The De-Peg Phenomenon: Inside the Fragile Core of Stablecoins

Key Takeaways

- De-peg defines stability under pressure. Each break in the peg reveals how design, liquidity, and confidence interact when markets tighten.

- UST collapsed through reflexivity. An overreliance on market belief and self-reinforcing mechanics turned volatility into destruction.

- USDe recovered through structure and speed. Real collateral, automated hedging, and transparent data transformed panic into recovery.

- Liquidity and transparency decide survival. Deep markets and visible reserves restore trust faster than code alone.

- DeFi’s future stability is earned, not assumed. Systems that adapt quickly, move transparently, and manage liquidity in real time define the next era of decentralized finance.

The de-peg phenomenon stands as one of the most defining signals in decentralized finance. It marks the instant a stablecoin’s promised value begins to shift and the hidden mechanics of liquidity, leverage, and collective trust rise to the surface. Each de-peg reveals how the idea of stability operates under pressure and how digital markets translate confidence into price.

In the ecosystem of DeFi, every stablecoin exists in a fragile balance between collateral, liquidity, and redemption flow. When this balance changes, the peg bends, sending shockwaves through exchanges, protocols, and investors who depend on it. A de-peg captures this moment: the intersection where financial design meets human behavior, and where transparency, liquidity, and risk converge.

Over the past three years, more than eighty billion dollars in market value have moved through major de-peg events, reshaping the way the market measures resilience. In this article, we explore how a de-peg forms, how it spreads across liquidity layers, and what it reveals about the architecture of stability in digital finance. Through two cases: UST & USDe, we explore the forces that determine whether a stablecoin collapses under pressure or regains balance when stability begins to fracture.

The Anatomy of a Peg

To understand de-peg, it is first necessary to look at the idea of a peg. A peg forms the foundation of every stablecoin and represents the link between a digital token and the value of the U.S. dollar. It acts as the backbone of decentralized finance, turning volatile digital assets into reliable instruments for trade and long-term value storage. The strength of this mechanism depends on the harmony between design, liquidity, and market confidence. When these elements work together, the system can adapt to pressure while preserving the sense of trust that holds stability in place.

A stablecoin’s peg rests on three interconnected layers: architecture, liquidity, and confidence. Each layer contributes a different form of strength, and together they define how the peg holds during turbulence.

Architecture

The foundation lies in how the stablecoin is engineered.

- Fiat-backed models such as USDT and USDC rely on cash reserves and short-term Treasuries, keeping parity through redeemable assets in traditional banks.

- Crypto-backed models like DAI use overcollateralized positions stored in smart contracts, adjusting collateral ratios as market conditions change.

- Algorithmic or synthetic models such as UST and USDe maintain equilibrium through on-chain arbitrage or delta-neutral hedging strategies.

Each approach builds a unique rhythm of stability, fiat brings assurance, crypto offers autonomy, and algorithmic design seeks efficiency.

Liquidity and Redemption

Liquidity forms the second layer and serves as the bloodstream of the peg. Deep liquidity across both centralized and decentralized venues allows stablecoins to move freely without slippage. When redemption flows remain open and capital circulates easily, the peg absorbs volatility with speed and flexibility. The capacity to convert one token into another asset instantly gives the system resilience and keeps markets synchronized under pressure.

Confidence and Market Psychology

The final layer belongs to psychology. Every peg depends on collective conviction in collateral, transparency, and redemption integrity. Markets thrive when users believe liquidity will hold and information remains visible. Clear proof-of-reserves, responsive governance, and consistent performance turn confidence into the most powerful form of collateral.

Model Type | Backing Mechanism | Example | Risk Profile |

| Fiat-backed | Cash, Treasuries, regulated reserves | USDT, USDC | Low |

| Crypto-backed | Overcollateralized digital assets | DAI, LUSD | Medium |

| Algorithmic / Synthetic | Incentive or hedging-based stability | UST, USDe | High |

A peg functions as a living equilibrium rather than a fixed point. Architecture shapes its foundation, liquidity keeps it active, and confidence gives it endurance. When these layers align, stability becomes more than a promise, it becomes performance.

What Exactly Is a De-Peg?

A de-peg happens when a stablecoin moves away from its target price, usually one U.S. dollar. The deviation may begin subtly, such as falling to 0.97 during redemptions or rising to 1.03 when supply tightens. Each fluctuation exposes the tension between market forces, liquidity, and redemption activity. In that instant, a stablecoin shifts from a symbol of calm into a visible gauge of financial strain across the digital economy.

Stablecoins are built on three primary design models, each carrying a different level of de-peg risk based on how value is maintained and collateral is managed.

Type | Backing Mechanism | Example | De-Peg Risk | Recovery Strength |

| Fiat-backed | Cash reserves and short-term Treasuries | USDT, USDC | Low | Strong, supported by direct redemption |

| Crypto-backed | Overcollateralized digital assets stored on-chain | DAI, LUSD | Medium | Conditional, influenced by collateral performance |

| Algorithmic or Synthetic | Incentive-based or hedged market mechanisms | UST, USDe | High | Variable, depending on design efficiency and liquidity depth |

De-peg may disappear within minutes or evolve into a severe breakdown. A 1% deviation rarely attracts attention, a 10% gap shakes confidence, and a 50% plunge signals a complete loss of balance. Each stage measures how well a system absorbs pressure, revealing the connection between structure, liquidity, and market psychology that defines real stability in decentralized finance.

The Mechanics Behind a De-Peg

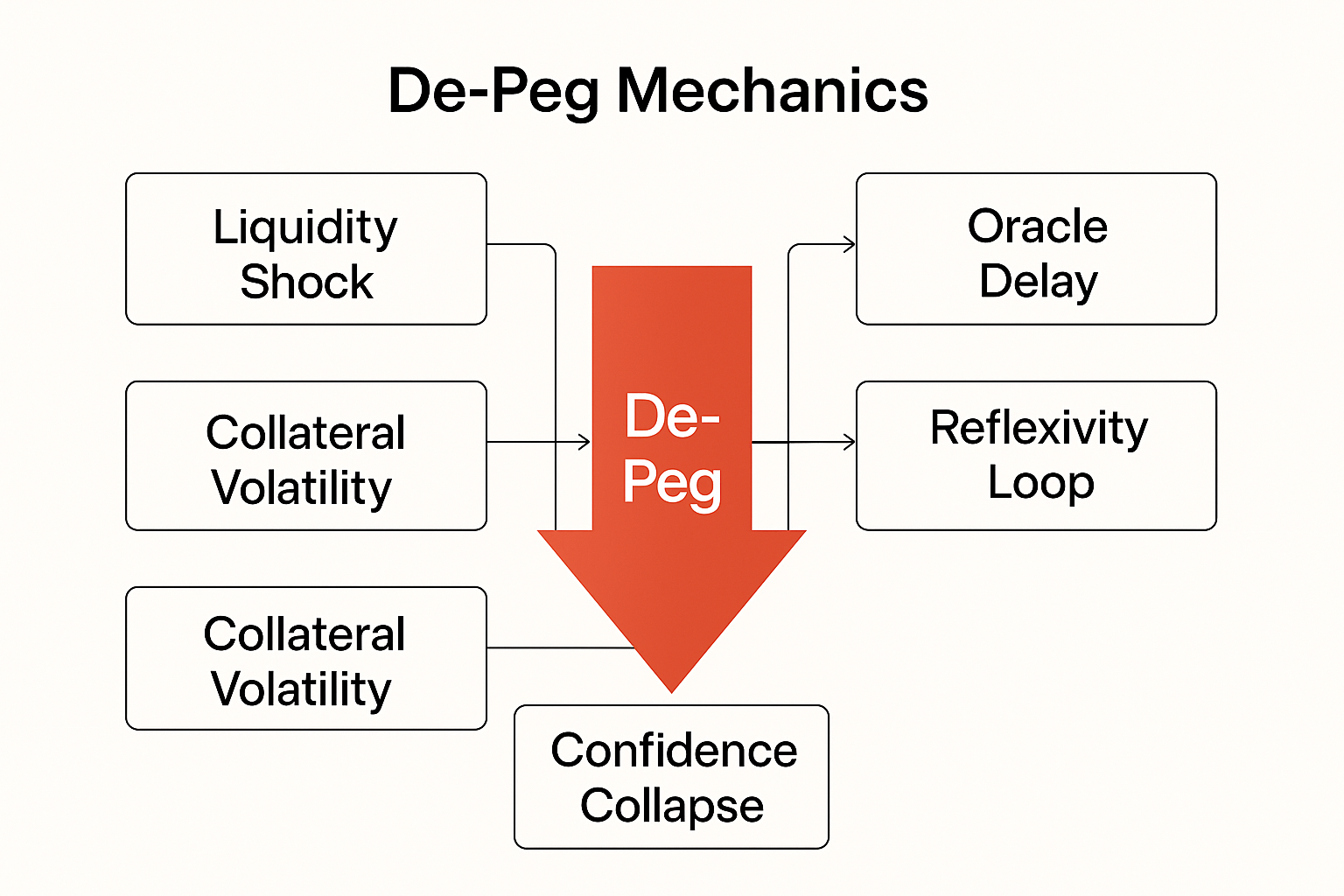

A de-peg often begins quietly. It starts with small imbalances that grow over time until the system loses its balance. Liquidity dries up, prices slip, and confidence weakens. What looks like a minor fluctuation becomes a chain reaction that feeds on itself and spreads through the market.

The first sign usually comes from a liquidity shock. Large redemptions pull funds out of pools on Curve, Uniswap, or major exchanges, leaving less capital for trading. With thinner liquidity, each transaction moves the price further from its target. Then comes collateral volatility, as the assets backing the stablecoin lose value faster than the system can react.

When oracles delay price updates, smart contracts begin to rely on outdated data, and the market starts to drift without a clear anchor. Traders sense the instability and begin selling. Selling creates more pressure, prices fall further, and fear spreads across platforms.

As confidence fades, redemption slows and liquidity fragments. The peg no longer represents one dollar but a signal of uncertainty. At this stage, the de-peg feeds on its own momentum. Recovery depends on how quickly liquidity returns, collateral stabilizes, and trust rebuilds before the system loses control entirely.

UST and USDe: Two Faces of a De-Peg

The de-peg of UST and USDe shows two very different realities in decentralized finance. One imploded within days, erasing tens of billions of dollars. The other faced the same pressure and came back stronger. Together, they proved how stability is earned through structure, speed, and transparency.

Aspect | UST (2022) | USDe (2025) |

| Model | Algorithmic mint-burn mechanism with LUNA | Synthetic dollar with delta-neutral hedging |

| Collateral | Reflexive token (LUNA) | ETH collateral and short futures positions |

| Trigger Event | Market sell-off and Curve pool imbalance | Global crash after 100% U.S.–China tariff |

| De-Peg Range | $0.99 → below $0.10 in 72h | $1 → $0.96, recovered within hours |

| Market Impact | $60B value erased, liquidity collapse | $19.3B liquidations absorbed, peg restored |

| Response | Reflexivity loop accelerated failure | Rapid rebalancing, capital injection, arbitrage through CEX and DeFi |

| Outcome | Collapse of confidence and system | Full recovery and restored trust |

| Lesson | Faith without collateral breaks | Structure and visibility preserve stability |

UST: The Reflexive Collapse

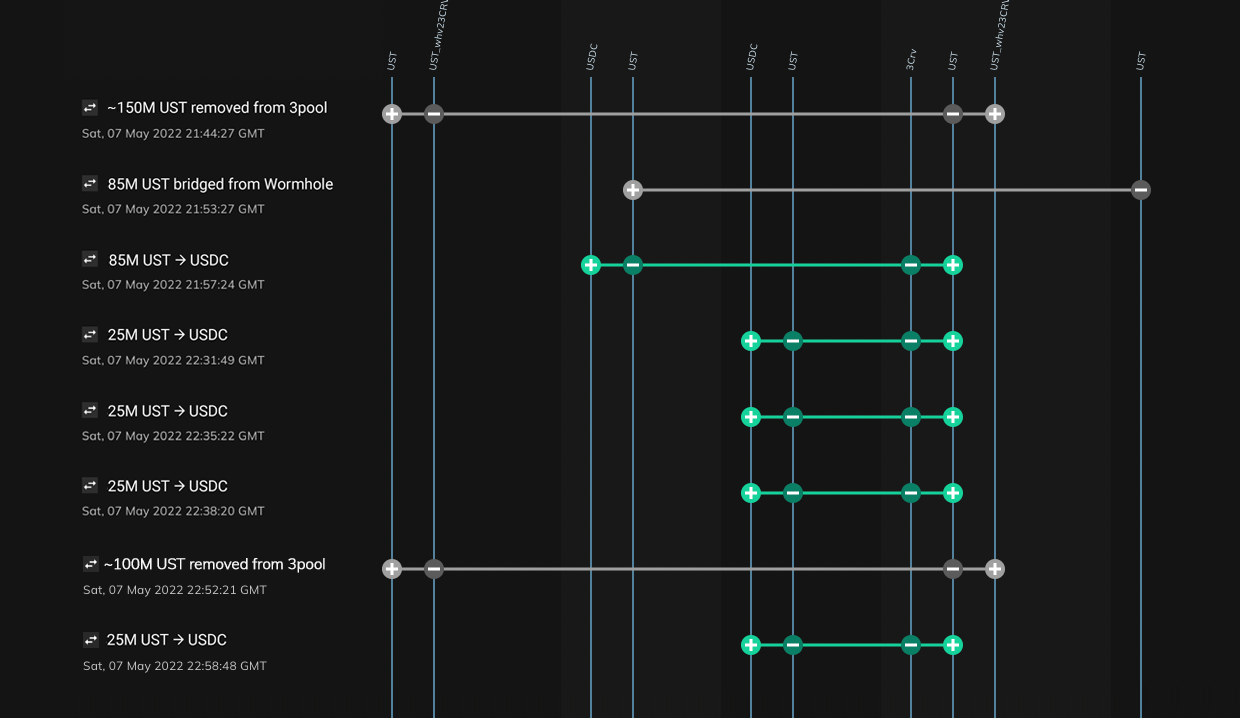

In 2022, TerraUSD (UST) became the icon of algorithmic stability. It tied its value to one dollar through an on-chain swap with LUNA, its volatile sister token. When UST traded below a dollar, traders burned UST for LUNA to try to restore the peg. The design counted on liquidity and constant market demand to hold.

The illusion lasted until early May. Curve’s UST pool showed a sharp imbalance as holders fled to safer assets. Redemptions spiked, LUNA supply exploded, and the peg slipped beyond recovery. Within 72h, UST fell from 0.99 to below 0.10. The reflexivity loop consumed the system: each sale minted more LUNA, drove its price lower, drained every pool that once supported stability. More than $60 billion in value vanished.

UST’s collapse became a study in structural fragility. Liquidity vanished faster than arbitrage could react. Every mechanism meant to protect the peg helped fuel its destruction. Confidence evaporated across DeFi and exchanges, turning the experiment into a financial implosion visible to the entire world.

USDe: The Controlled Recovery

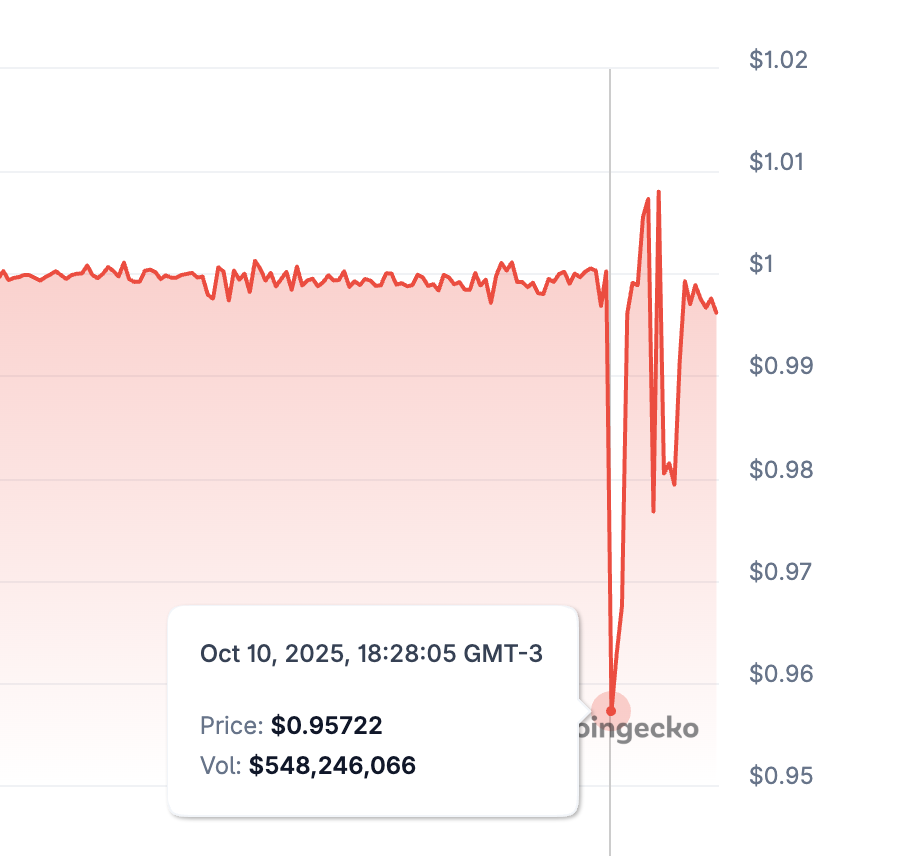

Two years later, Ethena Labs introduced USDe, a synthetic dollar built on delta-neutral hedging instead of algorithmic minting. Each token combined ETH collateral with short futures positions to balance exposure and capture funding yields. The system created a self-adjusting architecture where liquidity, data, and execution moved as one.

The real test arrived in October 2025. The United States announced a 100% tariff on Chinese imports, triggering an immediate global sell-off. Crypto markets lost nearly $19.3 billion in liquidations within 40 minutes. USDe slipped to 0.96 as funding rates flipped negative and oracle feeds mis-priced assets. Panic surged across trading desks.

Ethena’s response proved decisive. The protocol rebalanced hedges, injected capital, and opened arbitrage channels across major exchanges. Liquidity returned, spreads tightened, and within hours, USDe reclaimed its peg. Real-time dashboards confirmed collateral levels, calming a market already battle-hardened.

The USDe de-peg turned fear into proof. The system held through structure and speed. Hedging absorbed volatility, liquidity moved without friction, data restored confidence faster than panic could spread.

Two Outcomes, One Core Reality

UST and USDe faced the same event but lived opposite endings. UST collapsed under reflexive design; USDe recovered through controlled architecture and real liquidity. UST relied on faith, USDe on execution. One exposed fragility, the other created resilience.

Now, we can see de-peg is more than numbers on a chart. It is the moment design meets belief. UST’s fall taught the price of unanchored optimism. USDe’s recovery showed how engineering, liquidity, and speed define survival in the digital economy.

Anatomy of a De-Peg Cycle

The stories of UST and USDe outline a clear cycle that repeats across every stablecoin crisis. Each phase unfolds with growing intensity until the system either absorbs the pressure or breaks under it.

Phase 1: Stress Signal

Volatility surges and traders rush to redeem faster than liquidity can refill. Curve, Binance, and other markets begin showing heavy imbalance, often 80–90% one-sided. The system starts to tilt, and early movers sense weakness.

Phase 2: Liquidity Drain

Capital escapes. As pools thin, slippage widens and redemption queues stretch. Arbitrage spreads grow, leaving price gaps across exchanges. A token meant to trade at one dollar now slips to 0.99, then 0.97. The de-peg becomes visible.

Phase 3: Confidence Erosion

Fear takes control. Social channels ignite, amplifying every negative metric—funding rates turn red, collateral values slide, withdrawals slow. On-chain data confirms what traders already feel. Retail investors exit in waves, deepening the loss of balance.

Phase 4: Resolution or Collapse

Recovery depends on structure and speed. Stablecoins with tangible collateral and active redemption, like USDe or USDC, absorb the shock and regain stability. Projects built on reflexive assets, such as UST or IRON, enter a downward spiral until liquidity, price, and confidence vanish together.

Each phase in the de-peg cycle exposes the real foundation of stability: the strength of collateral, the depth of liquidity, and the speed of response when trust begins to move.

The Psychology Behind Every De-Peg

Every market collapse begins with emotion before it reaches the charts. A shift in mood moves faster than code, spreading through traders who act on instinct instead of calculation. Once conviction fades, liquidity follows, and the system starts to unravel from within.

Reflexivity sparks the chain reaction. A small sign of weakness turns into action, and that action reinforces the fall. Herd behavior magnifies the effect as exits multiply and liquidity drains. Information cascades push the panic further. A single update, rumor, or chart races through thousands of screens long before markets have time to settle.

Amid the rush, the mind locks onto a single number—one dollar. Anchoring creates a false sense of control, convincing traders to wait for a rebound until the price slides beyond reach. When the peg finally gives way, hesitation turns to panic, and emotion takes over entirely.

The contrast between UST and USDe shows how psychology decides outcomes. UST’s confidence collapsed as fear moved faster than information. USDe steadied once traders saw live data on reserves, hedge positions, and liquidity across exchanges. Transparency shifted perception and slowed the storm.

In every de-peg, markets follow the same pattern. Emotion moves first, information follows, and the system stabilizes only when clarity becomes louder than fear.

Recovery and Redesign After a De-Peg

We can see de-peg leaves deep traces across code, liquidity, and psychology. Every disruption becomes a lesson in control. When a system faces collapse, recovery depends on how fast it can restore alignment between structure, liquidity, and confidence. True restoration begins with precision, not promises.

The first step is architectural repair. Protocols backed by verifiable collateral can inject reserves, rebalance hedges, and reopen redemptions before panic spreads. Each adjustment rebuilds trust piece by piece. Real-time dashboards and third-party audits turn information into stability, replacing speculation with visible proof.

The second stage is liquidity recovery. Capital must flow again. Deep trading pools, active market makers, and cross-exchange coordination give the peg room to breathe. When liquidity returns quickly, the deviation narrows and the one-dollar mark regains weight.

The last phase is communication. Numbers alone cannot calm a market in motion. Clear direction from developers, traders, and institutions anchors sentiment. Updates delivered with speed and accuracy show command over the situation and remind the market that control still exists.

The contrast between UST and USDe captures this cycle of failure and renewal. UST collapsed into silence, while USDe restored order through visibility and execution. Each de-peg reshapes DeFi, forcing better design, faster reaction, and deeper transparency—the real foundation of stable value.

Lessons from the De-Peg Era

Every de-peg leaves a record of what holds and what fails. The last few years have turned stablecoins from experiments into case studies of resilience, where every collapse or recovery has sharpened the collective understanding of stability. Each event teaches a different principle: how structure, liquidity, and confidence behave under stress.

- Collateral defines credibility. Real reserves give stability its foundation. Whether in fiat, crypto, or synthetic form, collateral anchors trust and limits reflexive fear. Transparent balance sheets and auditable reserves now shape the standard for every serious stablecoin.

- Liquidity sustains survival. Deep markets are the bloodstream of the peg. Projects with access to broad liquidity networks can absorb redemptions without losing control of price. Stability grows stronger when liquidity flows freely across both centralized and decentralized channels.

- Transparency restores order. Open data dashboards, public hedging records, and real-time reporting have become essential. Visibility turns panic into patience, proving that information can defend a peg more effectively than code alone.

- Yield reveals design quality. Returns linked to genuine funding rates, not artificial incentives, reflect system health. UST’s unsustainable yield model burned through confidence, while USDe’s market-based returns demonstrated discipline.

- Speed determines outcome. Reaction time separates recovery from collapse. The faster a system rebalances collateral, injects liquidity, and communicates updates, the greater its chance of regaining stability before fear becomes irreversible.

In short, we can see all lessons reshape how DeFi approaches stability. The next generation of stablecoins will rise from this understanding: built with stronger collateral structures, deeper liquidity networks, and transparent governance. Every de-peg leaves the ecosystem sharper, faster, and more aware of what true stability demands.

The Future Beyond the De-Peg

The de-peg era has rewritten the meaning of stability in decentralized finance. Each disruption has driven innovation, turning volatility into momentum for progress. The next generation of stablecoins evolves with liquidity, regulation, and real-time data, rather than relying on a fixed design.

The future belongs to systems able to adjust faster than fear spreads. Collateral models combine fiat assurance with on-chain mobility. Hedging engines now rebalance positions automatically across exchanges, managing exposure within seconds. Proof-of-reserve frameworks shift from periodic audits to continuous verification. Stability becomes fluid, maintained through precision and transparency rather than slogans or speculation.

Institutional expansion will accelerate this transformation. Payment networks, asset managers, and fintech firms already integrate blockchain settlement into daily operations. Each new participant adds liquidity, deepens market depth, and strengthens redemption flow. As ecosystems merge, a de-peg may no longer signal collapse, it will act as a stress test measuring endurance and design integrity.

The era ahead focuses less on whether a stablecoin can stay at one dollar and more on how quickly it can return once shaken. True stability comes from systems built to flex, recover, and evolve under pressure. The de-peg remains a reminder that in every market cycle, resilience defines value.

FAQs

1. What does “de-peg” mean in stablecoins?

A de-peg occurs when a stablecoin’s market price diverges from its intended value, usually one U.S. dollar. It signals a loss of balance between liquidity, collateral, and market confidence.

2. Why did UST fail while USDe recovered?

UST depended on belief and algorithmic minting with no real collateral, leading to a reflexive collapse once confidence cracked. USDe combined collateralized ETH positions with delta-neutral hedging, giving it structural defense against volatility.

3. Can a fiat-backed stablecoin de-peg?

Yes, even fiat-backed models like USDC can temporarily lose parity during liquidity shocks, as seen during the Silicon Valley Bank crisis in 2023. Redemption mechanisms and real reserves usually restore balance quickly.

4. How can projects prevent a de-peg?

Maintaining deep liquidity, verified collateral, responsive hedging, and transparent communication reduces risk. Stability relies on preparation rather than reaction.

5. What lessons does the market learn from UST and USDe?

Confidence requires evidence. Sustainable yields, visible reserves, and rapid response mechanisms separate resilience from illusion. The future of stablecoins lies in systems that evolve faster than fear.

Conclusion

The de-peg is more than a market swing. It is the moment when reality rises to the surface and design meets pressure. Each episode tests the strength of stability and exposes how systems react under stress. UST collapsed as reflexivity consumed confidence within hours, while USDe recovered through speed, liquidity, and disciplined structure.

Decentralized finance has entered a new phase where stability depends on precision and execution. Systems able to adjust instantly, show reserves openly, and keep liquidity alive set the new benchmark. Transparency becomes a core function, not an accessory. Volatility turns from threat to catalyst, driving smarter design and stronger architecture.

A de-peg ends when clarity replaces fear and capital begins to move with purpose again. Each recovery marks progress, proving that stability is a living process—a balance of trust, timing, and control in motion.