Trump’s Proposed $2,000 Tariff Dividend Sparks Crypto Market Optimism

- Trump announced a proposed $2,000 “tariff dividend” for most U.S. citizens.

- The plan depends on a Supreme Court ruling on tariff legality.

- Analysts expect short-term asset boosts, including crypto.

- Long-term concerns include inflation and national debt growth.

United States President Donald Trump has announced a plan to provide most Americans with a $2,000 payment funded by tariff revenue, calling it a “dividend” that would bypass traditional stimulus methods. The proposal comes as part of his broader push for large-scale tariffs on foreign goods, which he argues are necessary for national security and U.S. economic protection.

In a post shared on Truth Social, Trump said the payments would go to the majority of Americans, excluding high-income earners. The announcement immediately drew attention across financial markets, especially in the cryptocurrency sector, where investors often react strongly to government stimulus discussions. The idea behind the “tariff dividend” is that funds collected from import taxes would be redistributed directly to citizens rather than being absorbed into government spending.

However, this proposal faces a major obstacle. The U.S. Supreme Court is currently reviewing whether such tariffs are legally enforceable at the scale Trump intends. Prediction markets show low confidence in the plan’s approval. Traders on platforms like Kalshi and Polymarket place the odds of the Supreme Court allowing the policy at roughly 20–23%. This reflects skepticism not only about legality but also political resistance in Congress.

Despite the legal uncertainty, the announcement was met with excitement by investors who view direct payments as a form of economic stimulus that typically pushes asset prices higher. During the COVID-era stimulus checks, a noticeable portion of funds flowed into Bitcoin, stocks, and other speculative markets. Analysts expect a similar trend if the tariff dividend moves forward, as retail investors often increase risk exposure when receiving unexpected cash inflows.

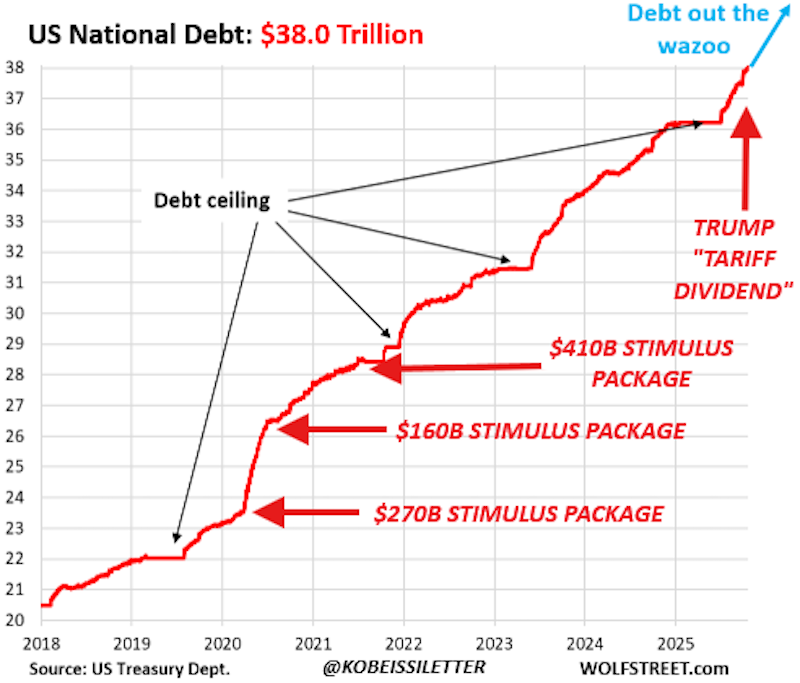

However, some market strategists warn that any short-term price boost could lead to long-term economic pressures. The Kobeissi Letter estimated that around 85% of U.S. adults would likely qualify for the payment, representing a significant federal expenditure. Funding these payouts through tariffs may indirectly raise consumer prices, contribute to inflation, and expand national debt burdens.

Bitcoin advocates emphasized that inflation risk strengthens the case for holding decentralized assets. Simon Dixon argued that unless recipients invest the $2,000 into assets like Bitcoin, the real value of the payout may erode over time. Meanwhile, market analyst Anthony Pompliano highlighted that both stocks and Bitcoin historically rise during periods of stimulus, suggesting traders may already be positioning for potential upside.

The ultimate impact on markets will depend heavily on the Supreme Court’s decision. If the plan is approved, a surge in liquidity could fuel higher crypto prices. If blocked, markets may retrace any stimulus-driven enthusiasm.

Final Thought

The proposed tariff dividend has sparked both excitement and caution. While it may provide a short-term lift to Bitcoin and other assets, the long-term economic cost remains a central concern. For now, crypto traders are watching closely for the Supreme Court’s ruling, which will determine whether this stimulus trend becomes reality or remains political messaging.