US Investors Show Less Interest in Crypto as Risk-Taking Declines, FINRA Study Finds

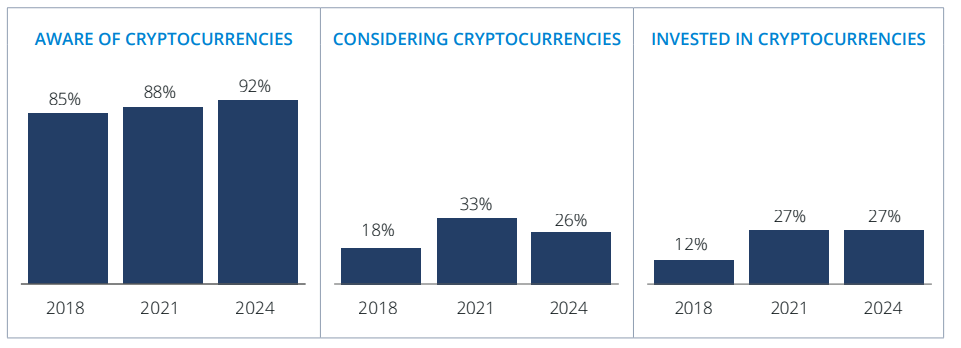

- FINRA says crypto investing stayed steady at 27% from 2021 to 2024.

- But only 26% of investors are considering buying crypto in 2024, down from 33% in 2021.

- High-risk investment behavior dropped from 12% to 8% over the same period.

- Younger investors under 35 saw the biggest decline in risk-taking.

- Most investors view crypto as risky, but many still believe risk is needed to reach financial goals.

- Fewer new investors are entering the market compared to 2021.

A new study from the Financial Industry Regulatory Authority (FINRA) shows that U.S. investors are now less interested in buying crypto, as overall risk-taking behavior has dropped since 2021.

According to FINRA, the share of Americans who currently hold crypto remained unchanged at 27% between 2021 and 2024. This means the number of people owning digital assets has held steady even through market cycles, economic uncertainty, and shifting investor sentiment.

However, interest in buying crypto has fallen. In 2021, 33% of investors said they were considering purchasing crypto either for the first time or adding more to their portfolio. In 2024, that number dropped to 26%, showing a clear decline in enthusiasm.

FINRA also found that the percentage of investors with a “high appetite for investment risk” fell from 12% to 8% over the same period. The biggest shift happened among younger investors under 35, where high-risk behavior dropped by nine percentage points, reaching only 15%. This group previously fueled much of the crypto and meme stock boom during the pandemic years.

Shifting sentiment during economic uncertainty

FINRA’s data suggests that wider economic conditions are influencing investors’ decision-making. In times of strong macroeconomic optimism, crypto investments typically rise. But with continued uncertainty around interest rates, inflation, and the overall direction of the economy, many investors are choosing safer assets.

The findings were based on research conducted between July and December 2024, surveying 2,861 U.S. investors and an additional 25,539 adults through a state-by-state online survey.

The report also showed that 66% of respondents now view crypto as a risky investment, a jump from 58% in 2021. This perception of risk has strengthened even as the number of actual crypto holders remains stable.

Still, a significant portion of investors believe risk is necessary for long-term wealth building. About one-third of all survey participants said taking big risks is required to reach financial goals. This number jumps to 50% among investors aged 35 and under.

Continued interest in speculative assets

Even with declining risk appetite, many young investors continue to explore high-risk instruments. About 13% of investors reported buying meme stocks and other viral assets, with nearly one-third of people under 25 participating in this trend.

This shows that while broad interest in crypto may be cooling, speculative behavior hasn’t disappeared — it’s only shifting.

Fewer new investors entering the market

The study also noted a slowdown in people entering the investing world. Only 8% of current investors started investing in the last two years (2022–2024), compared to 21% who joined during the pandemic boom in 2020–2021.

FINRA explained that the surge of young investors seen early in the pandemic has faded, bringing the percentage of investors under 35 back to 2018 levels. These trends suggest that the U.S. market is moving toward more conservative investment behavior overall.

FINRA concluded that there is now a “modest trend toward more cautious attitudes and behaviors” compared to its 2021 survey.

Final Thought

The FINRA study shows a clear shift in U.S. investor behavior: crypto ownership remains steady, but interest in buying more is declining as people take fewer risks. With economic uncertainty and shifting market conditions, many investors — especially younger ones — are becoming more cautious. However, the desire for higher-risk opportunities hasn’t disappeared entirely, especially among younger adults pursuing big financial goals.