Tron Gas Fee Cut Slashes Daily Revenue 64% in 10 Days but L1 Lead Remains

Tron’s recent network fee reduction has caused a sharp drop in daily revenue for its block producers. Despite the hit, the blockchain still tops all layer-1 competitors in total revenue.

- Daily network fees plunged from $13.9M to $5M after fee cut

- Gas fees fell 60% after energy price dropped from 210 to 100 sun

- Proposal #789 aimed to boost user transfers and ecosystem growth

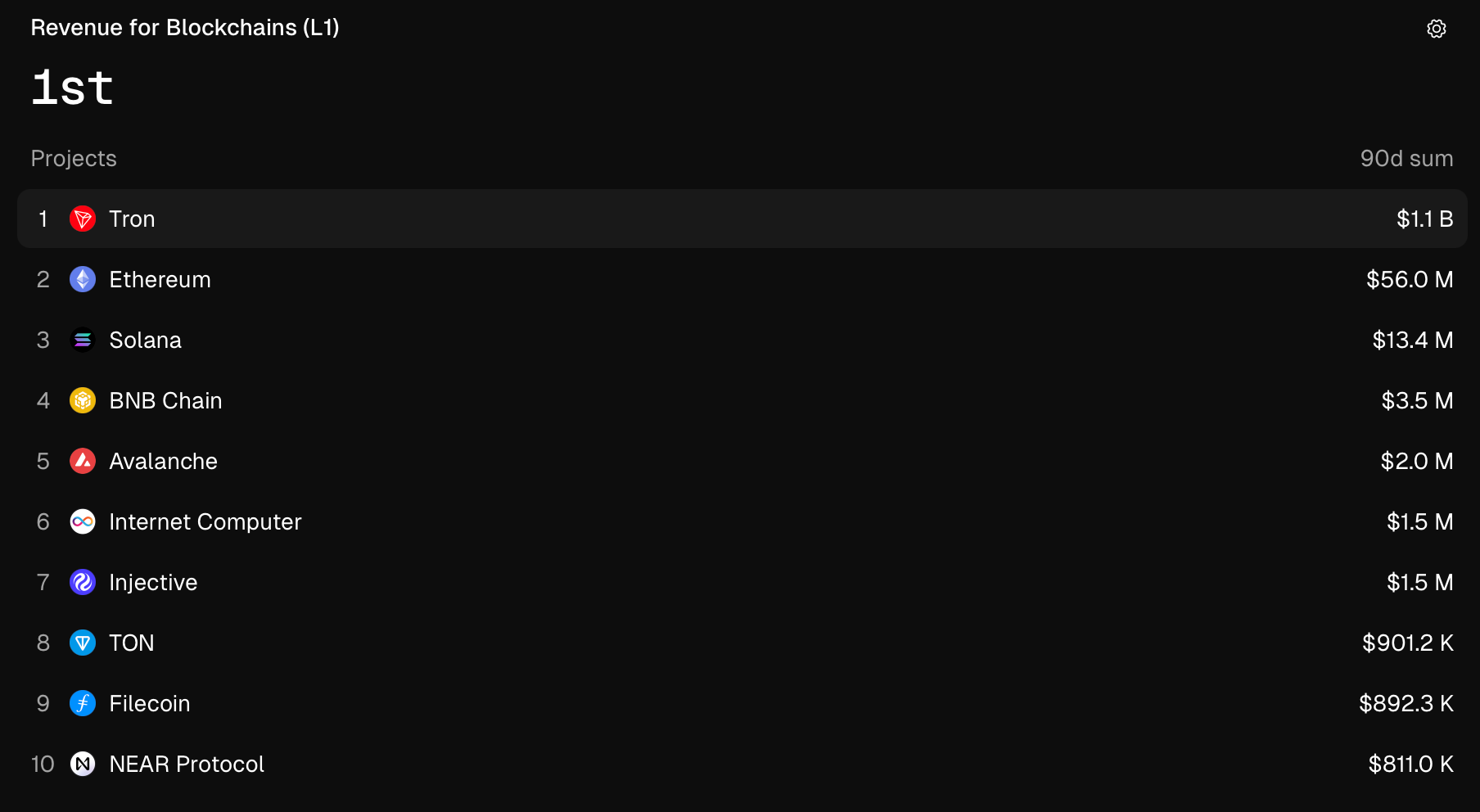

- Tron still captured 92.8% of all L1 revenue over the past week

- $1.1B fees generated in 90 days keeps Tron ahead of Ethereum, Solana, BNB

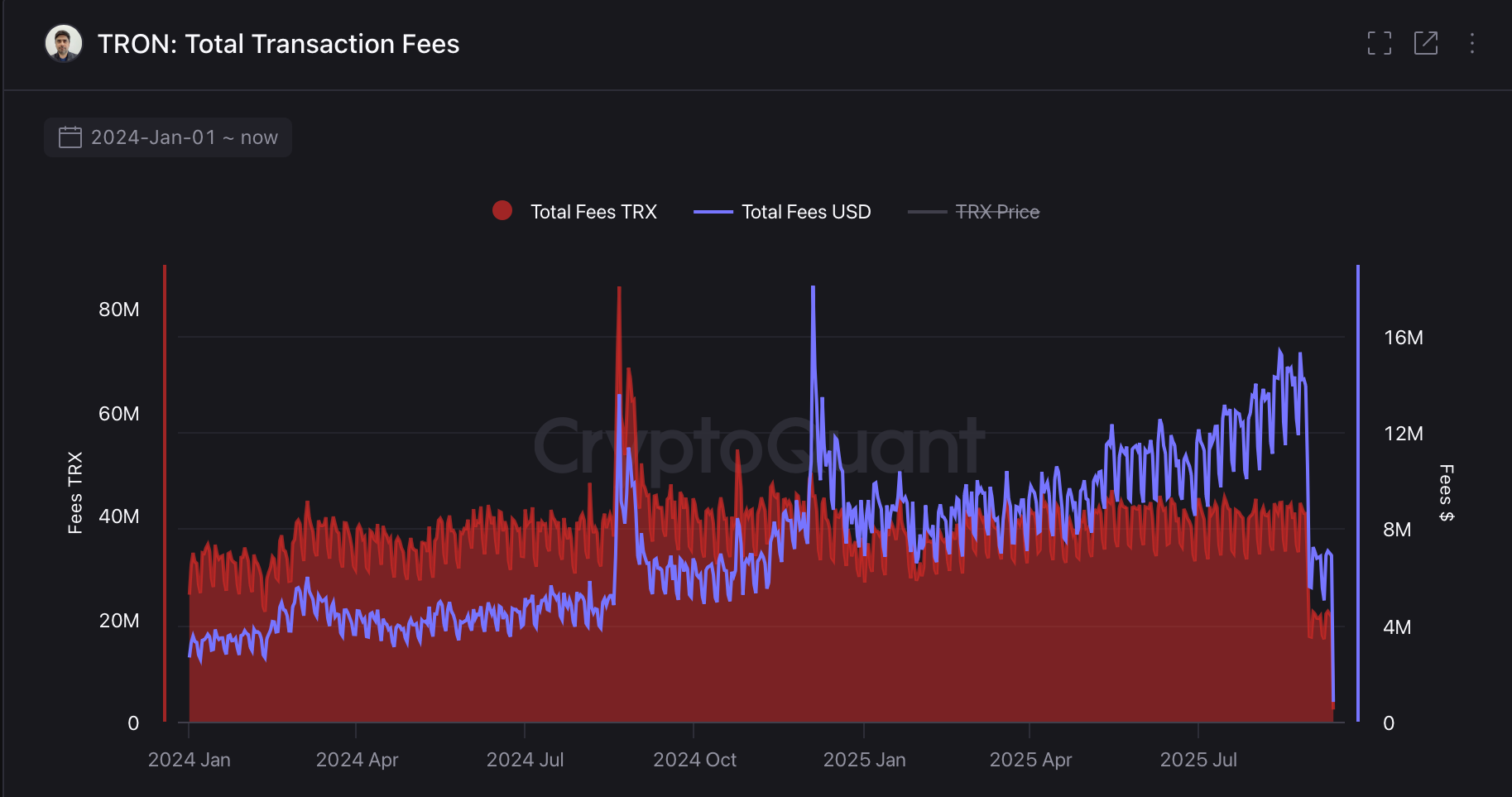

Tron’s decision to lower transaction fees has had an immediate impact on network earnings. According to CryptoQuant, the total daily fees collected by Super Representatives dropped to $5 million on Sept. 7, the lowest in over a year, representing a 64% decline from the $13.9 million recorded just before the fee change.

On-chain data shows that average gas fees decreased by 60% after Proposal #789—titled “Decrease the transaction fees”—reduced the energy unit price from 210 sun to 100 sun. One TRX equals one million sun, making the new cost significantly cheaper for users.

The proposal, introduced by community member GrothenDI and approved by a Super Representative vote on Aug. 29, aimed to encourage greater network activity, estimating up to 12 million more potential transfers. While the revenue hit is clear, Tron’s dominance among layer-1 blockchains remains intact. Token Terminal data reveals Tron captured 92.8% of total L1 revenue in the last seven days and generated $1.1 billion in fees over the past 90 days.

For comparison, Ethereum has amassed $13 billion in fees over the past five years, while Tron has reached $6.3 billion, showing the network’s rapid rise despite the recent cut.

Final Thought

Tron’s aggressive fee reduction highlights a strategic trade-off: sacrificing short-term revenue for broader ecosystem growth. If user activity rises as expected, the network could maintain its lead in layer-1 revenue while fostering sustainable adoption.