Strategy weathers Bitcoin crash and stays on track for S&P 500 inclusion

- Matrixport says Strategy is still on track for potential S&P 500 inclusion in 2025

- The recent Bitcoin crash raised concerns, but analysts see no near-term liquidation risk

- Strategy remains the world’s largest corporate Bitcoin holder

- Share price dropped from $474 to around $207 during the correction

- NAV compression is hurting shareholders more than the company itself

- 10X Research estimates a 70% chance of S&P 500 inclusion

- Strategy received a “B-” credit rating from S&P Global — speculative but notable

- Smaller corporate Bitcoin treasuries are under pressure due to falling mNAV ratios

- Strategy claims it can survive 80–90% Bitcoin drawdowns

- Company recently bought 8,178 BTC worth $835M

The recent Bitcoin market crash has renewed doubts about the stability of corporate Bitcoin treasury strategies. But according to a new report from Matrixport, Strategy — the company with the largest Bitcoin holdings on earth — is still positioned for long-term strength and may even secure a spot in the S&P 500 as early as 2025.

Matrixport analysts explained that despite the steep crypto pullback, Strategy is not at risk of forced liquidation. The company’s long-term design allows it to withstand major Bitcoin drawdowns, even as deep as 80–90%, according to executive chair Michael Saylor. Because Strategy does not rely on selling its Bitcoin for operating capital, a crash does not create immediate liquidity problems.

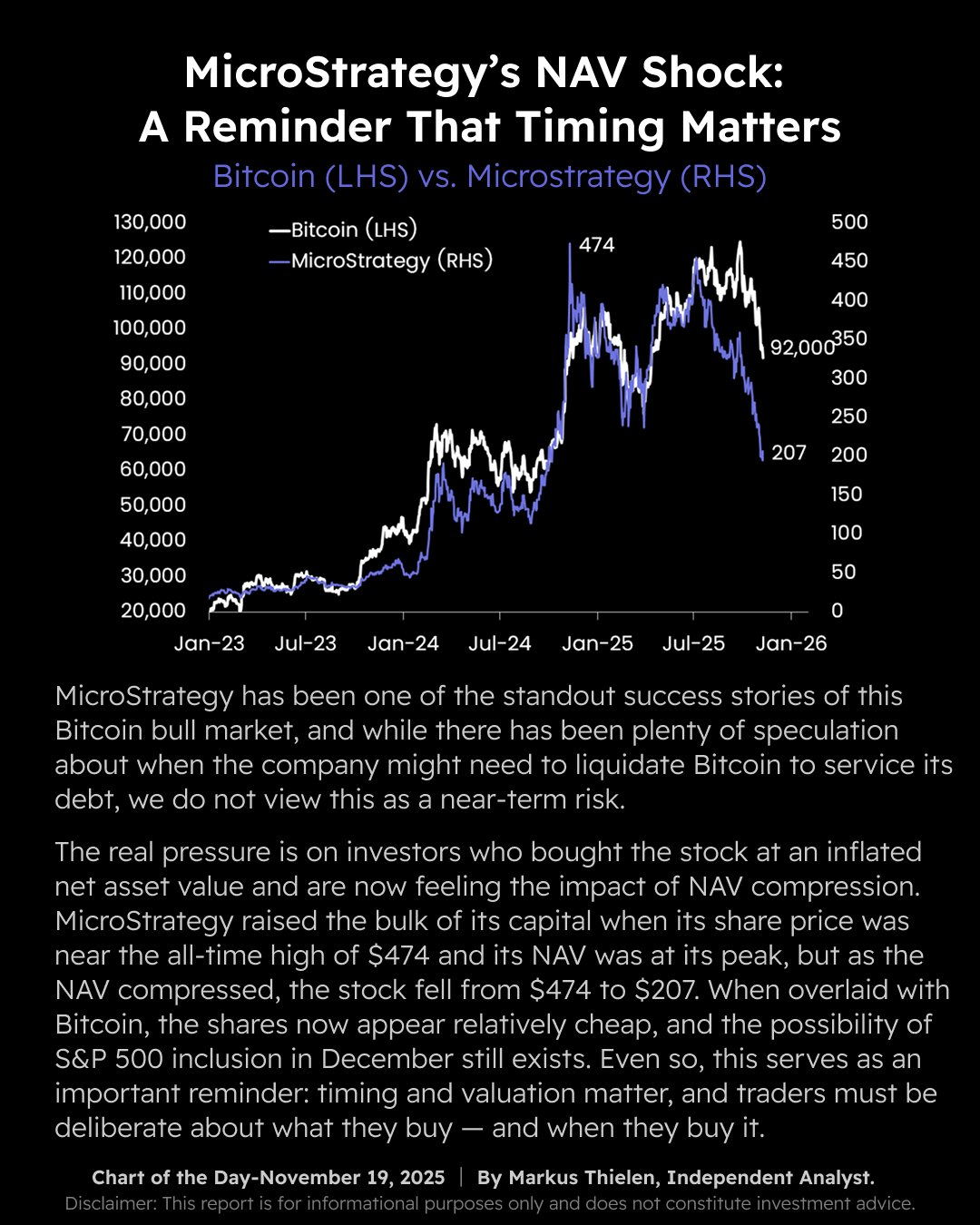

The biggest pain is instead being felt by investors who purchased Strategy stock at a high premium over net asset value. NAV compression has pushed the share price down from its peak of $474 to around $207, making the stock appear relatively cheap when compared with Bitcoin’s price. Matrixport said this price behavior actually strengthens the case for a potential S&P 500 inclusion, since the stock remains large, active, and closely tied to one of the strongest macro trends in global markets.

10X Research also predicted a 70% chance that Strategy will join the S&P 500 before the end of the year, making it the first Bitcoin-focused company to enter the index.

Beyond stock performance, Strategy also received a “B-” rating from S&P Global, placing it in speculative-grade territory but still marking an important milestone: it is the first time an S&P assessment has been applied to a Bitcoin-treasury-driven company. This rating may help set benchmarks for evaluating similar firms in the future.

However, not all crypto-treasury companies are faring as well. Many smaller digital asset treasuries (DATs) have seen their market net asset value (mNAV) fall below the critical level of 1. When mNAV drops under 1, these companies can no longer efficiently raise capital to buy more Bitcoin. Firms like Bitmine, Sharplink Gaming, Upexi, Metaplanet, and DeFi Development Corp have all slipped below this threshold during the market correction.

Meanwhile, Strategy continues to double down. The company recently purchased 8,178 BTC worth $835 million, a much larger weekly allocation than the 400–500 BTC it had been buying in recent months.

Despite market turbulence, both Matrixport and other research firms believe Strategy remains structurally strong and still on the path for possible S&P 500 entry — something that would mark a major milestone for Bitcoin’s presence in traditional markets.

Final Thought

Strategy’s strong balance sheet, long-term Bitcoin strategy and continued accumulation have helped it withstand market volatility. While smaller corporate treasuries face pressure, Strategy’s scale and structure may allow it to secure a historic S&P 500 spot — a major step toward mainstream acceptance of Bitcoin-based treasury models.