Tether Moves $1 Billion in Bitcoin to Reserve Wallet as Holdings Near 109,000 BTC

Tether, the world’s largest stablecoin issuer, has moved 8,888 BTC worth $1 billion into its official bitcoin reserve wallet, according to on-chain data. The transfer highlights the company’s ongoing effort to grow its Bitcoin holdings as part of a long-term diversification strategy.

- The transaction raises Tether’s total bitcoin holdings to about 109,410 BTC, worth $12.4 billion.

- Tether began buying bitcoin in 2022, allocating 15% of its profits each quarter toward BTC.

- CEO Paolo Ardoino confirmed the move and hinted it was a fresh purchase.

- Tether now ranks among the largest private holders of bitcoin globally.

- The company holds over $127 billion in U.S. Treasuries and continues expanding into AI, energy, and telecom projects.

Stablecoin giant Tether has once again added to its growing bitcoin reserves. On-chain analytics from Arkham and Nansen revealed that 8,888.88 BTC, worth roughly $1 billion, were transferred from a Bitfinex hot wallet to an address labeled as Tether’s bitcoin reserve on the morning of September 30, 2025.

The address, beginning with “bc1qj”, has been linked to Tether’s previous bitcoin purchases and is used for quarterly reserve transfers. While Tether has not issued an official announcement, the transaction aligns with its usual pattern of moving funds into reserve wallets at the end of each quarter.

The amount — 8,888 BTC — mirrors earlier transfers made in previous quarters, suggesting this is part of Tether’s consistent accumulation strategy. Although the funds originated from Bitfinex (a company under the same parent group), analysts note it’s unclear whether this was a new purchase or an internal fund movement.

Tether began accumulating bitcoin in September 2022 and publicly committed in May 2023 to allocate 15% of its quarterly profits to BTC purchases. Since then, the company has steadily increased its reserves. If confirmed, this latest transfer pushes Tether’s total holdings to about 109,410 BTC, valued at $12.4 billion at current market prices.

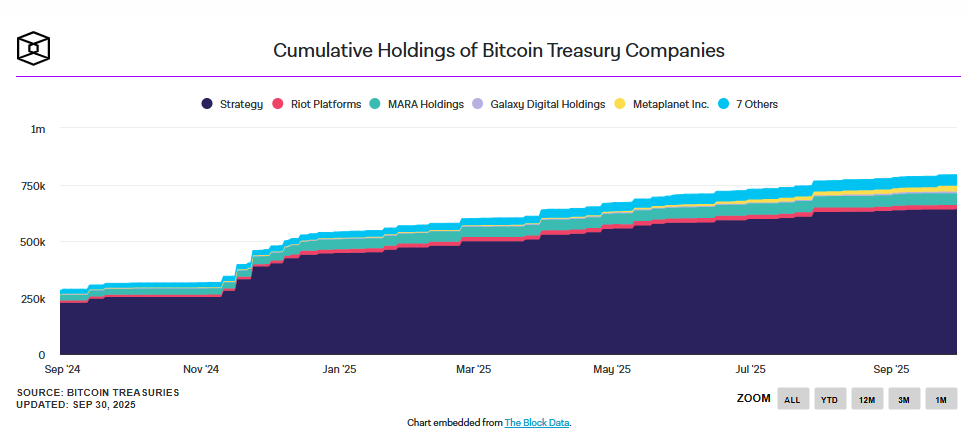

This makes Tether one of the largest corporate bitcoin holders globally — ranking behind Block One (164,000 BTC) and MicroStrategy (640,000+ BTC). Additionally, Tether-backed Twenty One, a bitcoin treasury entity, holds 43,514 BTC valued near $4.9 billion.

Tether CEO Paolo Ardoino, who also serves as CTO at Bitfinex, appeared to confirm the move on X by replying “yeah” to a post tracking the on-chain transaction, humorously adding a meme captioned “it ain’t much, but it’s honest work.”

Beyond crypto holdings, Tether has become a financial powerhouse. The company manages over $127 billion in U.S. Treasuries, placing it among the top 20 largest holders worldwide — ahead of several nations, including Germany and the UAE. Despite having fewer than 200 employees, Tether generated approximately $13 billion in profit in 2024.

The firm has also expanded into new sectors such as artificial intelligence, data centers, telecommunications, and bitcoin mining. Recently, it introduced USAT, a new U.S.-regulated, dollar-backed stablecoin designed to serve American users alongside USDT, which remains the largest stablecoin globally with a circulating supply of $175 billion.

Earlier this week, Bitwise CIO Matt Hougan speculated that Tether could eventually become “the most profitable company in history,” with potential assets surpassing $3 trillion, outpacing even Saudi Aramco’s record-breaking profits.

Final Thought

Tether’s $1 billion bitcoin transfer reinforces its growing role not only as a stablecoin leader but also as a major institutional force in Bitcoin. As it continues to accumulate BTC and diversify into global industries, Tether is positioning itself as a bridge between traditional finance and the digital asset economy — and potentially one of the most powerful companies in the financial world.