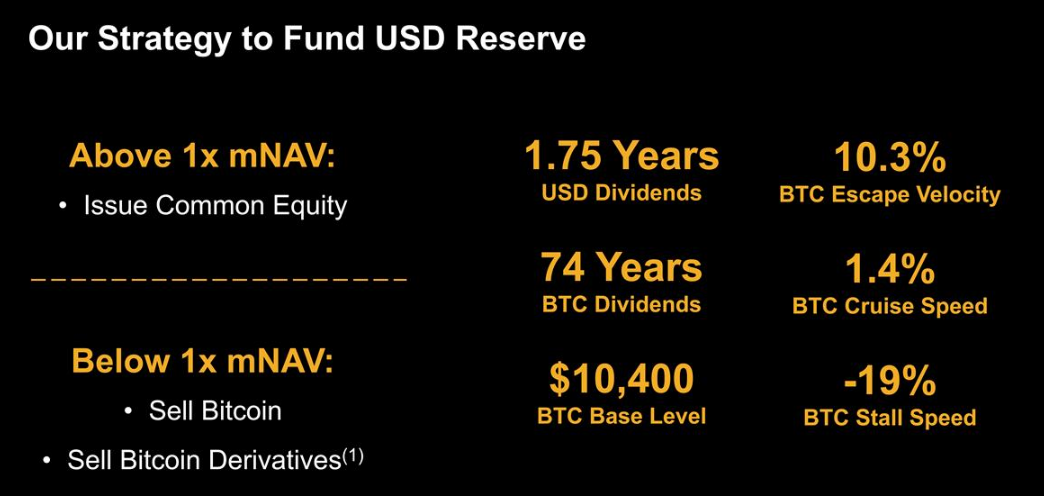

Strategy, led by Michael Saylor, is taking major steps to strengthen its financial position during ongoing Bitcoin market volatility. The company has announced a new $1.44 billion cash reserve, built from recent sales of Class A common stock. This reserve is designed to cover dividend payments for at least 12 months and eventually up to 24 months. According to Strategy, maintaining a strong cash buffer will boost confidence among investors holding its preferred shares, common equity and debt.

Along with improving its financial stability, Strategy is continuing its long-term Bitcoin accumulation strategy. The company disclosed that it recently purchased 130 additional BTC for $11.7 million. This brings its total holdings to 650,000 Bitcoin — around 3.1% of the entire supply that will ever exist. Strategy acquired this massive stash for a combined value of $48.38 billion, reinforcing its position as the world’s largest public holder of BTC.

The new USD reserve is intended to work alongside Strategy’s Bitcoin holdings rather than replace them. Founder Michael Saylor explained that adding a cash reserve gives the company better tools to handle short-term market turbulence without selling Bitcoin. CEO Phong Le noted that the reserve already covers 21 months of dividend payments and strengthens Strategy’s standing in the wider Bitcoin ecosystem.

In its update, Strategy explained that the reserve equals 2.2% of the company’s enterprise value, 2.8% of equity value and 2.4% of the total value of its Bitcoin. Raising $1.44 billion in less than nine trading days shows strong market demand for its MSTR shares, the company added.

However, alongside these strategic moves, Strategy has lowered its expectations for 2025. The firm now projects a BTC yield between 22% and 26%, down from previous estimates. It also expects Bitcoin’s price at the end of 2025 to be in the range of $85,000 to $110,000. Additionally, Strategy cut its target for BTC gains from $20 billion to between $8.4 billion and $12.8 billion. Operating income expectations have also been reduced significantly.

The combination of a major cash reserve, rapid BTC accumulation and realistic revised targets suggests Strategy is preparing for a more cautious market environment while still firmly committed to its Bitcoin-first vision.

Final Thought

Strategy is doubling down on long-term stability by combining a massive BTC position with a strong cash reserve. Even with lowered projections for 2025, the company continues to position itself as a key player in the Bitcoin ecosystem — balancing aggressive accumulation with financial discipline.