Tether’s Infrastructure Strategy: Building the Future of Stablecoins

The global stablecoin landscape is entering a turning point, and Tether’s infrastructure strategy is emerging as its most decisive evolution yet. With a market capitalization of $178 billion and a commanding 64–68% share of global circulation, Tether remains the core liquidity engine of digital finance. But as regulatory clarity deepens through the GENIUS Act and new compliance frameworks, the balance of power is shifting toward projects built on legal precision and institutional trust.

Tether’s answer is expansion through architecture. By positioning itself as the backbone of the stablecoin ecosystem rather than a single issuer, Tether is constructing a network of payment rails, interoperability layers, and blockchain infrastructure designed to support every participant in the market. This marks a transformation from dominance through issuance to leadership through design, a long-term vision to sustain its influence as regulation, competition, and technology reshape the financial frontier.

This article examines how Tether’s infrastructure strategy is redefining its role in the stablecoin era: shifting from market share battles to building the foundation of tomorrow’s digital economy.

Global Dominance and Geopolitical Role

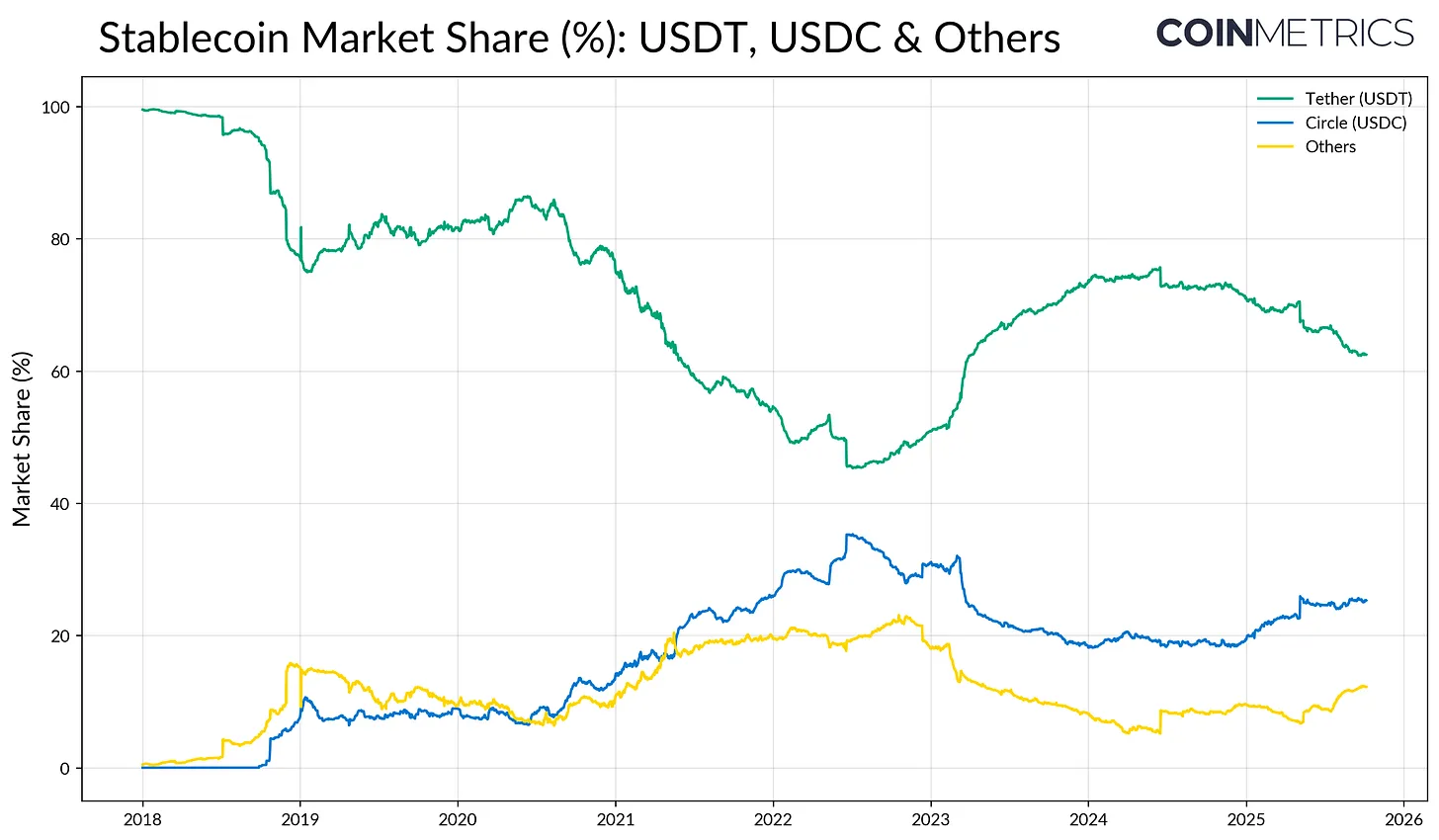

Data from Nansen (April 2025) highlights Tether’s continuing command over the global stablecoin market, with USDT holding 66% of the total $237.7 billion capitalization. Although slightly lower than its 2024 peak of 69%, this scale remains 2.4 times larger than Circle’s USDC at 28%. Insights from Coin Metrics further demonstrate USDT’s unrivaled activity, averaging over 2.3 million transactions per day on Tron and sustaining 24-hour trading volumes above $75 billion, exceeding both Bitcoin and Ethereum. These figures underscore Tether’s role as the primary liquidity engine driving digital asset markets across multiple blockchains.

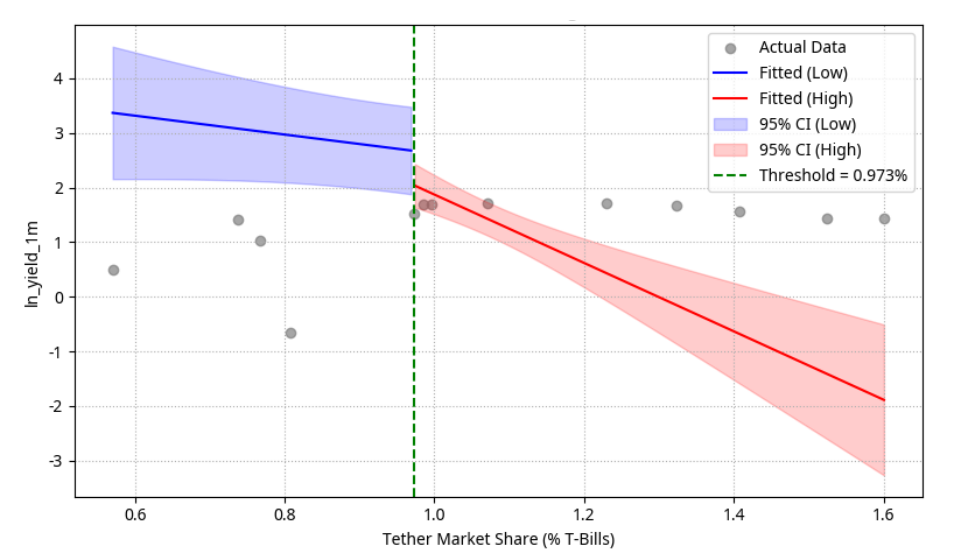

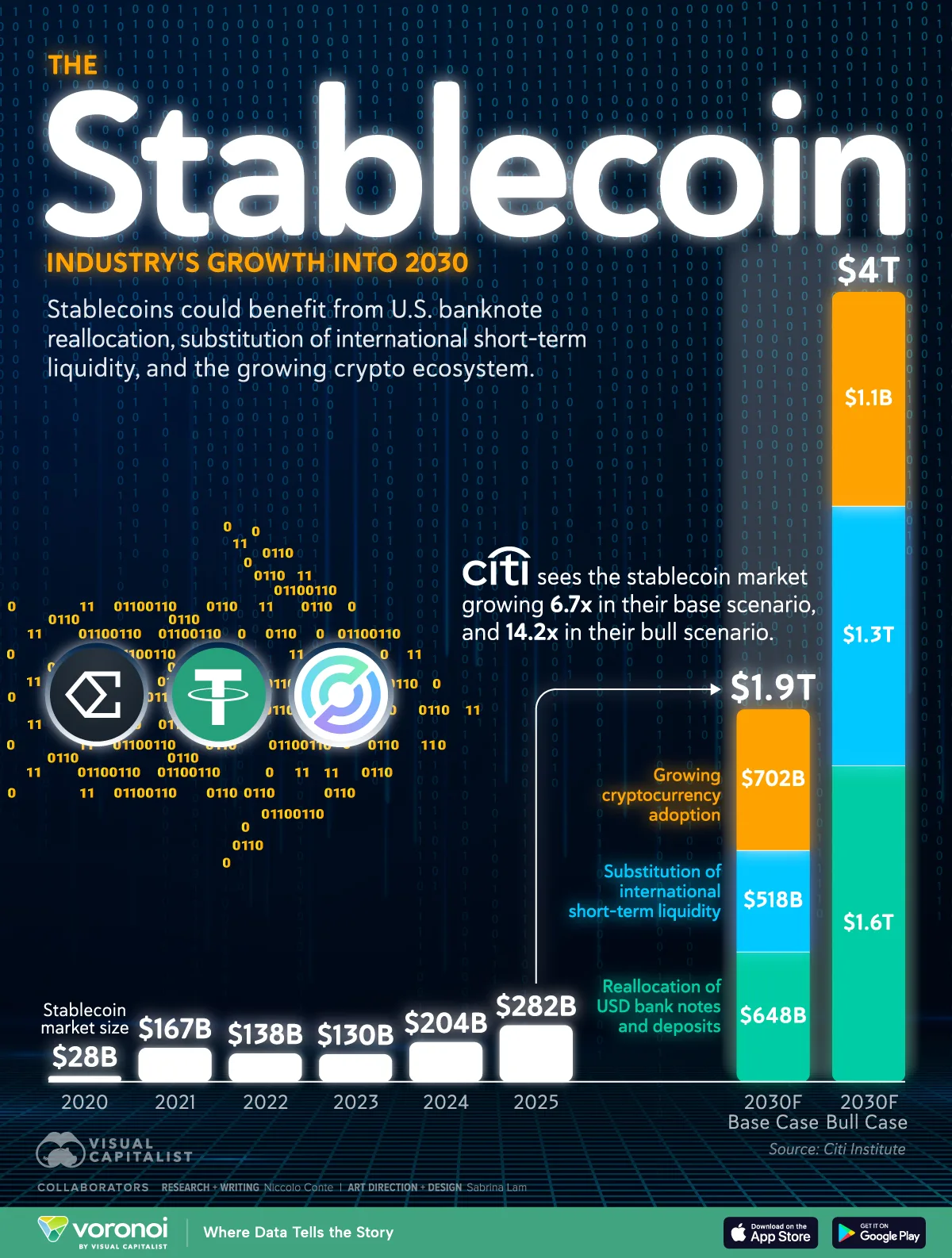

Beyond market leadership, Tether’s growing influence extends deep into the geopolitical and macroeconomic arena. A landmark SSRN study (May 2025) by Ante, Saggu, and Fiedler revealed that by the first quarter of 2025, Tether held approximately $98.5 billion in U.S. Treasury bonds, equal to 1.6% of all outstanding Treasuries. This scale positions Tether among the largest non-sovereign holders of U.S. debt. The research estimated that Tether’s consistent demand delivers roughly $15 billion in annual interest savings for the U.S. government and contributes to lowering 1-month bond yields by about 24 basis points—a market impact typically reserved for major institutional or state-level investors. U.S. Treasury Secretary Scott Bessent emphasized this influence, projecting that the stablecoin market could expand eightfold to $2 trillion in the coming years.

Financially, Tether operates with the precision and profitability of a top-tier technology enterprise. The company reported $13.7 billion in profit for 2024 and $4.9 billion in the second quarter of 2025, reflecting a business model built on deep liquidity, efficient reserve management, and sustained trust. With an ongoing $20 billion fundraising round, Tether’s valuation is on course to reach levels that place it among the most valuable private companies globally. This combination of financial scale, geopolitical relevance, and market velocity secures Tether’s standing as a defining force in the evolution of digital finance.

The Silent Crisis: Tether Is Gradually Losing Its Dominant Position

Beneath the commanding figures lies a quieter shift reshaping thestablecoin hierarchy. While USDT continues to dominate with 66% of the $237.7 billion global market, recent data from Nansen (April 2025) illustrates a steady erosion of share from its 2024 peak of 69%. Circle’s USDC, now accounting for 28% of global circulation, has accelerated growth across regulated markets, narrowing the gap through a stronger compliance framework and expanding institutional adoption.

Research by Coin Metrics shows that USDT still processes over 2.3 million transactions daily on Tron, with average 24-hour trading volumes exceeding $75 billion, surpassing both Bitcoin and Ethereum. Yet the pace of expansion has moderated as global capital begins favoring stablecoins built under transparent, jurisdictional oversight. The GENIUS Act and a series of new U.S. financial directives have reinforced this direction, enabling compliant issuers such as Circle to scale rapidly within American and institutional channels. Since the November 2024 U.S. election, the growth of USDC has accelerated sharply, with circulating supply surpassing $56 billion, doubling from its 2023 bear-market low.

Tether’s market position continues to benefit from immense liquidity and a diversified user base, particularly across emerging markets where stablecoin demand is rooted in remittance and cross-border payments. Nansen data highlights that USDT still attracts nearly three times more active users than Uniswap and records over 50% higher transaction frequency than the next-largest decentralized application. This scale reinforces Tether’s network advantage, but the evolving regulatory order is creating a new competitive frontier. Institutional investors increasingly prioritize compliance certainty, driving capital toward stablecoins that align seamlessly with domestic and international regulatory regimes.

At the same time, Tether’s financial power and asset depth remain unmatched. The SSRN study (May 2025) confirmed Tether’s direct holdings of $98.5 billion in U.S. Treasuries, accounting for 1.6% of total outstanding bonds, a level of exposure comparable to sovereign wealth participants. This presence equates to $15 billion in annual interest savings for the U.S. government and contributes to reducing 1-month yields by approximately 24 basis points, demonstrating Tether’s macro-level importance to global liquidity dynamics. The company’s $13.7 billion profit in 2024 and $4.9 billion in Q2 2025 provide an unparalleled foundation for reinvestment and strategic adaptation within a rapidly institutionalizing market.

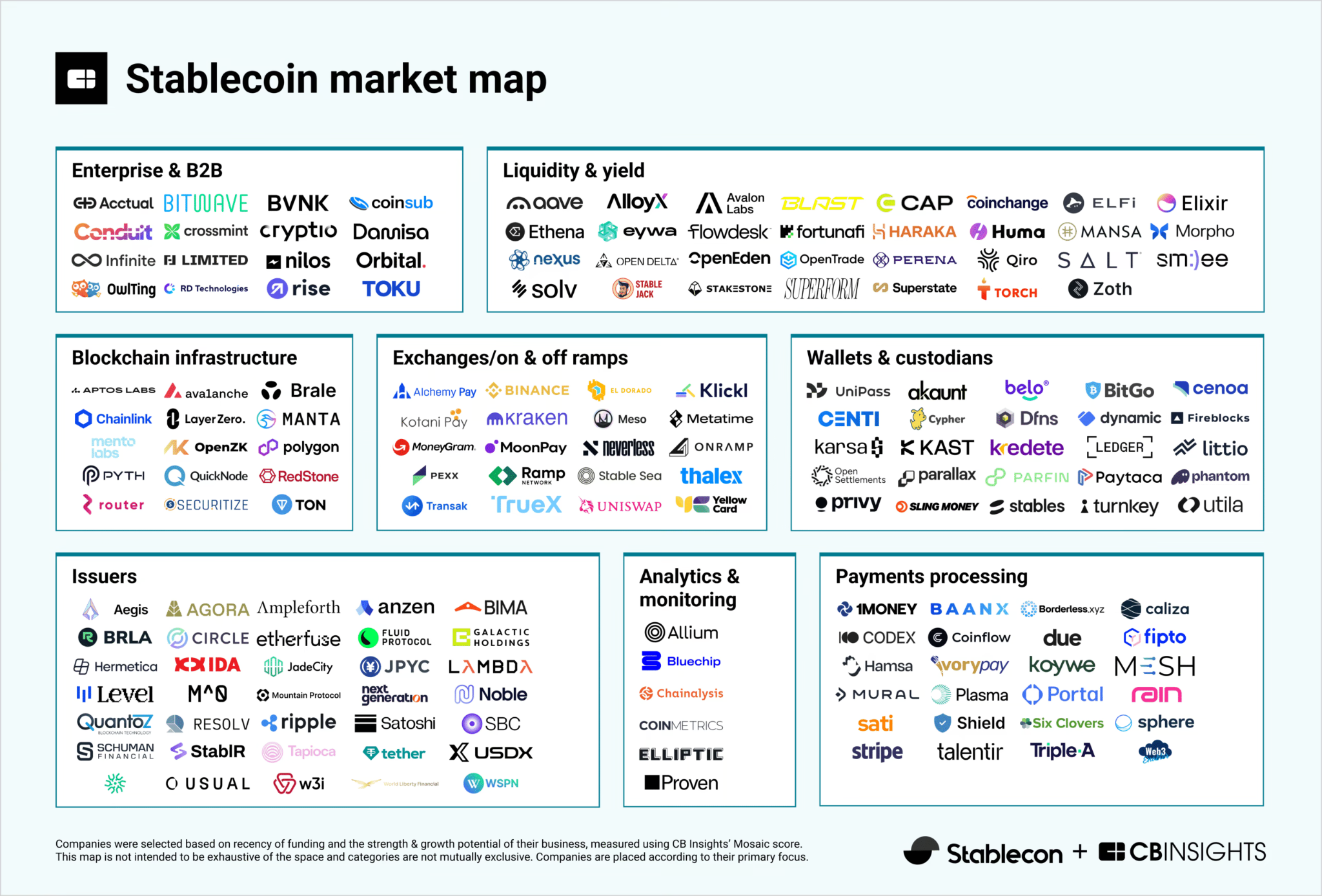

New forms of competition are rising from yield-bearing and hybrid models such as Ethena’s USDE, which has captured over 2% market share, alongside Sky’s USDS and tokenized money market funds offering profit-sharing mechanisms. These innovations appeal to an audience that values both stability and yield, expanding user expectations for digital dollars. In this changing landscape, Tether faces a complex challenge, sustaining leadership through innovation and scale while reinforcing trust through transparency and infrastructure excellence.

Counter-Strategy: From Issuer to Infrastructure Architect

Amid tightening regulations and intensifying competition, Tether is entering a new phase of strategic evolution. The company is advancing beyond the traditional role of a stablecoin issuer to become an infrastructure architect for the entire stablecoin ecosystem. This long-term transformation strengthens USDT’s influence while extending Tether’s reach across every layer of digital finance, shaping how stablecoins move, connect, and settle on a global scale.

Tether’s vision is reflected in its major infrastructure investments, most notably USDT0 and Plasma. These projects represent the foundation of a network designed to serve not only USDT but all compliant stablecoins that require fast, interoperable, and secure settlement. Through dedicated payment layers, cross-chain communication systems, and stablecoin-focused blockchains, Tether is creating an ecosystem where its technology becomes the standard backbone of liquidity and connectivity. In doing so, the company ensures a role of lasting relevance as the stablecoin market expands under new regulatory frameworks.

This strategic shift is powered by Tether’s extraordinary financial strength. The company earned 13.7 billion USD in 2024 and 4.9 billion USD in the second quarter of 2025, providing substantial capital for research, development, and global expansion. The ongoing 20 billion USD fundraising round further reinforces this position, giving Tether the resources to build long-term infrastructure while many competitors remain focused on short-term issuance battles. The strategy reflects a higher-level ambition, turning Tether from a market participant into a market architect.

The changing legal environment adds clarity and momentum to this transformation. On June 17, 2025, the U.S. Senate passed the GENIUS Act with a 68–30 bipartisan vote, marking the first comprehensive federal legislation for stablecoins. The law authorizes only approved issuers to operate within the United States, mandates a 1:1 reserve ratio backed by USD or equivalent liquid assets, and enforces monthly audits and compliance with anti–money laundering regulations. It also prohibits interest payments to stablecoin holders, creating a level field that redefines competition within the sector.

According to Sullivan & Cromwell LLP, the GENIUS Act sets clear boundaries for technology companies by requiring them to either become licensed financial entities or partner with regulated institutions. For Tether, headquartered in El Salvador with reserves including Bitcoin, precious metals, and secured loans, the law presents both a challenge and an opportunity to align with global standards. The company has announced USAT, a fully compliant stablecoin to be issued within the U.S., strengthening its domestic presence and meeting the GENIUS Act’s requirements.

Jack Forestell, Chief Product and Strategy Officer at Visa, described the law as a turning point for stablecoins, noting that it provides long-awaited clarity while paving the way for broader adoption. Visa has committed to supporting regulated stablecoin platforms and financial partners through its global network, accelerating the integration of blockchain-based payment systems into mainstream finance.

Through this multidimensional strategy, Tether’s infrastructure vision is emerging as a blueprint for the next chapter of the digital economy: one built on stability, interoperability, and institutional trust.

Blockchain Dynamics: The Shift from Tron to Ethereum

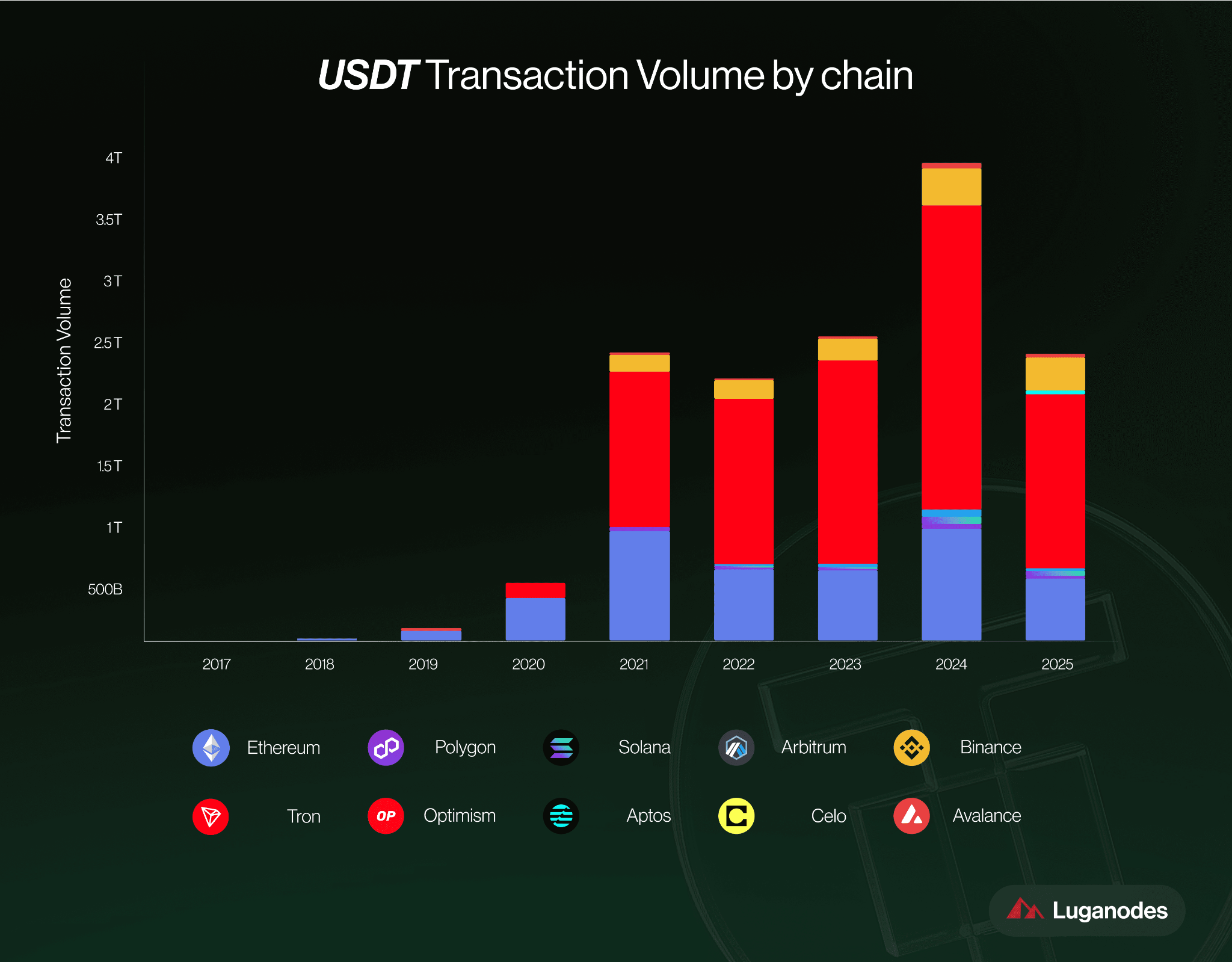

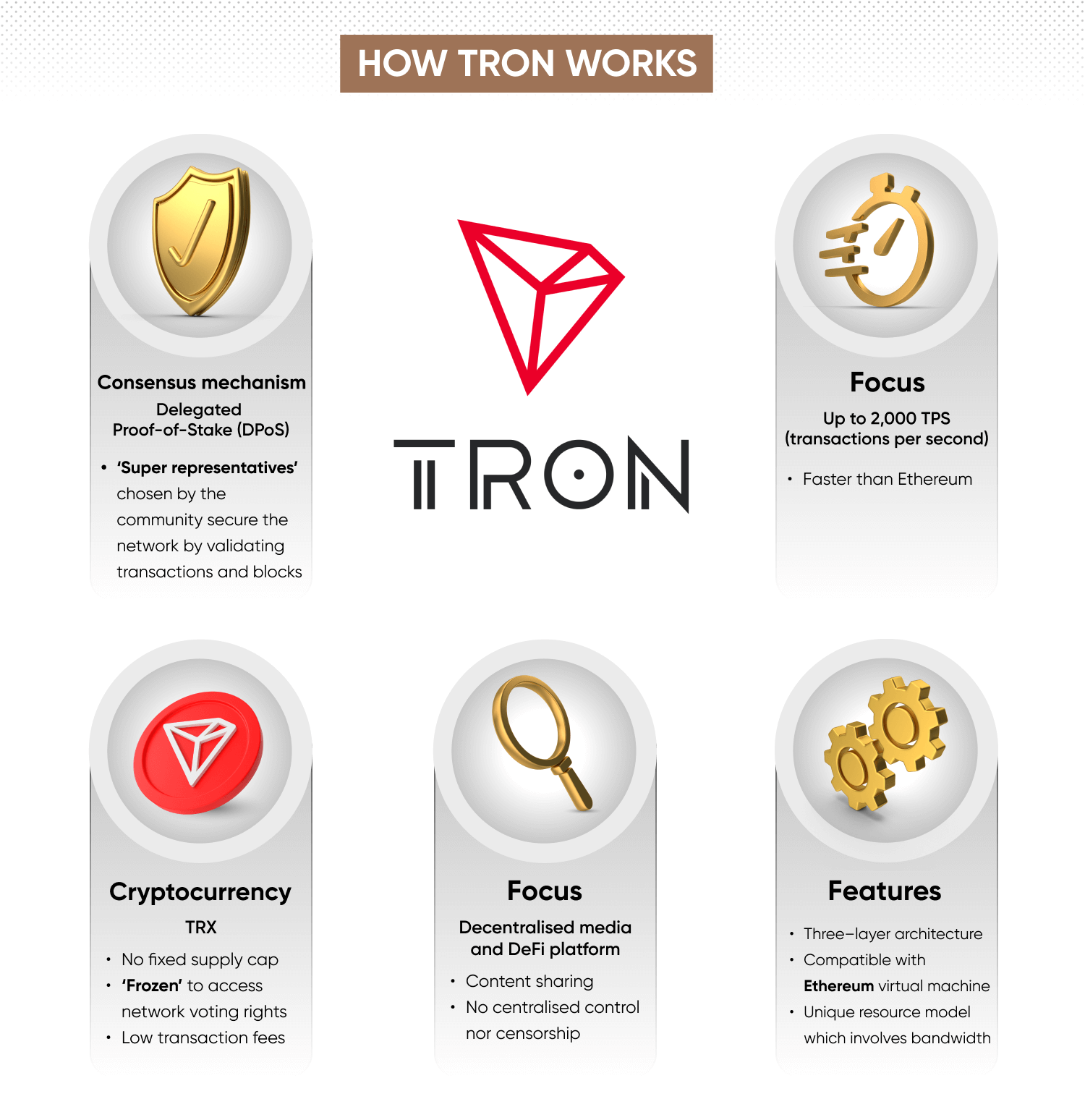

For years,Tron served as the main engine behind USDT’s global circulation. Its low transaction fees, often under 0.10 USD, and near-instant settlement made it ideal for small-scale payments, remittances, and retail transfers. With an average of more than 2.3 million USDT transactions per day, Tron became the network most closely associated with the stablecoin’s explosive growth, especially across emerging markets where accessibility and speed define adoption.

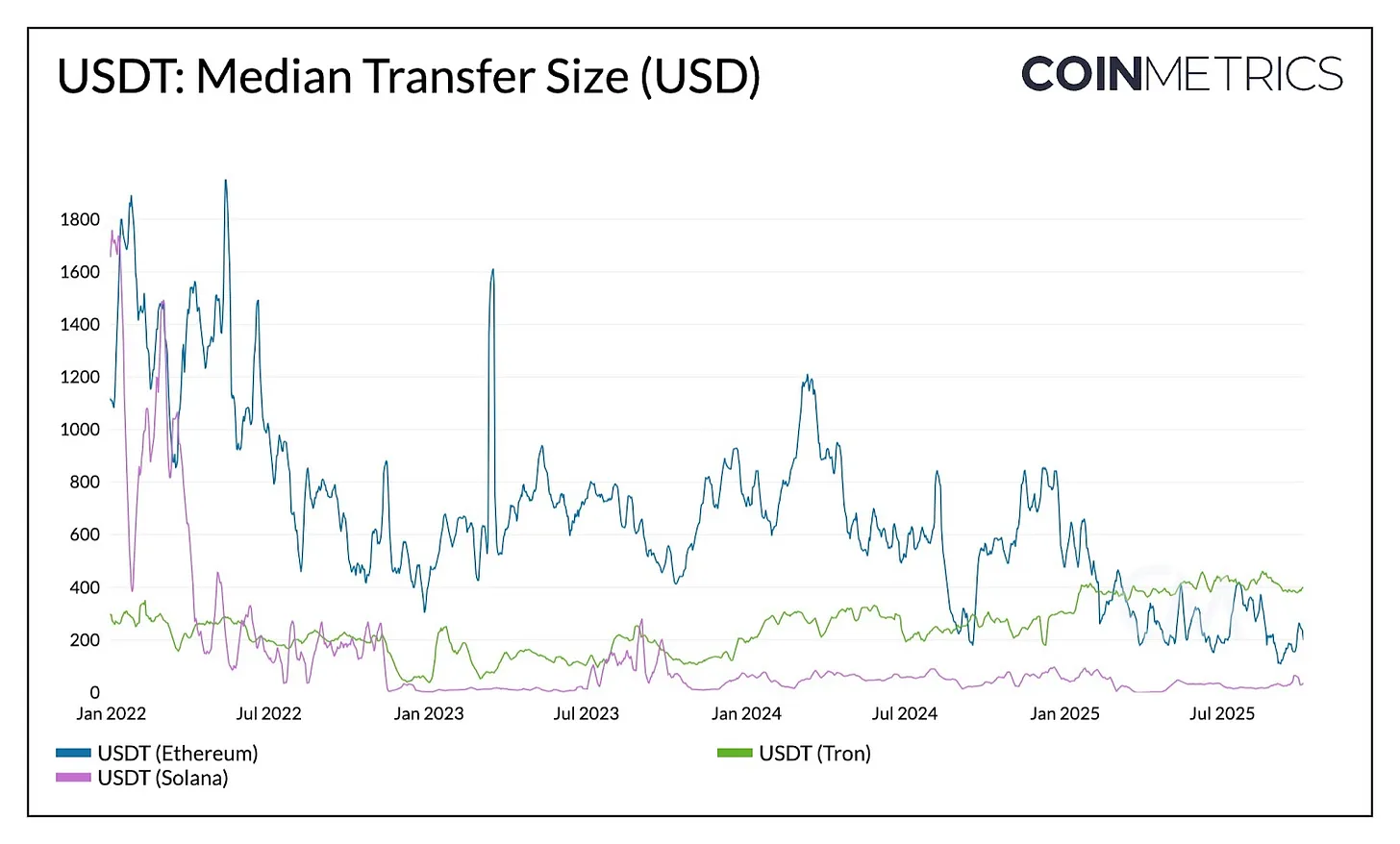

The landscape, however, has evolved rapidly with Ethereum’s technological upgrades. Following the Dencun and Pectra updates, Ethereum’s average transaction cost dropped below 1 USD, bringing it closer to parity with Tron’s efficiency. At the same time, Ethereum’s ecosystem has matured into a more diverse financial environment, one that supports large-scale DeFi operations, institutional settlements, and now increasingly, smaller consumer payments. As a result, the average transaction value on Ethereum fell from over 1,000 USD in 2023 to around 240 USD by mid-2025, indicating deeper engagement from retail users.

This shift is reflected in supply migration. By August 2025, the USDT supply on Ethereum reached 96 billion USD, overtaking Tron’s 78 billion USD. Liquidity, once heavily concentrated on Tron, is now dispersing across multiple chains as users seek flexibility, lower fees, and richer integration with DeFi protocols. Ethereum’s expanding role has redefined how USDT operates within the broader crypto economy, connecting traditional institutions and blockchain-native users through a unified layer of liquidity.

On Tron, the transaction profile is also evolving. Average transfer sizes have increased, signaling a growing focus on higher-value transactions and cross-border settlements. Meanwhile, Ethereum’s accessibility is driving a new wave of micro-payments and mid-tier transfers, particularly in the 100 to 10,000 USD range. This balance between the two networks illustrates a healthy segmentation: Tron powers high-velocity flows, while Ethereum anchors liquidity depth and retail engagement.

Tether’s infrastructure vision integrates these dynamics into a cohesive system. Through projects such as USDT0 and Plasma, the company is designing cross-chain solutions that unify stablecoin liquidity regardless of network. These platforms enable seamless movement of value between blockchains, eliminating the friction of siloed ecosystems. The result is an interoperable network where stablecoins flow freely across layers of the digital economy, supporting both institutional scale and consumer simplicity.

USDT0 and Plasma: Strategic Weapons in the Infrastructure War

At the center of Tether’s infrastructure strategy stand two defining projects, USDT0 and Plasma, marking a pivotal step in the company’s evolution from stablecoin issuer to infrastructure builder. These initiatives illustrate how Tether is positioning itself at the foundation of the digital financial system, where control of infrastructure determines who sets the rules for liquidity, settlement, and interoperability across the blockchain economy.

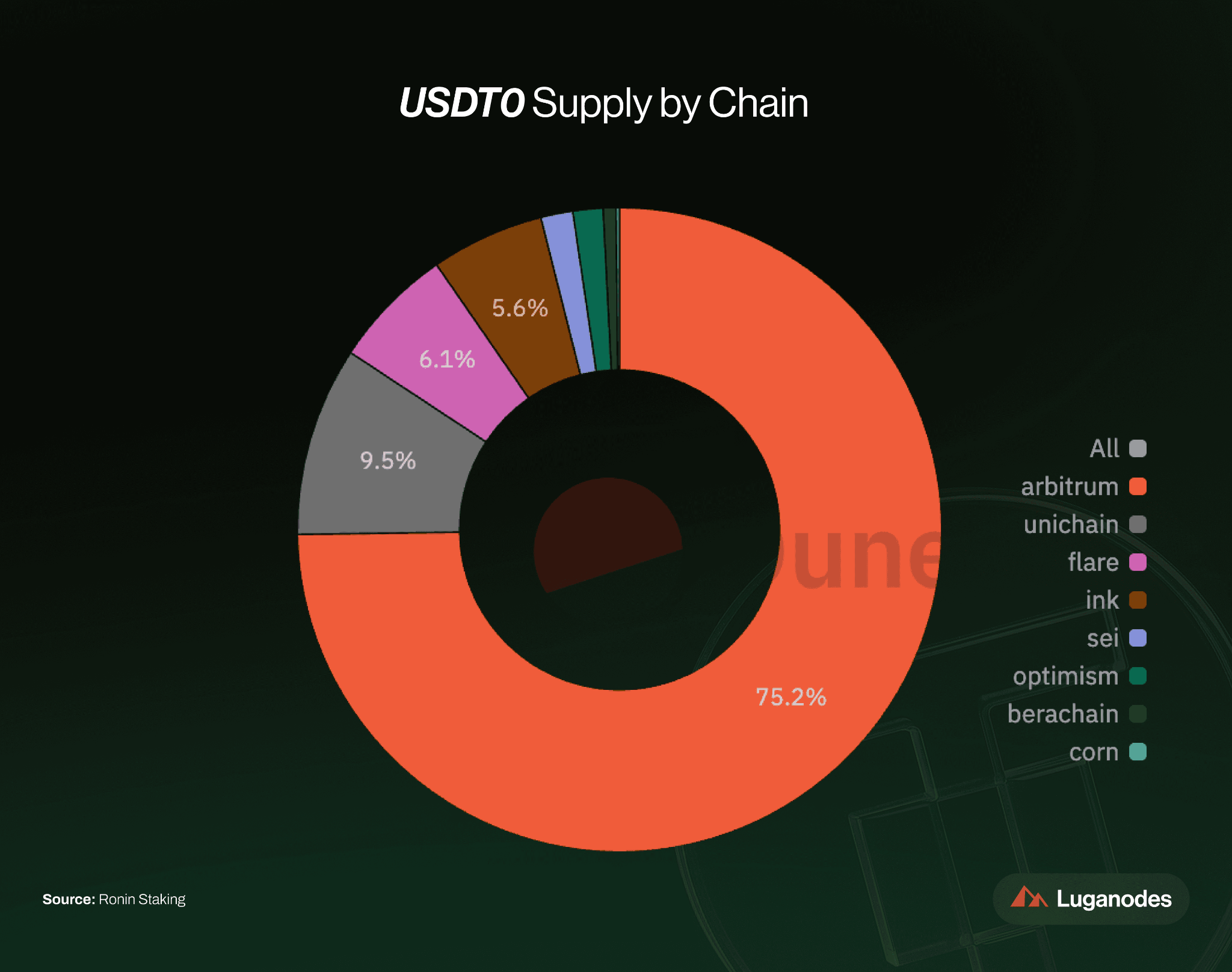

USDT0, developed in collaboration with Everdawn and LayerZero, represents a major leap toward seamless cross-chain connectivity. Built on LayerZero’s OFT (Omnichain Fungible Token) standard, USDT0 allows stablecoins to move effortlessly between blockchains. When a transfer is made, USDT is locked on Ethereum, and an equivalent amount is minted on the destination chain with full 1:1 verification, ensuring integrity and traceability across networks. This system eliminates fragmentation between ecosystems and creates a unified liquidity layer for the entire stablecoin market. The impact was immediate. Following Plasma’s launch on September 25, 2025, the amount of USDT locked in USDT0 contracts surged from 2.8 billion USD to 7.7 billion USD, demonstrating strong market demand for stablecoin interoperability at scale.

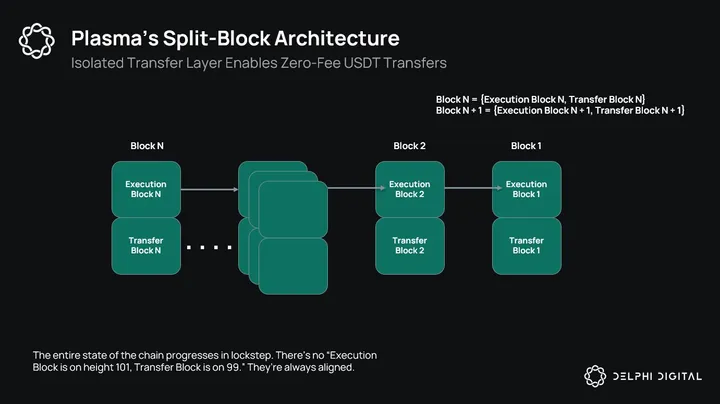

Plasma extends this vision into a dedicated blockchain environment built specifically for stablecoins. Designed as a Bitcoin sidechain with full EVM compatibility, it operates through the PlasmaBFT consensus mechanism, adapted from Fast HotStuff, enabling thousands of transactions per second with near-instant finality. Plasma introduces a key innovation through its protocol-level paymaster system, allowing users to pay transaction fees directly in USDT or BTC, which simplifies user experience and removes reliance on separate native tokens. Every element of the system is optimized for performance, compliance, and institutional-grade stability.

The design philosophy behind Plasma is openness. The network is structured to host any major stablecoin, creating a neutral, high-performance environment that promotes cooperation rather than competition. In this model, Tether no longer depends solely on USDT’s market dominance but instead becomes the essential infrastructure supporting all participants in the stablecoin economy.

The project’s early traction reflects strong market confidence. Plasma raised 74 million USD at a 500 million USD valuation from investors such as Peter Thiel, Paolo Ardoino, Framework Ventures, and Bitfinex. Within weeks of its debut, it had already attracted over 6 billion USD in USDT0 liquidity, stabilizing around 4.2 billion USD as usage matured. The figures confirm that stablecoin-focused blockchains are not just conceptually relevant but commercially viable.

According to Paul Faecks, CEO of Plasma, stablecoins have become the most successful bridge between traditional finance and blockchain, yet they have long operated within infrastructures designed for other purposes. By building on Bitcoin’s security and offering free USDT transfers alongside advanced liquidity management, Plasma establishes a specialized layer where stablecoins function as first-class assets. The network achieves a balance of speed, security, and scalability that current general-purpose blockchains struggle to match.

Announced on September 22, 2025, Plasma One brings this infrastructure vision into the hands of users. It operates as a digital banking super-app connected directly to the Plasma network, allowing payments, transfers, and savings within a unified ecosystem. Users can earn up to 10% annual yield, receive 4 percent cashback through the Plasma One Card, and transact across 150 countries with instant, fee-free transfers. By merging blockchain efficiency with the familiarity of traditional finance, Plasma One demonstrates how stablecoins can evolve into a complete financial experience accessible to both institutions and individuals.

Through USDT0, Plasma, and Plasma One, Tether is no longer defining leadership by market share but by infrastructure ownership. The company is building the technological and financial backbone of the next stablecoin era—an ecosystem where value moves freely across networks, compliance meets innovation, and digital money functions with the same reliability as the global financial system it mirrors.

Challenges and Risks on the Transformation Path

Tether’s expansion into infrastructure marks a major turning point in its history. The company is moving into a domain where technology, finance, and regulation intersect, requiring precision, vision, and scale. This transformation strengthens its role as a global architect of digital money while introducing new layers of responsibility and strategic complexity.

The first challenge lies in balancing innovation with regulation. The Independent Community Bankers of America has expressed concern that large-scale stablecoin infrastructures could reshape how banks handle deposits and settlements. Policymakers are working to ensure private issuers operate within the established financial system. As Tether expands deeper into payment and settlement networks, it must coordinate across multiple jurisdictions and maintain alignment with international standards.

Competition is also intensifying. Major financial institutions are entering the stablecoin arena with strong regulatory foundations and deep market experience. JPMorgan Chase launched JPMD, a blockchain-based settlement token that enables 24/7 transactions and offers interest-bearing features for institutional clients. At the same time, the Global Dollar Network, supported by Kraken, Paxos, and Robinhood, is deploying the USDG stablecoin to link regulated exchanges and payment systems. These developments create an environment where trust, compliance, and integration carry as much weight as technological innovation.

Market structure presents another area of focus. More than 90 percent of global stablecoin capitalization is concentrated in centralized, fiat-backed assets. This concentration provides stability and liquidity for the broader ecosystem while placing significant responsibility on a small number of issuers. Maintaining confidence in this structure requires transparency, governance, and resilience across all operating layers.

Tether has strengthened its credibility by publishing regular assurance reports and providing detailed information about its reserves, including 98.5 billion USD in U.S. Treasury holdings. These disclosures align the company with institutional standards and reinforce market trust. Continuous transparency, third-party verification, and global consistency remain essential for sustaining this progress over time.

The path of adoption represents another challenge. For USDT0 and Plasma to reach their full potential, they must be integrated into major exchanges, wallets, and financial platforms. Achieving that level of adoption depends on active collaboration with developers, payment providers, and stablecoin issuers who can leverage Tether’s infrastructure to enhance performance and interoperability across markets.

Tether’s strong financial position creates a powerful foundation for this transition. The company earned 13.7 billion USD in 2024 and 4.9 billion USD in the second quarter of 2025, ensuring abundant resources for research, innovation, and long-term development. Its extensive U.S. Treasury holdings highlight its global economic influence and its growing role in international liquidity management.

The stablecoin landscape is entering a phase defined by maturity and accountability. Tether’s progress will depend on its ability to execute with clarity, maintain consistent transparency, and extend cooperation across the financial ecosystem. Through this disciplined approach, the company has the potential to shape the next evolution of digital finance and reinforce its position at the center of the world’s stablecoin infrastructure.

Expert Insights

Industry experts share a clear perspective that stablecoins have become the defining force of blockchain adoption. Zaheer Ebtikar, Chief Investment Officer at Split Capital, emphasizes that stablecoins stand as the most successful application of crypto technology. He explains that few initiatives have focused on building the base-layer infrastructure needed for true interoperability, a gap that Plasma is now addressing. By optimizing transaction throughput while keeping fees exceptionally low, Plasma introduces an architecture purpose-built for stablecoins, designed to achieve efficiency through focus rather than breadth.

Steven Lubka of Swan Bitcoin adds that the rise of dedicated stablecoin networks marks an evolution in blockchain philosophy. He points out that new infrastructures like Plasma are built on the thesis that blockchains excel when optimized for stablecoins and that adopting Bitcoin’s security model provides the stability and trust required for large-scale adoption. This approach aligns performance with resilience, creating systems capable of supporting the next generation of global payments.

According to Paul Faecks, Chief Executive Officer of Plasma, stablecoins are the leading catalyst for blockchain’s mainstream use. He explains that most networks still prioritize other applications, leaving stablecoins as secondary assets within their ecosystems. Plasma reverses this hierarchy by using Bitcoin as its security foundation and enabling free USDT transfers within a network designed exclusively for stablecoins. Through this structure, it achieves deep liquidity, high scalability, and seamless efficiency, establishing Plasma as a cornerstone for the digital financial infrastructure of the future.

Tether's Future: Three Scenarios

Tether’s position in the global stablecoin market will rely on three decisive factors that shape its competitiveness and long-term growth. The first is regulatory transition, centered on the launch of USAT and full compliance with the GENIUS Act. This step determines how effectively Tether secures its place in the U.S. financial system and builds trusted relationships with institutional partners. The second factor is cross-chain expansion, driven by USDT0 and Plasma, which allow Tether to extend liquidity across multiple blockchains without issuing new tokens on each one. These networks create stronger connectivity and broader utility for stablecoins. The third factor is product innovation, where Tether’s ability to compete with yield-bearing stablecoins and integrated financial services will shape its appeal in an evolving market.

In an optimistic scenario, Tether could maintain a 60–65% market share by 2027 if USAT, USDT0, and Plasma continue to gain adoption and strengthen network effects. Consistent liquidity, deep integration, and broad distribution would reinforce Tether’s role as the central infrastructure layer of the stablecoin economy.

A neutral scenario projects a 50–55% market share, reflecting growing competition from USDC and other regulated issuers. In this case, Tether keeps a strong foothold in emerging markets while sharing the U.S. market with compliant competitors. Overall market expansion could still balance the shift in share, allowing Tether to retain scale and profitability.

A conservative scenario places Tether’s market share below 45% if compliance timelines slow, rival issuers accelerate growth under stronger regulation, or product development loses momentum. Even with a smaller share, Tether would remain an influential player supported by its infrastructure presence and strong liquidity foundation.

Conclusion: Winning Through Infrastructure, Not Market Share

Tether is stepping into a new phase of leadership. The company is expanding beyond issuance to shape the foundation of the global stablecoin economy. Its focus on infrastructure, through USDT0, Plasma, and USAT, marks a strategic shift from market share to market design. Tether is building the systems that power stablecoin movement, liquidity, and interoperability across borders.

As regulation advances and competition grows, strength now depends on scale, transparency, and trust. Tether has the financial depth to sustain long-term growth, earning 13.7 billion USD in 2024 and 4.9 billion USD in the second quarter of 2025, with 98.5 billion USD held in U.S. Treasury bonds. These resources give the company unmatched capacity to invest in technology, compliance, and infrastructure that connect digital money to the global economy.

Tether’s strategy reflects confidence in its role as a cornerstone of modern finance. The company is not only adapting to change but defining how value moves in the digital era. As the stablecoin market evolves, Tether’s infrastructure will remain the foundation that enables it: fast, compliant, and built for the future.