UK Expands Crypto Reporting to Cover Domestic Activity

Key Takeaways

- The UK expand crypto platforms to report all domestic user transactions from 2026.

- HMRC gains automatic access to both domestic and cross-border crypto data.

- Change expands the OECD’s CARF, which originally focused on cross-border activity.

- The UK also proposes “no gain, no loss” tax rules for DeFi users.

- Global regulators, including South Korea, Spain and the U.S., are tightening crypto tax oversight.

HMRC Moves to Close Domestic Reporting Gaps

The United Kingdom will introduce a major expansion of its crypto reporting obligations starting in 2026. Under the new rules, all UK-based crypto platforms must report activity from domestic users, extending the Cryptoasset Reporting Framework (CARF) beyond its original cross-border scope. The move gives His Majesty’s Revenue and Customs automatic access to both domestic and international crypto data for the first time.

CARF, created by the OECD, establishes a global system for tax authorities to exchange crypto transaction data. While its initial focus was cross-border activity, domestic transactions within the UK would not have been automatically reported. HMRC’s new rule closes that gap, preventing crypto from becoming an asset class that falls outside the visibility applied to traditional accounts under the Common Reporting Standard.

Officials say the expanded framework will streamline compliance for crypto firms by unifying reporting obligations while giving HMRC a more complete picture of taxpayer behavior. The first global CARF data exchange is scheduled for 2027, meaning the UK’s domestic reporting requirement will be active in time for the inaugural cycle.

Alongside these changes, the government also proposed a “no gain, no loss” model for DeFi users, allowing capital gains taxes to be deferred until the underlying tokens are fully disposed of. The adjustment has been widely welcomed by local industry groups seeking clearer tax treatment for protocol-based transactions.

Governments Intensify Global Efforts to Tax Digital Assets

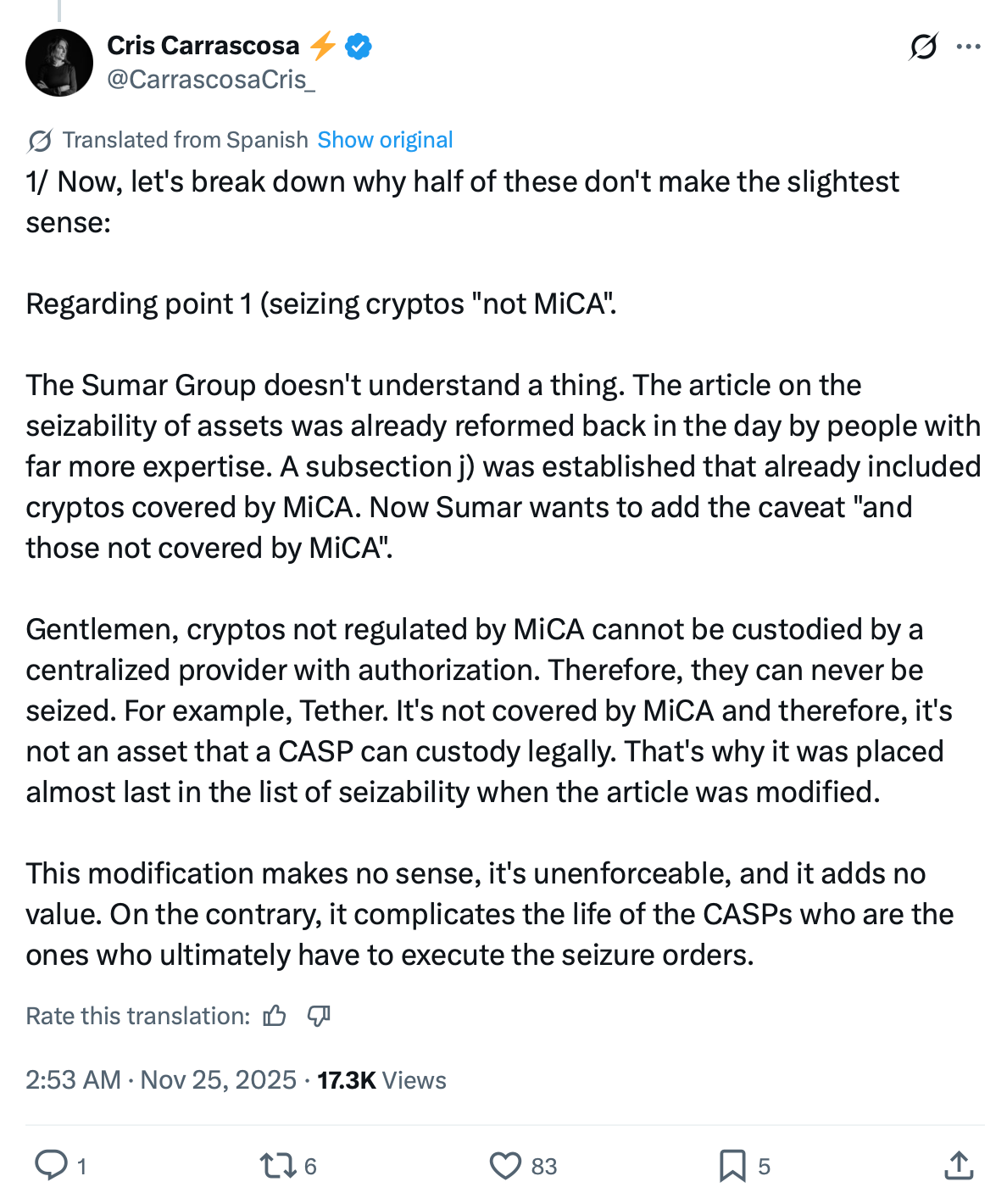

The UK’s expanded CARF implementation comes as governments worldwide move to tighten oversight of digital assets. South Korea’s National Tax Service announced it will seize crypto stored in cold wallets and conduct home searches if it suspects tax evasion. In Spain, lawmakers have proposed raising the top tax rate on crypto gains to 47% and shifting profits into general income brackets.

Switzerland confirmed it will delay its first automatic crypto information exchange until 2027 as it finalizes the list of partner countries. Although CARF will enter Swiss law on January 1, the rollout includes transitional measures to help firms adapt.

In the United States, Representative Warren Davidson introduced the Bitcoin for America Act, which would allow citizens to pay federal taxes in Bitcoin. The bill proposes that transferred BTC be treated as neither a gain nor a loss, effectively removing capital gains obligations for those payments. Tax contributions would flow into a strategic national Bitcoin reserve.

From Europe to Asia to the U.S., regulators are moving quickly to align tax frameworks with the rapid adoption of digital assets. The UK’s expanded reporting system marks one of the most sweeping updates yet, signaling the next phase of global crypto tax enforcement.