Understanding DEXTScore

In the fast-moving world of decentralized finance, information is power. With thousands of tokens launching every year, it can be difficult for traders and investors to separate legitimate projects from risky ones. This is where DEXTScore, a feature developed by DEXTools, comes in.

DEXTScore was designed to make token analysis easier by providing a single, easy-to-read metric that reflects a project’s overall credibility. It doesn’t replace deep research, but it gives users a reliable starting point when navigating the decentralized exchange (DEX) landscape.

What is DEXTScore?

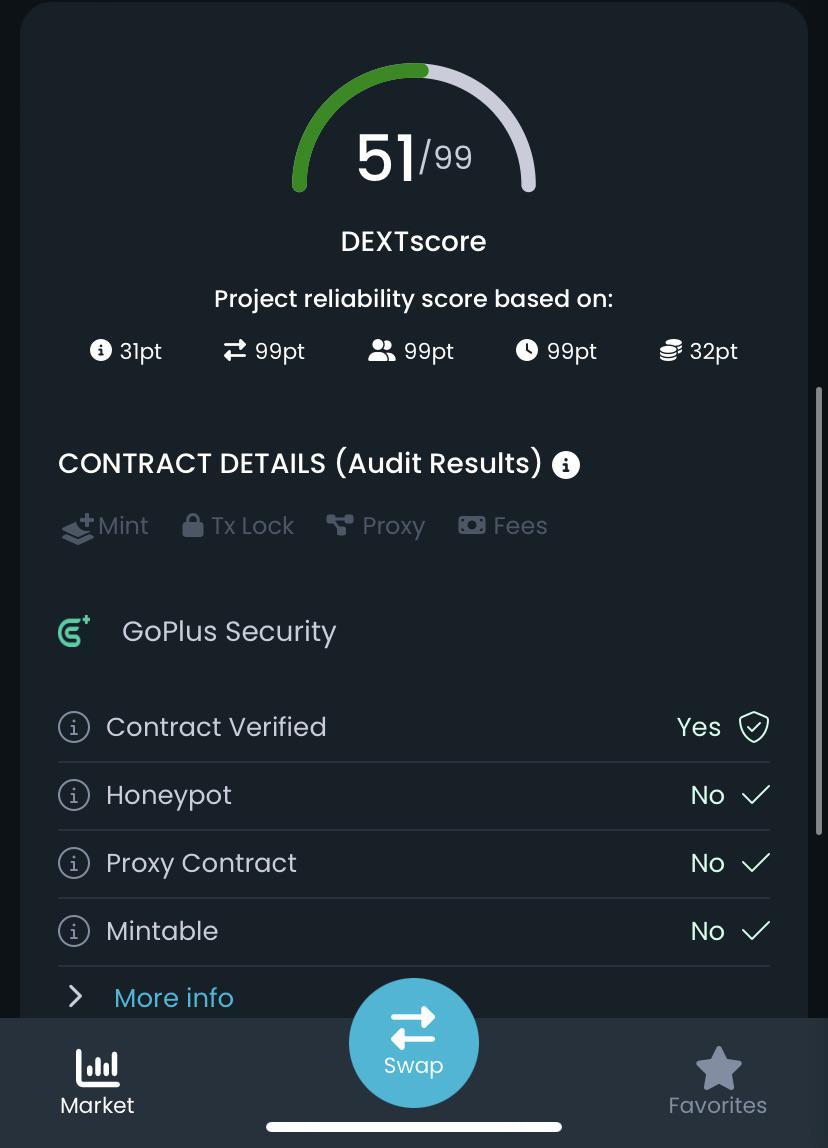

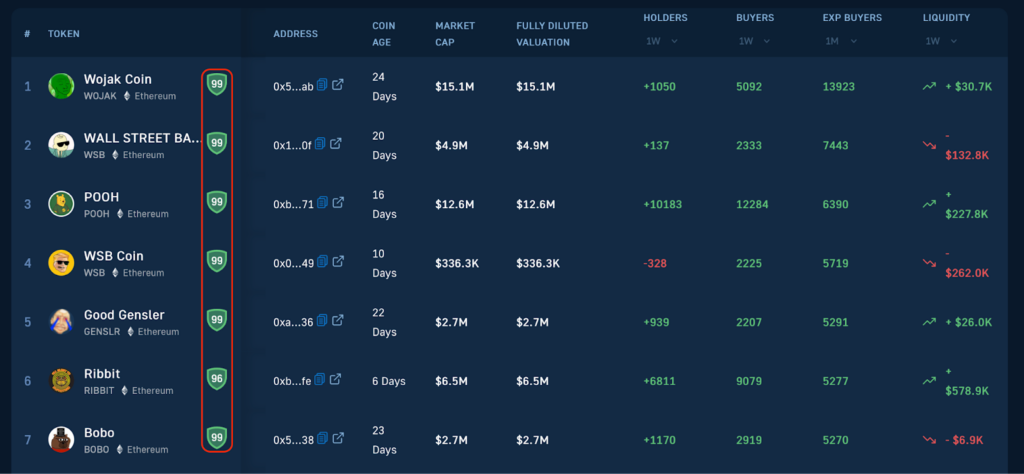

DEXTScore is a reputation and reliability score assigned to token pairs on DEXTools. It condenses a variety of factors—on-chain activity, liquidity, contract status, and community presence—into a single number ranging from 1 to 99.

A higher score, usually above 80, generally indicates that the token is more transparent and has healthier fundamentals. Moderate scores between 50 and 80 may signal early-stage projects with room to grow but also potential risks. On the other hand, a low score, typically under 50, often highlights issues such as poor liquidity, limited holders, or missing contract verification. In short, DEXTScore acts as a quick reference for token trustworthiness.

How is DEXTScore Calculated?

The score is built from several weighted data points that are continuously monitored. Liquidity is one of the biggest factors, as deeper and more stable pools suggest a healthier market. Transaction volume is also important, showing whether the token is actively traded or if activity is artificially inflated through wash trading.

The number of holders provides another layer of insight—tokens widely distributed among many wallets are generally healthier than those concentrated in a few hands. Contract details, such as verification and audits, further affect the score, as do the presence of official social links that make the project’s communications transparent and accessible. Together, these inputs create a composite score that allows traders to quickly assess where a token may excel or raise red flags.

Why DEXTScore Matters

The decentralized nature of DeFi comes with both opportunity and risk. Rug pulls, scams, and poorly designed contracts are not uncommon. While DEXTScore cannot guarantee safety, it provides a valuable layer of transparency. It allows traders to filter tokens quickly and identify those that may be worth deeper research. It also gives projects an incentive to adopt practices that improve transparency, such as maintaining liquidity and verifying contracts.

For traders, the score acts as an early-warning tool, highlighting tokens that may carry unnecessary risk. For projects, a strong DEXTScore serves as a signal to the market that they take credibility and community trust seriously.

The Limitations

It’s important to remember that DEXTScore is not a foolproof rating system. A high score may confirm that a token isn’t an obvious scam, such as a honeypot, but it doesn’t guarantee strong fundamentals, locked liquidity, or long-term sustainability. Many seasoned traders therefore treat DEXTScore as a starting point, using it as an initial checkpoint before diving into deeper research.

Comprehensive due diligence still requires looking into tokenomics, assessing the credibility of the team, evaluating governance mechanisms, and reviewing independent audits. In other words, DEXTScore provides a compass but not the full map.

Conclusion

As DeFi continues to grow, tools like DEXTScore are becoming essential. They help cut through noise, surface meaningful data, and guide traders toward smarter decisions. Still, the golden rule applies: always DYOR (Do Your Own Research).

Use DEXTScore as a helpful indicator, not as the final verdict. It can point you in the right direction, but navigating the DeFi landscape still requires vigilance, context, and deeper analysis.