US Trade War Escalates – A Threat or Opportunity for Crypto

US Tariffs Trigger Market Volatility, Crypto Takes a Hit

In early February 2025, the crypto market faced significant turbulence following US President Donald Trump’s announcement of new tariffs on imports from Canada, Mexico, and China.

Market Reaction:

This mirrored past economic crises where uncertainty led to mass liquidations across financial markets.

This is the only thing you need to read about tariffs to understand Bitcoin for 2025. This is undoubtedly my highest conviction macro trade for the year: Plaza Accord 2.0 is coming.

Bookmark this and revisit as the financial war unravels sending Bitcoin violently higher. pic.twitter.com/WxMB36Yv8o

— Jeff Park (@dgt10011) February 2, 2025

Canada & Mexico Retaliate, Then Pause Tariffs

As a countermeasure, Canada retaliated by imposing tariffs on $155 billion worth of US goods, announced by Prime Minister Justin Trudeau on Feb. 3, 2025.

However, the situation changed rapidly. On Feb. 4, 2025, the US paused the tariffs on Canada and Mexico, triggering a strong crypto market rebound:

Market Recovery:

Is Bitcoin a Safe Haven or a Risk Asset?

Bitcoin’s Role in Economic UncertaintyTraditionally, Bitcoin is seen as a hedge against economic instability. However, recent events suggest it still behaves like a risk asset, moving in tandem with stock markets rather than acting as a safe haven like gold.

Analysts’ Views:

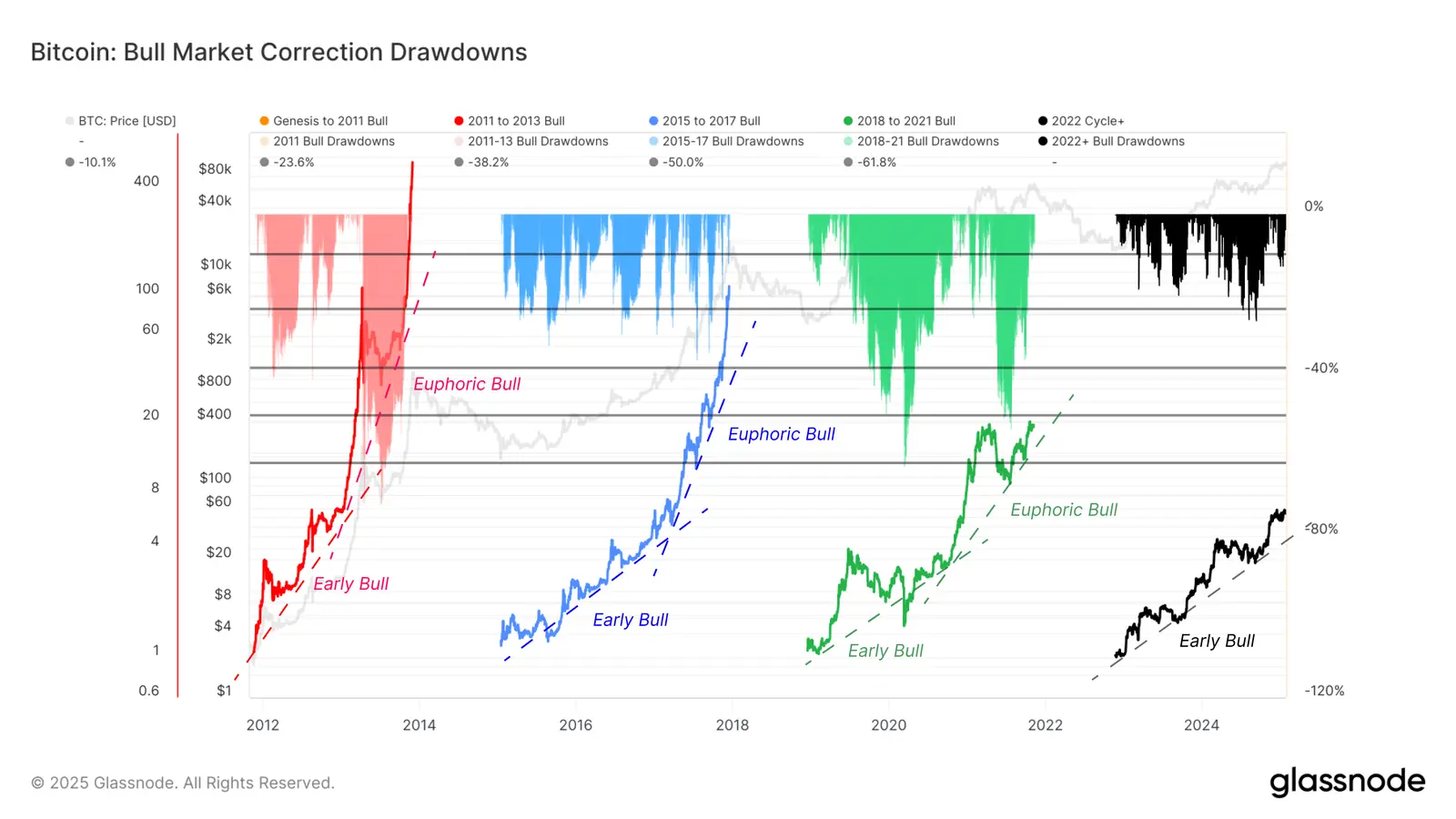

Statistics of Bitcoin’s adjustment levels in previous cycles. Source: Glassnode

Impact on DeFi and the Crypto Ecosystem

Short-Term Impact:

Long-Term Opportunity:

What’s Next for Crypto?

With the US trade war escalating, crypto investors must stay alert:

Regardless of the outcome, one thing is clear—crypto remains at the center of economic uncertainty and could play a key role in the shifting global financial landscape.