US Bitcoin Reserve Funding Ready to Begin, Says Senator Cynthia Lummis

US Senator Cynthia Lummis confirmed that funding for the Strategic Bitcoin Reserve (SBR) could begin “anytime,” emphasizing that the only remaining hurdle is legislative red tape. The Bitcoin-friendly lawmaker credited President Donald Trump for enabling the fund’s creation but acknowledged that bureaucratic processes have slowed progress.

- Senator Cynthia Lummis says Bitcoin reserve funding can start immediately.

- Legislative delays remain the main obstacle to implementation.

- The reserve will initially use Bitcoin seized by the US Treasury.

- Additional BTC may be acquired without costing taxpayers.

- Market watchers expect an official Bitcoin purchase announcement soon.

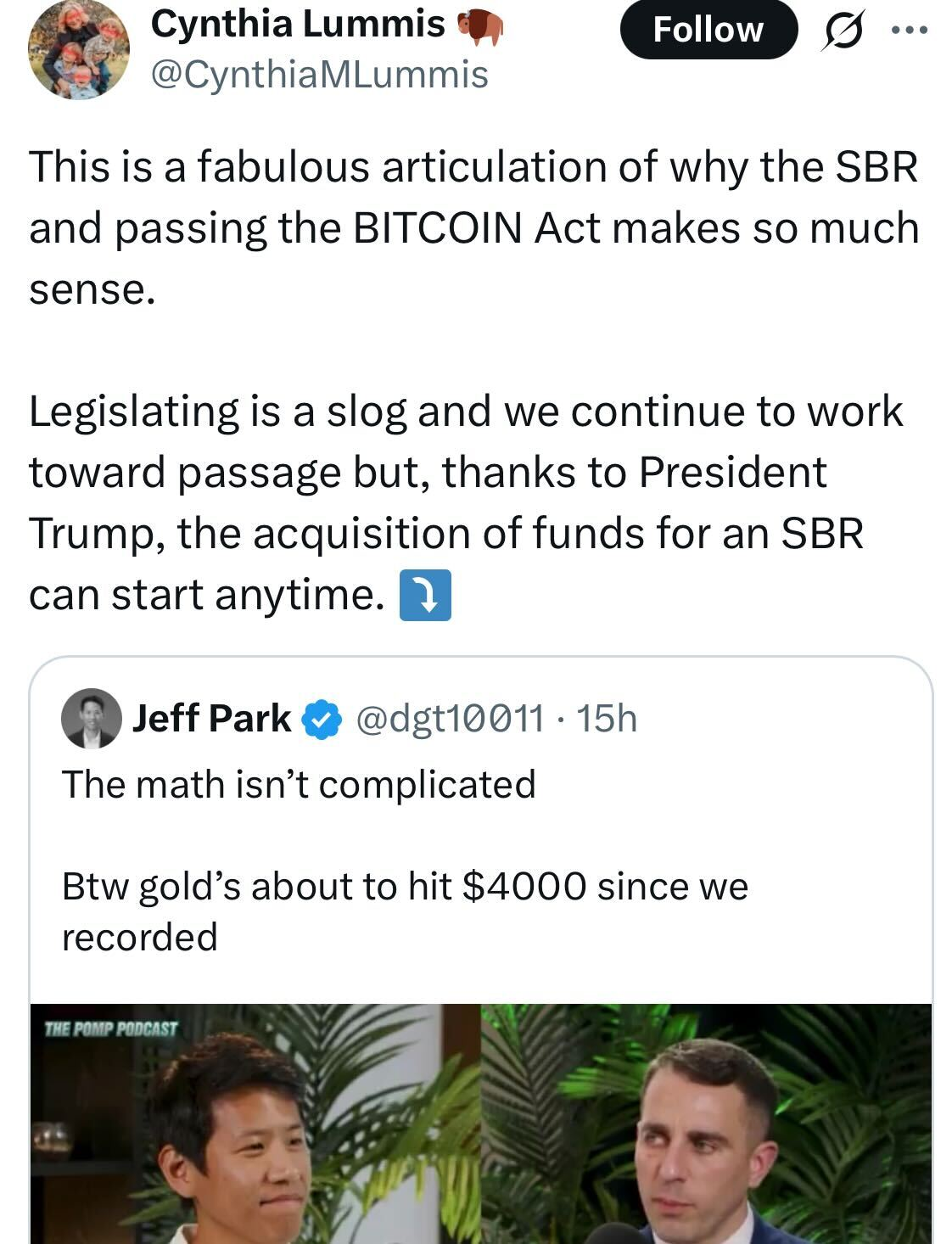

Senator Cynthia Lummis has reiterated that the US Strategic Bitcoin Reserve (SBR) is ready to move forward, with fundraising able to “start anytime.” In an X post on Monday, Lummis said that while bureaucratic hurdles persist, the legislative framework is now in place, allowing the acquisition of Bitcoin to begin whenever approved.

Lummis was responding to a post from Jeff Park, chief investment officer at ProCap BTC, who shared a discussion with Bitcoin advocate Anthony Pompliano about how the US could leverage its gold holdings to invest in Bitcoin. Park suggested that the government’s $1 trillion in unrealized gains from gold could serve as collateral for Bitcoin exposure, describing it as a low-risk strategy given America’s $37.9 trillion debt.

“If the government can use gold gains to buy Bitcoin, it could close a massive fiscal gap over time,” Park said. “With a 12% annual growth rate, Bitcoin could theoretically cover most of the deficit in 30 years.”

Lummis endorsed the idea, calling it “a fabulous articulation” of why both the Strategic Bitcoin Reserve and the BITCOIN Act make economic sense. The senator has been one of Washington’s strongest Bitcoin supporters, arguing that the US should hold BTC as a long-term strategic asset.

According to the official SBR fact sheet, the reserve will be funded initially with Bitcoin seized by the Department of Treasury through law enforcement actions. Additional BTC purchases could follow, financed through “budget-neutral” means that would not add costs to taxpayers.

President Donald Trump signed the executive order to establish the Strategic Bitcoin Reserve seven months ago, aiming to position the US as a leader in digital asset adoption. However, the program’s official structure and capital sources are still being finalized, leading to speculation about when government purchases will begin.

Over the weekend, Pompliano said on CNBC that markets are now watching closely for the first signs of US government Bitcoin buys. “Creating the initial reserve was good, but the next step — actual accumulation — is what everyone’s waiting for,” he said.

Analysts believe an official Bitcoin purchase announcement could boost confidence in the digital asset market and further legitimize Bitcoin as part of national financial strategy.

Final Thought

Senator Lummis’ remarks suggest that the Strategic Bitcoin Reserve is no longer just an idea — it’s on the brink of activation. While bureaucratic delays continue to slow progress, the possibility of the US government officially buying Bitcoin could mark a turning point for both national monetary policy and global crypto adoption.