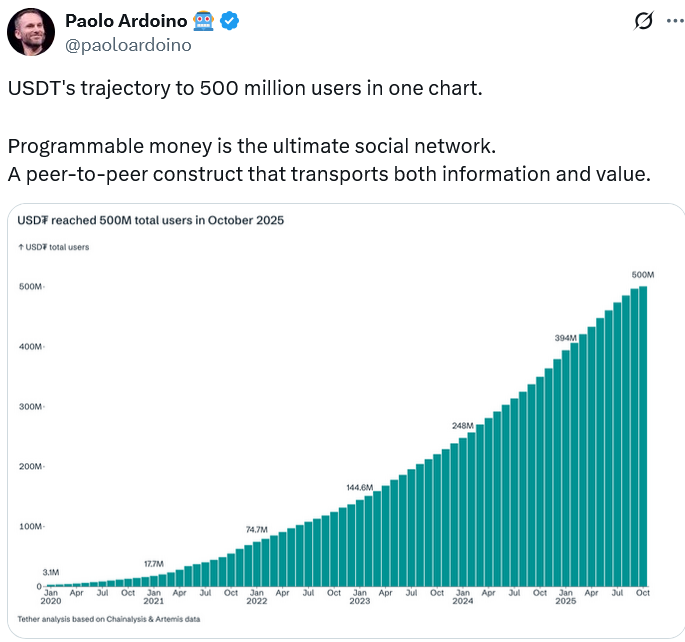

Tether’s Stablecoin Reaches 500M Users: Touching 6.25% of Global Population

- Tether’s USDT has reached 500 million users, representing around 6.25% of the world’s population.

- CEO Paolo Ardoino calls it “the biggest financial inclusion achievement in history.”

- Tether says the number reflects real users, not just wallets.

- A new documentary from Kenya shows how USDT supports small businesses and citizens in high-inflation economies.

- Tether’s market cap now exceeds $182.4 billion, and the company is reportedly seeking a $500 billion valuation.

Tether, the issuer of the world’s largest stablecoin USDT, has hit a major milestone – 500 million users worldwide. This figure, announced by CEO Paolo Ardoino on Tuesday, represents approximately 6.25% of the global population, marking what he described as “likely the biggest financial inclusion achievement in history.”

Unlike user counts based purely on digital wallets, Tether emphasized that the figure represents real people using USDT for transactions, remittances, and savings. This surge highlights the expanding role of stablecoins as a bridge to financial access for populations excluded from traditional banking systems. According to the World Bank, around 1.4 billion adults globally remain unbanked – a gap stablecoins are increasingly helping to fill.

For many in developing nations, USDT provides more than just a digital asset – it’s a lifeline against inflation and capital controls. With only a smartphone, users can access a global, borderless store of value and transfer system that doesn’t require a bank account. Tether’s milestone underscores how crypto can offer stability and financial sovereignty where traditional systems fall short.

To commemorate the achievement, Tether released a documentary set in Kenya, showcasing how small businesses and individuals use USDT “not for speculation, but for survival.” In a country grappling with currency devaluation, local entrepreneurs now rely on stablecoins to pay suppliers, preserve earnings, and maintain cross-border trade. Ardoino also revealed that about 37% of USDT users hold it primarily as a store of value, reflecting its growing use as an inflation hedge rather than just a trading instrument.

According to CoinGecko, Tether’s market capitalization has reached $182.4 billion, commanding 58.4% of the global stablecoin market share. Its closest competitor, Circle’s USDC, trails far behind with a $76.8 billion market cap. This dominance reflects not only Tether’s liquidity advantage but also its widespread adoption across emerging markets and decentralized platforms.

Tether’s success has also attracted major financial attention. Reports last month revealed that the company is in talks with investors to raise up to $20 billion at a valuation approaching $500 billion. If completed, this would make Tether one of the world’s most valuable private companies, placing it alongside global financial giants. The potential deal is reportedly being advised by Cantor Fitzgerald, underscoring the growing institutional recognition of stablecoin infrastructure.

Final Thought

Tether’s reach to 500 million users marks a turning point for digital finance and financial inclusion. As USDT becomes a critical tool for individuals in unstable economies, it illustrates how blockchain-based money can serve practical, humanitarian purposes far beyond speculation. With ambitions for a half-trillion-dollar valuation and expanding use in real-world economies, Tether is positioning itself as both a leader in financial technology and a symbol of global monetary transformation.