Strategy May Sell Bitcoin Only as a Last Resort if mNAV Drops and Capital Dries Up

- Strategy will only sell Bitcoin if its stock falls below net asset value and no new capital is available.

- CEO Phong Le says selling BTC would be a last-resort financial decision, not a change in strategy.

- The company faces annual dividend obligations of $750–$800 million.

- Raising capital at a premium to mNAV remains the main method for funding operations.

- Strategy recently launched a BTC credit dashboard to calm investor concerns.

Strategy CEO Phong Le has clarified that the company would consider selling Bitcoin only under extreme financial pressure. Speaking on the What Bitcoin Did podcast, Le explained that the company’s approach is built around protecting “Bitcoin yield per share,” a metric tied to how much BTC shareholders indirectly hold.

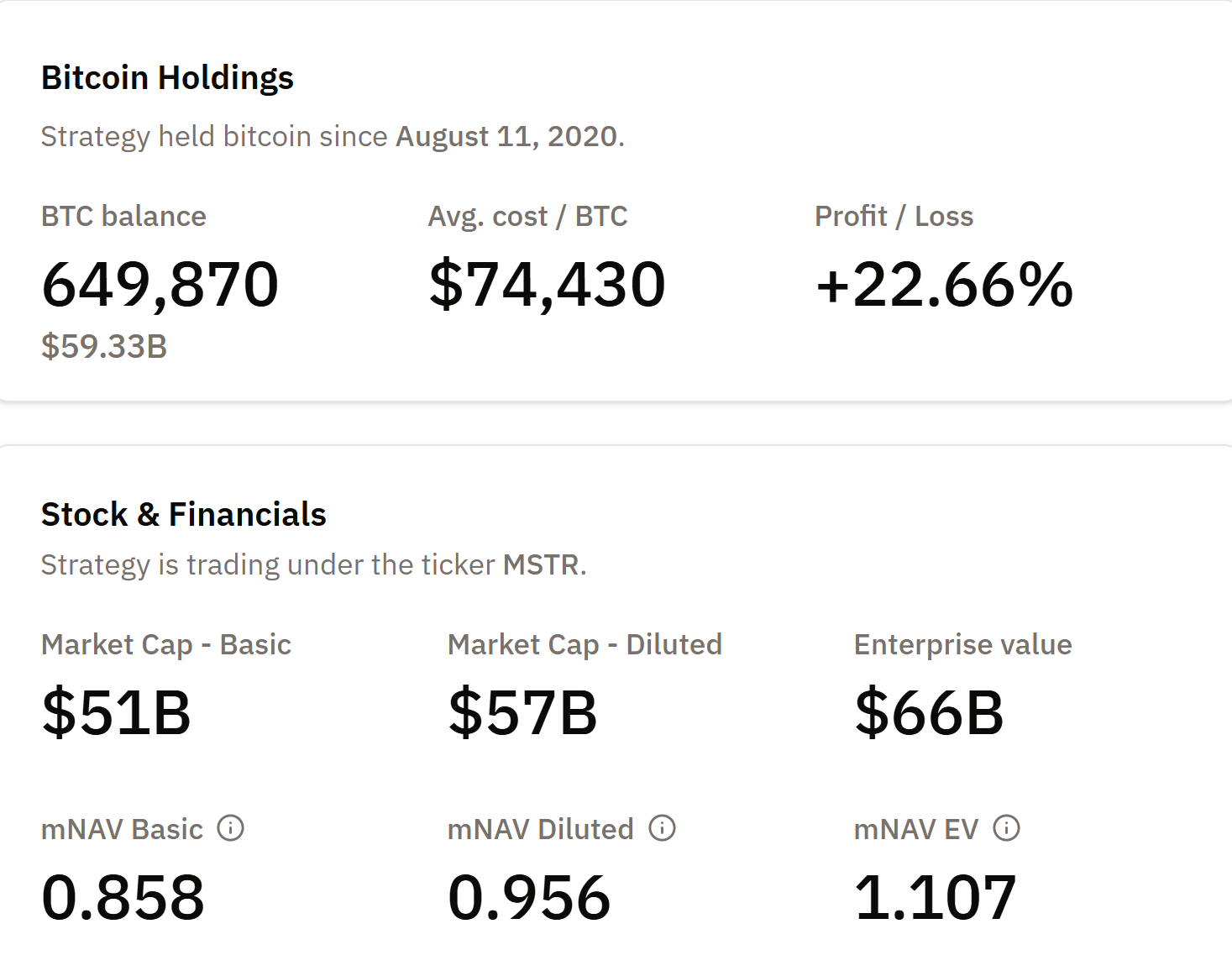

Under normal conditions, Strategy raises capital when its stock trades above net asset value (NAV). That premium allows the company to issue new shares and use the funds to buy more Bitcoin. This model works as long as the company’s multiple to NAV (mNAV) stays above one.

Le explained that if the stock falls below mNAV and Strategy can’t raise additional capital, selling BTC becomes “mathematically” justified. In that scenario, holding Bitcoin without the ability to cover obligations could damage shareholder value. He emphasized that this decision would be a last resort, not a change in Strategy’s core belief in Bitcoin.

The company is under increasing attention because of its growing dividend obligations. Strategy introduced several preferred share instruments this year, creating annual payouts between $750 million and $800 million as these issues mature. Le expects to fund these payments mostly through capital raised at a premium to mNAV. As the market sees consistent dividend payments, he believes investor confidence — and share prices — will stabilize.

Even with these obligations, Le remains confident in Bitcoin’s long-term role as a global, non-sovereign store of value. He highlighted Bitcoin’s appeal across countries like Australia, Ukraine, Argentina, the United States, Vietnam and more, reinforcing its widespread adoption and resilience.

To support investor confidence, Strategy recently launched a BTC Credit dashboard. The dashboard is meant to reassure markets after Bitcoin’s latest price pullback and a broader sell-off in digital-asset treasury stocks. According to the company, its debt remains well-covered even if Bitcoin falls back to its average purchase price of around $74,000 — and still manageable at prices as low as $25,000.

Overall, Strategy continues to build around a long-term Bitcoin accumulation strategy while maintaining financial discipline during periods of market stress.

Final Thought

Strategy remains committed to holding Bitcoin, but the company is prepared to make tough financial decisions if market conditions turn against it. Selling BTC is not the plan — but if mNAV drops and capital becomes unavailable, the company may be forced to act to protect shareholder value.