TerraUSD and USDe: How Algorithmic Stablecoin Risk Evolved

Key Takeaways

- Algorithmic stablecoin risk defines stability under pressure: UST collapsed through reflexive design, while USDe endured by combining collateral, liquidity, and hedging.

- Collateral anchors confidence: Verified reserves and balanced exposure turn volatility into control.

- Liquidity ensures survival: Deep pools and open redemption keep systems functional during market stress.

- Yield reveals structure: Sustainable returns tied to real markets strengthen trust; artificial yields erode it.

- Infrastructure drives resilience: Accurate oracles, strong exchanges, and transparent data uphold stability.

- Stress exposes truth: The real measure of stability lies in performance when markets shake, not in promises during calm.

In digital finance, the rise and fall of algorithmic stablecoin risk has become one of the defining stories of modern markets. Stablecoins were built on a simple equation, one token equals one dollar, yet that equation carries the weight of an entire ecosystem. It fuels lending, trading, payments, and on-chain liquidity across the crypto economy. When this balance falters, the shock waves reach every layer of digital finance.

Two events captured the full scope of algorithmic stablecoin risk. The first came with the collapse of TerraUSD (UST) in May 2022, which wiped out tens of billions in value and shattered confidence in self-balancing algorithms. The second unfolded in October 2025, when USDe, a synthetic dollar issued by Ethena Labs, momentarily fell to $0.65 amid a $19 billion liquidation storm but ultimately preserved its framework.

This article will examine how these two moments transformed the industry’s grasp of algorithmic stablecoin risk, tracing the shift from fragile experimentation to engineered resilience. It follows the path from collapse to recovery, revealing how stability in crypto has evolved from a promise to a proven discipline.

What Is Algorithmic Stablecoin Risk?

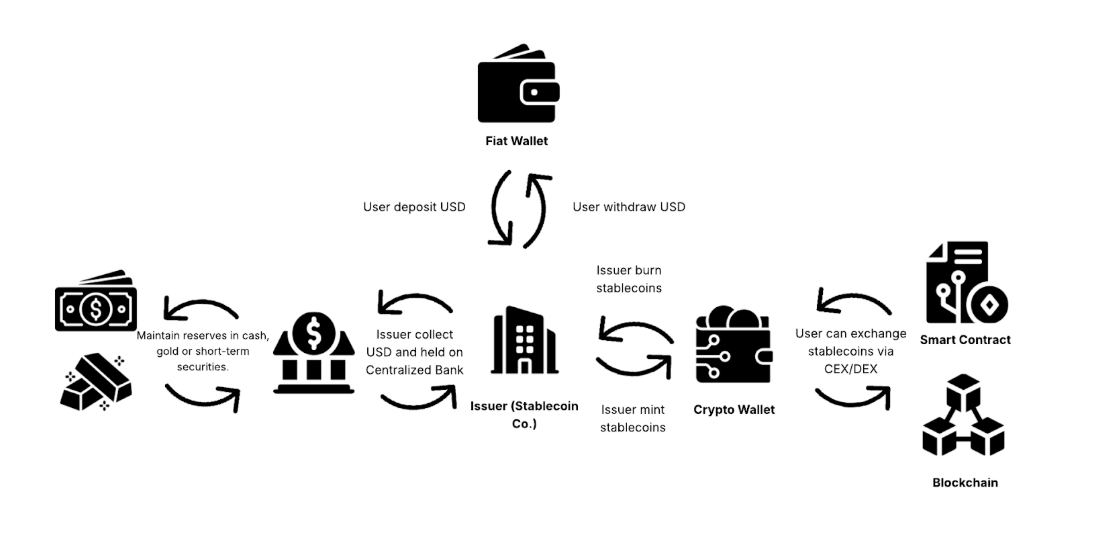

Algorithmic stablecoin risk sits at the heart of modern digital finance. It describes the gap between how systems are designed to behave and how markets actually move. In this model, stability depends on algorithms and trader activity rather than clear, liquid reserves. The code creates or removes tokens to keep prices near one dollar. As demand grows, new supply enters the market. As demand cools, the algorithm pulls it back. In theory, everything stays balanced: efficient, mathematical, precise.

Reality moves differently. Markets shift in seconds, and confidence can change even faster. Every design depends on liquidity and timing. When investors hesitate or capital starts to flow out, movements become sharp and unpredictable. The same structure that holds steady in calm periods can accelerate losses during stress. Each fluctuation triggers another, creating a chain reaction of algorithms, traders, and emotion feeding into one another. This compounding effect is the essence of algorithmic stablecoin risk - a moment when automation meets raw human behavior.

Liquidity is the system’s true line of defense. Deep markets and reliable redemption create breathing space for algorithms to function. Thin liquidity removes that cushion. Once the market tightens, reactions grow extreme, and value escapes faster than it can be contained. In these moments, stability stops being a formula. It becomes a test of adaptability, trust, and resilience under pressure.

Builders have learned from past failures. They now approach algorithmic stablecoin risk as something measurable and manageable. Modern synthetic models rely on collateral pools, futures hedging, and real-time transparency to absorb volatility. The aim is to turn instability into motion that can be controlled rather than feared. How well these ideas work becomes clear only through experience, as seen in the very different outcomes of TerraUSD and USDe.

Case Study 1: TerraUSD (UST) and the Anatomy of Algorithmic Stablecoin Risk

According to data from Chainalysis and The Block Research, TerraUSD (UST) once stood at the center of decentralized finance’s most ambitious experiment in stability. The project aimed to prove that an algorithm could maintain a one-dollar value without relying on banks or collateral reserves. Its mechanism linked UST with LUNA, the network’s volatile counterpart. When the price of UST dipped below one dollar, traders could exchange it for an equivalent amount of LUNA, reducing supply and restoring balance. When UST traded higher, users minted more UST by burning LUNA, expanding supply until the price returned to parity. The design looked self-sufficient, turning market activity into a stabilizing force.

At its peak, Terra appeared unstoppable. Anchor Protocol, the core lending platform within the ecosystem, offered nearly 19.5% annual yield to anyone holding UST. This return drew vast inflows from investors worldwide. By early May 2022, UST’s circulating supply had climbed to roughly $18 billion, with $14 billion deposited in Anchor. Daily transaction volume exceeded $800 million, and more than 4.5 million wallets held the token. According to Messari, UST represented over 75% of all algorithmic stablecoin activity. For many, it became a symbol of how decentralized money could scale.

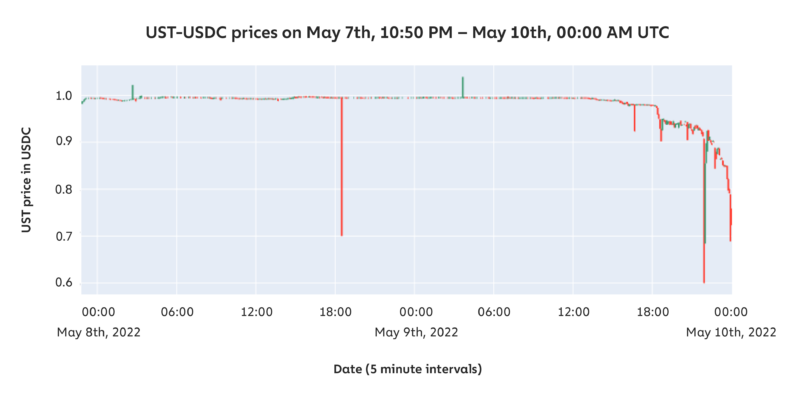

The unraveling began on May 7, 2022, during what seemed like an ordinary adjustment. The Luna Foundation Guard removed about $150 million UST from Curve’s liquidity pool to rebalance reserves. Minutes later, two major transactions swapped $85 million and $100 million UST into USDC. Liquidity vanished, confidence faltered, and the peg slipped. Traders rushed to exit while arbitrage systems lagged. Within seventy-two hours, UST had fallen below $0.30, and by May 12, it hovered near $0.08.

LUNA’s supply ballooned from 340 million to more than 6 trillion tokens, erasing over $60 billion in market value. Exchanges halted trading, and several DeFi platforms built on Terra froze operations. The algorithm that once held the system together now accelerated its collapse. Terra’s structure relied on trust and liquidity, yet both vanished under pressure.

According to the Federal Reserve Board, the collapse of UST exposed the true nature of algorithmic stablecoin risk. The mechanism functioned smoothly while confidence and liquidity supported it, but once that balance broke, the same design amplified the crisis. Terra became a turning point for digital finance, showing how quickly engineered stability can unravel when markets lose faith.

The next section examines USDe, a synthetic model that faced a similar storm in 2025 yet managed to preserve its structure. The contrast between these two moments reveals how the understanding of algorithmic stablecoin risk has matured since Terra’s downfall.

Case Study 2: USDe and the Real Test of Algorithmic Stablecoin Risk

After the collapse of TerraUSD, the search for a stronger model began. Builders and researchers studied every weakness exposed by 2022 and used it as a foundation for a more disciplined design. By 2024, Ethena Labs introduced USDe, a synthetic dollar engineered to withstand market volatility. It was created for transparency, durability, and scale. Instead of chasing returns through speculation, it focused on structure and control. In this new generation, algorithmic stablecoin risk became a variable to manage rather than a flaw to fear.

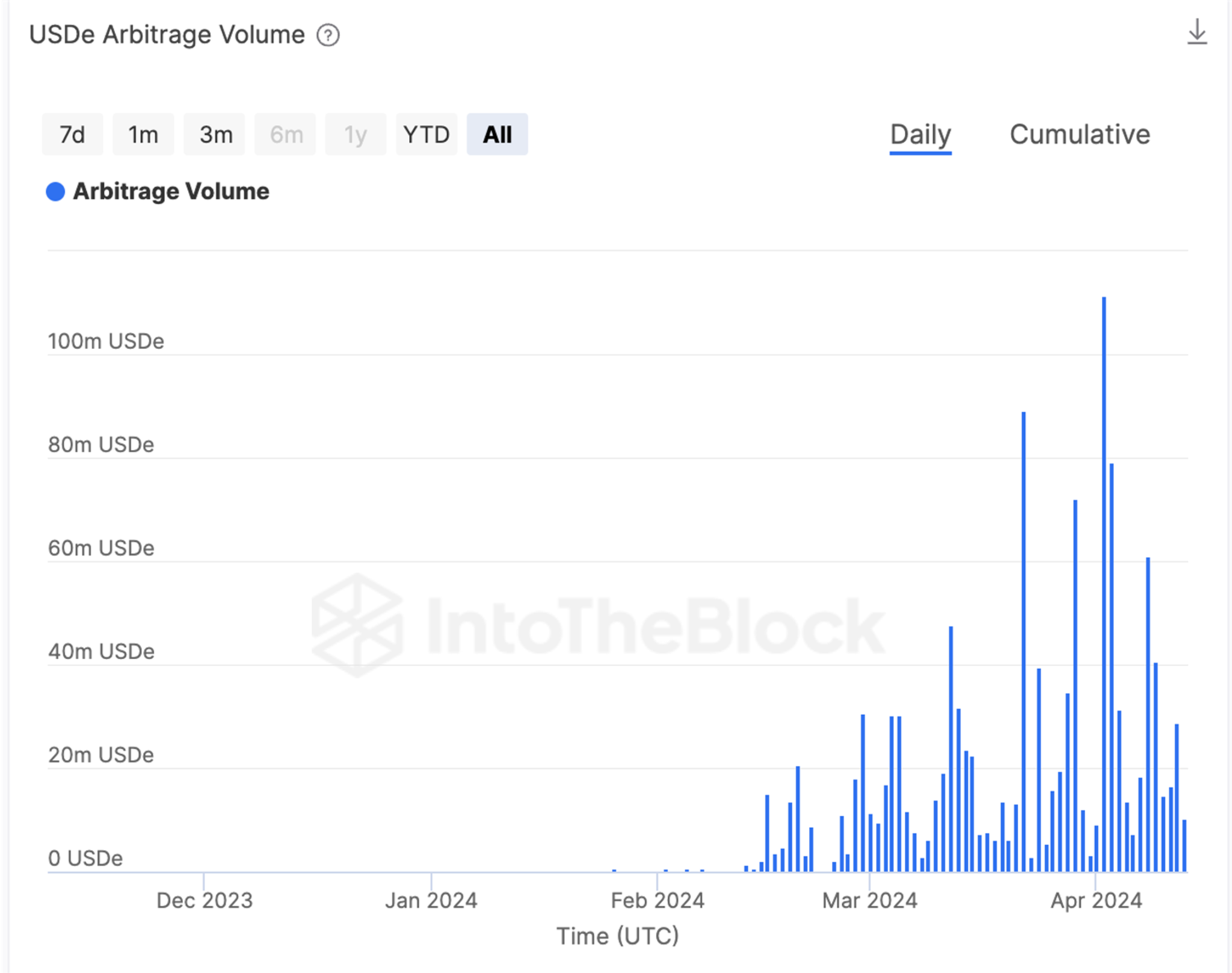

USDe operates on a delta-neutral framework. For each dollar issued, the protocol holds crypto assets such as ETH and BTC while opening short positions in perpetual futures markets. The long exposure of the assets and the short hedge in derivatives offset each other, neutralizing price movements. Yield for holders of sUSDe comes from funding rates and basis spreads in those markets. According to research data, during 2024 the average funding rate reached 11% on BTC and 12.6% on ETH, producing a return of about 18–19% APY for participants. The yield flowed from real market activity rather than from fixed incentives, creating a more organic system of balance.

By mid-2025, total supply had exceeded $12 billion, making USDe one of the largest dollar-pegged assets in circulation. The design gained trust through transparent collateral management, active hedging, and reliable redemption. Each feature was built to contain algorithmic stablecoin risk before it could escalate.

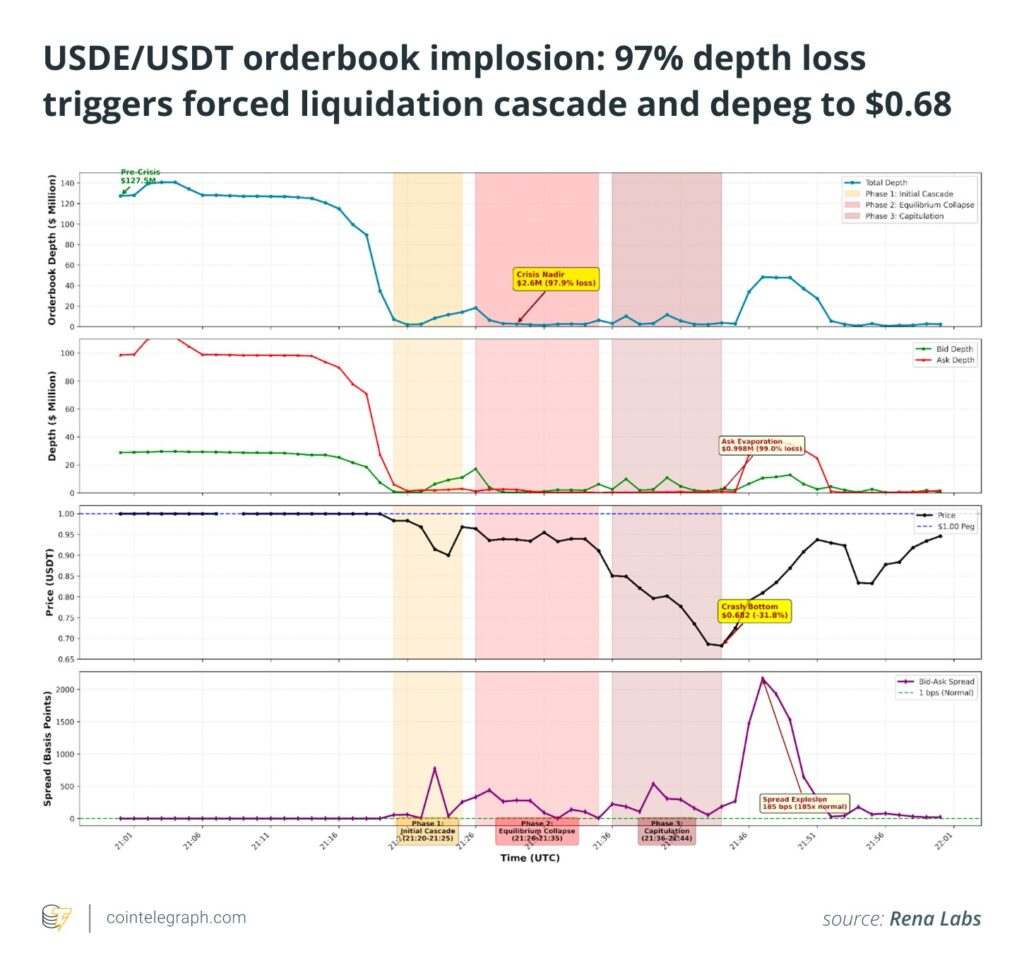

The decisive moment arrived on October 10–11, 2025, when a sudden geopolitical announcement triggered a massive liquidation wave across global markets. In less than a day, over $19 billion in leveraged positions were wiped out. During this chaos, Binance recorded a sharp drop in USDe’s price to $0.65, sending shock across the industry. On-chain data and reports from other venues, however, showed the peg holding close to $1. Minting and redemption continued normally, and collateral ratios stayed intact. The temporary dislocation originated from one exchange’s thin order book and a lagging price oracle, while the protocol’s mechanics remained stable.

This event became a milestone in understanding algorithmic stablecoin risk. It revealed how much stronger a system can become when liquidity, collateral, and execution work in unison. USDe did not rely on faith or reflexive loops; it relied on architecture. It proved that resilience in digital finance comes not from perfect calm but from the ability to absorb shock and keep operating when markets turn violent.

Comparative Anatomy of Two Models

Understanding the contrast between TerraUSD (UST) and USDe reveals how design decisions determine the outcome of stress events. Each line in this comparison shows how architecture, liquidity, and behavior under pressure shape the expression of algorithmic stablecoin risk.

Attribute | TerraUSD (UST) – May 2022 | USDe – Oct 2025 |

| Model Type | Fully algorithmic model built on the mint–burn link with LUNA | Synthetic dollar supported by spot collateral and futures hedging |

| Collateral Structure | Depended entirely on LUNA’s market value, with no liquid reserves | Backed by crypto assets and short derivatives that neutralize exposure |

| Yield Mechanism | Fixed yield of about 19.5% through Anchor subsidies | Variable yield of 18–19% APY generated from real market funding rates |

| Crisis Trigger | Rapid withdrawals, thin liquidity pools, arbitrage pressure | Market-wide liquidation wave, exchange liquidity shortage, oracle lag |

| Outcome | Peg collapsed, LUNA hyperinflated, over $60 billion in value erased | Brief dislocation on one venue, peg recovered, collateral remained secure |

| Core Vulnerability | Confidence-based design with reflexive feedback loops | Reliance on exchange infrastructure and accurate data feeds |

| Lesson for Risk | Algorithmic stablecoin risk materialized through total collapse | Algorithmic stablecoin risk contained through collateral and system design |

This comparison illustrates how stability is never defined by ambition alone but by structure. UST built its foundation on belief and arbitrage, which unraveled once confidence broke. USDe, by contrast, embedded risk control through hedging, liquidity depth, and collateral transparency. Both faced moments of stress, yet only one turned the crisis into proof of resilience.

What These Case-Studies Reveal About Algorithmic Stablecoin Risk

The two case studies of UST and USDe reveal how structure decides survival. Each crisis turned abstract theory into tangible lessons on algorithmic stablecoin risk, showing how design, liquidity, and trust interact under pressure.

- Collateral defines strength. Systems grounded in visible, liquid assets create confidence that endures through volatility. UST depended on momentum and reflexive demand. USDe built its base on collateral and active hedging, turning uncertainty into measurable control. When assets exist in balance with liabilities, trust becomes part of the design.

- Liquidity governs survival. In moments of panic, markets reward projects with deep trading pools and flexible redemption. UST’s liquidity thinned until movement stalled. USDe sustained access across exchanges and redemption platforms, keeping value flowing even in turbulence. Abundant liquidity turns fear into flow instead of freeze.

- Yield shapes credibility. Investors follow returns, but sustainable yield comes from real activity, not subsidy. UST’s 20% return drew attention but weakened durability. USDe’s 18–19% yield came from futures funding and basis spreads, linking income to genuine market mechanisms. When yield reflects real economics, it reinforces trust rather than strain.

- Redemption measures confidence. Every stablecoin relies on the ability to convert value on demand. During UST’s crisis, exits were locked up, and faith dissolved. USDe allowed redemption at full value throughout the shock, proving that accessibility is the foundation of endurance. Redemption protects both price and perception.

- Infrastructure determines reality. Algorithmic stablecoin risk lives not only in smart contracts but in the broader network of exchanges, oracles, and data systems. USDe’s brief mispricing on Binance revealed how external mechanics can influence internal stability. Reliable data, efficient routing, and coordinated liquidity create the environment where stability holds.

- Stress reveals the truth. Calm markets reward ambition; chaos rewards preparation. UST’s design worked in theory but fractured under speed and scale. USDe endured a $19 billion liquidation wave while maintaining operations. Real stability appears in movement, not stillness, in how a system reacts when tested.

Together, these lessons turn algorithmic stablecoin risk from a technical term into a strategic discipline. The future of decentralized money belongs to models that build transparency, liquidity, and collateral into their core, transforming volatility into proof of design.

The Broader Implications of Algorithmic Stablecoin Risk

By 2025, stablecoins had become the financial backbone of digital markets. Their combined market capitalization surpassed hundreds of billions of dollars, supporting everything from decentralized finance to cross-border payments and institutional settlement. Each token now plays a structural role in liquidity, lending, and global money flow. When one loses balance, the impact travels instantly through exchanges, lenders, and payment networks. The two case studies of UST and USDe capture this evolution. Terra’s collapse forced regulators and developers to rethink how digital dollars are built, while USDe’s recovery showed that innovation can meet the new challenges of algorithmic stablecoin risk through architecture and discipline.

For issuers, investors, and policymakers, the direction is clear. Effective design grows from multiple layers working in harmony. Transparency operates as a continuous process that keeps participants informed and engaged. Liquidity spreads across venues and regions to ensure access in every condition. Collateral remains visible and measurable to reinforce confidence. Redemption functions as a constant promise of value, while infrastructure integrates with the protocol rather than standing apart from it. When these elements align, a stablecoin transforms into financial infrastructure capable of carrying real economic weight.

Institutions entering the market now approach stablecoins with rigorous evaluation. They assess collateral quality, derivative exposure, liquidity depth, redemption mechanisms, governance, and audit integrity. Regulators, too, focus on these dimensions, treating each as part of systemic safety. Algorithmic stablecoin risk has moved from concept to operating reality, shaping how digital finance measures strength, stability, and credibility in the years ahead.

FAQs

1. What is algorithmic stablecoin risk?

It is the risk that arises when a stablecoin’s price stability depends on algorithms, trading behavior, or synthetic hedging instead of direct collateral. The balance works in theory but can break when liquidity dries up or confidence fades.

2. How did TerraUSD (UST) fail?

UST lost its $1 peg in May 2022 after massive outflows exposed thin liquidity. The mint-burn system with LUNA spiraled into hyperinflation, erasing over $60 billion in value.

3. Why did USDe survive a similar crisis in 2025?

USDe used a delta-neutral model with collateral and futures hedging. When markets faced $19 billion in liquidations, USDe’s collateral and redemption system held steady, proving structural resilience.

4. What lessons do these cases teach?

They show that stablecoins must integrate transparency, liquidity, and collateral from the start. Confidence must come from design and data, not assumption.

5. How will future stablecoins evolve?

The next generation will emphasize cross-market liquidity, continuous audits, and integrated infrastructure. Algorithmic stablecoin risk will serve as the benchmark for trust, guiding how stability is engineered, tested, and maintained.

Conclusion: The Future of Algorithmic Stablecoin Risk

The story of TerraUSD and USDe marks a pivotal moment in the evolution of digital stability. TerraUSD exposed how fragile confidence can become when it stands alone, while USDe showed how structure, liquidity, and transparency can transform the same idea into lasting strength. Together, these events moved algorithmic stablecoin risk from theory into global focus, reshaping how builders, investors, and regulators define trust in digital money.

Today, the meaning of stablecoin carries new depth. It reflects resilience born from architecture, clarity built through open data, and readiness proven in real conditions. Stability now speaks through transparency, liquidity, and disciplined design. Future digital dollars will earn credibility through consistent performance in volatile markets, where stability is shown, not claimed.

The collapse of one and the resilience of the other trace a shared journey of progress. Each episode demonstrates how pressure refines systems and how adaptation strengthens purpose. Stability has become dynamic, moving with markets while grounded in structure and trust. The next generation of stablecoins will embody this evolution, turning algorithmic stablecoin risk into a driver of innovation and a foundation for enduring confidence in digital finance.