USDe by Ethena: How the Synthetic Stablecoin Survived Collapse

Key Takeaway

- USDe remains one of the most ambitious experiments in on-chain finance, proving that market-based stability can exist beyond fiat systems.

- The October 2025 collapse exposed weaknesses in liquidity, oracle precision, and funding dependence but did not destroy the model.

- Ethena’s redesign now focuses on wider collateral, faster oracles, and stronger reserves — turning a setback into a roadmap for evolution.

- The future of USDe will depend on resilience, not perfection, defining how decentralized finance measures true stability.

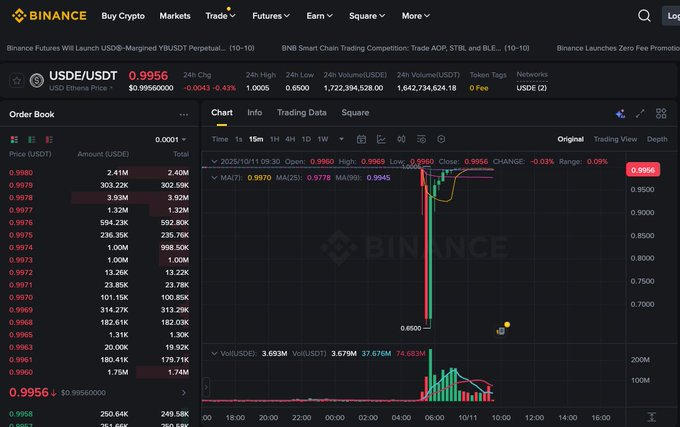

Earlier this week, the crypto market witnessed one of its most dramatic moments as USDe, the synthetic stablecoin developed by Ethena Labs, lost its peg during a wave of mass liquidations. In just 40 minutes on October 10, 2025, more than $19B were wiped out after USDe briefly dropped to $0.65 on Binance, shaking confidence across the DeFi landscape.

In this article, we’ll explore what USDe is, how its mechanism works, how it compares with USDC and USDT, the strengths and weaknesses of its synthetic model, and what this event reveals about the future of stability in decentralized finance.

What Is USDe?

USDe introduces a new approach to digital stability within the crypto economy. Developed by Ethena Labs, it reflects the value of the U.S. dollar through an on-chain system built entirely around market mechanisms.

Instead of traditional banking reserves, USDe maintains value through crypto collateral such as Bitcoin and Ethereum. The protocol manages these assets with derivatives hedging, aligning gains and losses to preserve balance in all market conditions.

Ethena’s vision centers on creating a currency that is decentralized, efficient, and self-sustaining. USDe captures that idea by transforming volatility into structure. Its stability emerges from coordination between collateral, liquidity, and algorithmic precision, forming a digital dollar native to the blockchain economy.

How USDe Works

USDe is a synthetic dollar built on a principle of balance. Its value remains stable through a delta-neutral structure that pairs crypto collateral with offsetting derivatives positions. Rather than depending on banks or fiat reserves, USDe holds its peg through continuous market hedging and liquidity efficiency.

Minting and Hedging

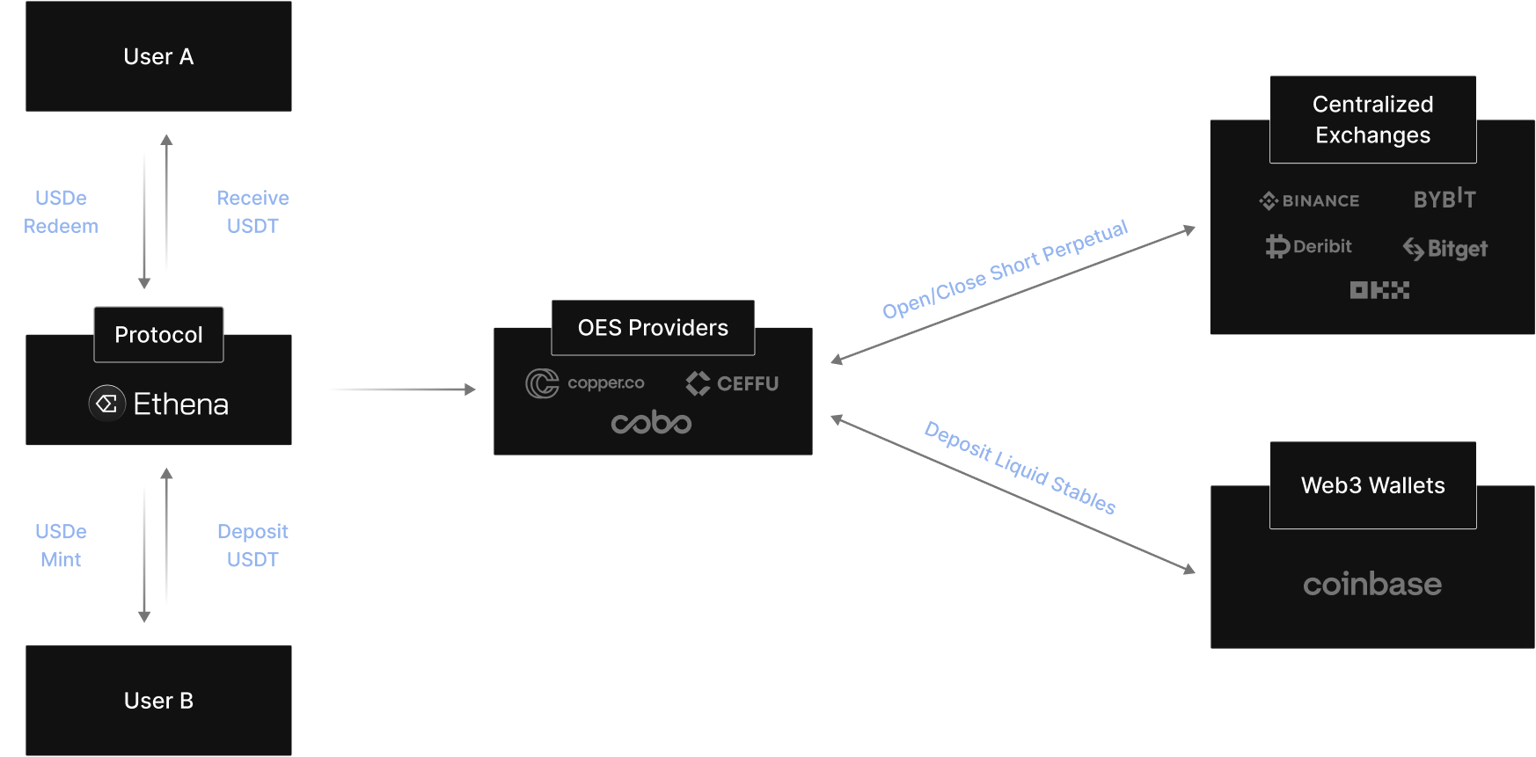

When a participant deposits assets such as ETH, BTC, or USDT, the protocol issues an equal amount of USDe, adjusted for gas and execution costs. At that exact moment, Ethena opens a matching short perpetual position on leading exchanges like Binance or Bybit.

This structure neutralizes market swings. If the collateral’s price rises, the futures position offsets the gain. If the price falls, the hedge delivers profit that compensates for the loss. The two sides move in opposite directions, keeping the system’s overall exposure stable around one dollar per USDe.

Delta-Neutral Stability

Ethena’s stability mechanism relies on precision. The protocol constantly rebalances the ratio between collateral value and hedge exposure to keep volatility near zero. Every position in the system is monitored and adjusted when markets shift sharply, ensuring that the portfolio remains fully collateralized.

This equilibrium forms USDe’s core strength: it mirrors the value of the dollar not by holding cash, but by maintaining perfect symmetry in market positions.

Custody and Settlement

All collateral supporting USDe is stored with off-exchange custodians to protect it from exchange failures. Assets move to trading venues only for settlements or funding adjustments, then return immediately to custody.

By separating asset control from trading execution, Ethena gains access to global liquidity without depending on a single centralized exchange. The protocol retains ownership of its collateral at all times, reducing counterparty risk while preserving operational flexibility.

Yield and sUSDe

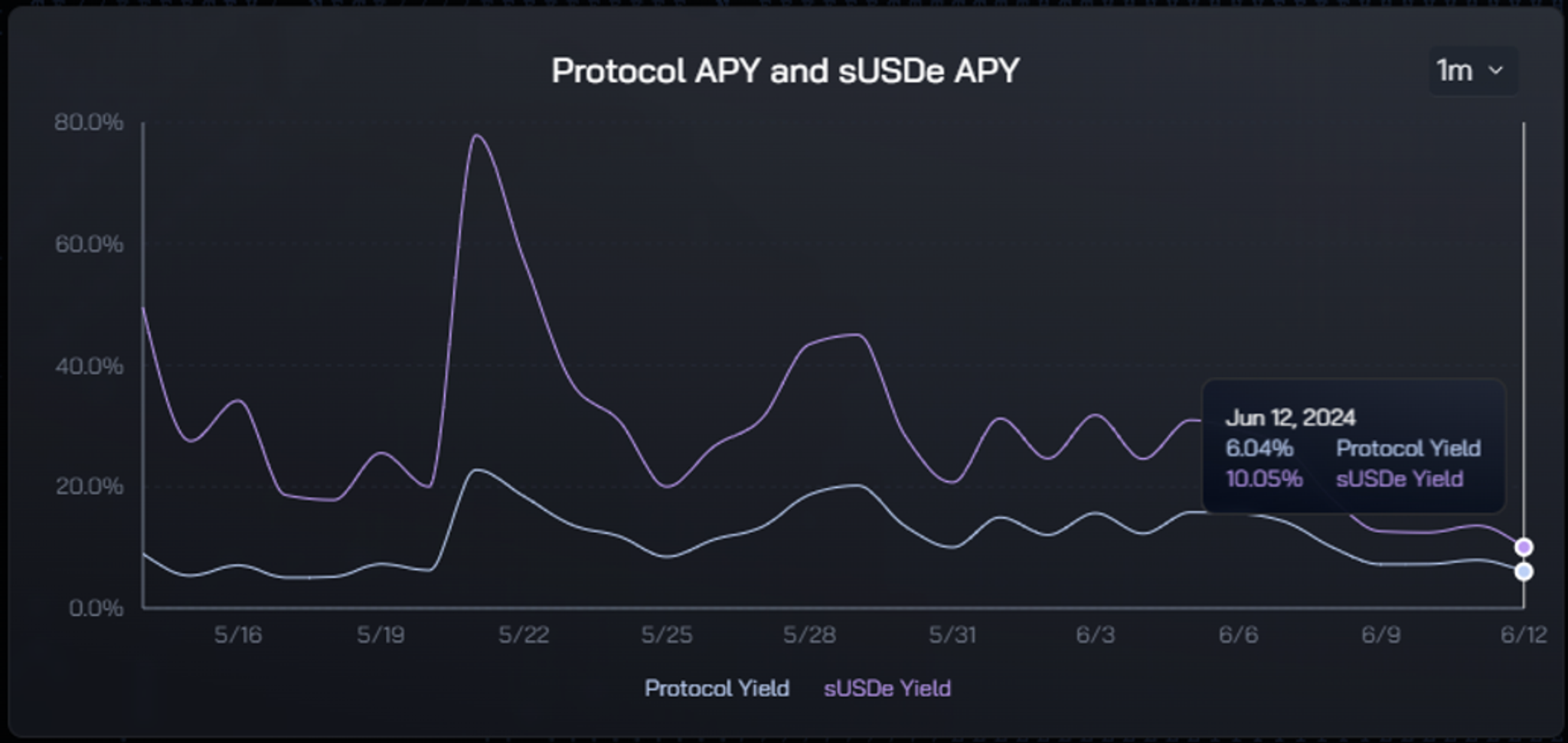

Ethena added a yield component through sUSDe, a stackable version of the stablecoin. Holders earn income from positive funding rates in perpetual futures markets, fees that long traders pay to short traders when leverage is high.

During 2024, average funding rates of roughly 11% on BTC and 12.6% on ETH generated yields approaching 19% APY for sUSDe holders. This model transformed USDe from a simple stability token into a productive on-chain asset that attracted billions in deposits.

Peg Maintenance and Liquidity

USDe maintains its peg through natural market arbitrage. When it trades below one dollar, traders buy and redeem it for the underlying collateral. When it rises above, they mint new tokens and sell them back into the market. These actions continuously pull the price toward equilibrium.

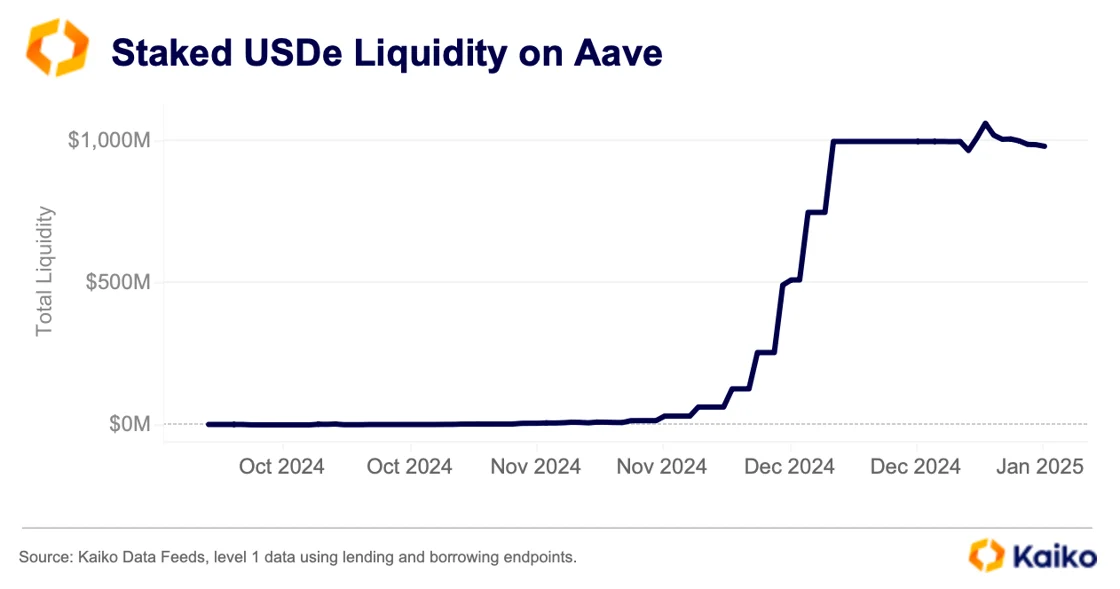

Ethena also keeps a reserve of liquid stablecoins such as USDC and USDT. This buffer strengthens redemption capacity and ensures smooth operations when derivatives markets tighten or funding conditions shift.

USDe’s design reflects mathematical discipline. Its stability arises from liquidity, arbitrage, and precise market execution rather than institutional backing. The system performs best in active, well-functioning markets, where equilibrium can be constantly maintained.

To understand the value and risk of this structure, it helps to compare USDe with traditional stablecoins such as USDC and USDT, which follow a completely different philosophy of stability.

How USDe Differs from USDC and USDT

While USDC and USDT anchor their value in fiat reserves held by financial institutions, USDe maintains its peg through market mechanics. Traditional stablecoins depend on custody, regulation, and direct redemption, whereas USDe relies on crypto collateral, derivatives hedging, and real-time balance between long and short exposure. The contrast reveals two distinct models of trust: one rooted in traditional finance, the other shaped by on-chain dynamics.

Aspect | USDC / USDT | USDe |

| Backing Assets | Cash, bank deposits, short-term Treasuries | Crypto collateral such as BTC and ETH paired with futures positions |

| Stability Mechanism | 1:1 redemption through custodians | Delta-neutral hedging that offsets market movement |

| Trust Model | Institutional solvency and regulatory oversight | Market efficiency and execution accuracy |

| Yield Source | Interest from reserves | Funding-rate income from perpetual futures |

| Risk Exposure | Custody and compliance risk | Funding pressure, oracle errors, derivatives liquidity |

| Behavior in Volatility | Stable when reserves remain accessible | Sensitive to funding rate and market depth |

The contrast between these models shapes how each behaves under pressure. Fiat-backed stablecoins remain steady as long as custodial reserves stay liquid, while synthetic stablecoins like USDe depend entirely on the precision of their internal mechanics. In next step, we'll look at what made USDe’s structure so appealing at first, and what hidden weaknesses later came to the surface.

Strengths and Vulnerabilities of the USDe Model

The rise of USDe came from its ability to blend stability, yield, and transparency in a single framework. It created a dollar native to crypto, functioning through precision and open-market logic. Yet the same structure that made it efficient also introduced sensitivities tied to liquidity and execution.

Strengths | Vulnerabilities |

| Market-based stability built on delta-neutral hedging | Dependence on derivatives liquidity and positive funding rates |

| Full composability across DeFi ecosystems | Exposure to rapid volatility that challenges rebalancing speed |

| Attractive yield from futures funding and market activity | Reliance on accurate oracles and operational integrity of exchanges |

| Transparent and auditable on-chain structure | Limited liquidity buffers during large-scale redemptions or funding stress |

USDe’s model thrived when every element: collateral, liquidity, and execution, moved in sync. Its balance delivered both transparency and yield, yet that same precision left little margin for error once market pressure intensified.

USDe’s Collapse on October 10, 2025

The decisive moment for USDe unfolded on October 10, 2025, when intense volatility tested every element of its structure. Within forty minutes, over $19 billion in open interest vanished across exchanges. On Binance, USDe touched $0.65 before returning to parity, a brief but unforgettable signal of how fragile synthetic balance can become under stress.

The Chain Reaction

The tension began when the United States announced a 100% tariff on Chinese goods, sending global markets into turbulence. Bitcoin and Ethereum declined sharply as traders unwound leveraged positions. Funding rates, which powered USDe’s yield, turned negative and reversed the flow of income inside the protocol.

As the market absorbed the shock, hedging costs increased. Liquidity on perpetual futures markets thinned, reducing the efficiency of rebalancing. The mechanism continued to operate but at higher friction, creating visible strain across collateral and hedge positions.

At the height of the sell-off, Binance’s internal oracle delayed price updates, displaying an inaccurate valuation for USDe. Automated systems reacted instantly, triggering large liquidations within minutes. Other trading venues, including Curve and Uniswap, still held near $1, yet the distortion on Binance ignited panic that spread through the market.

The Immediate Impact

For several hours, uncertainty dominated sentiment. DeFi platforms raised collateral thresholds, and users shifted liquidity to safer assets. On-chain data showed that Ethena’s collateral reserves remained whole, although the event shook market confidence.

Recovery came as liquidity returned and funding stabilized. Within a day, USDe traded again at parity. Binance later confirmed an oracle malfunction and announced $283 million in compensation for affected traders.

Aftermath and Market Perception

The incident changed how stablecoin investors viewed synthetic designs. It highlighted how dependence on funding, oracle precision, and derivatives liquidity can amplify stress. The event did not stem from insolvency but from the narrow margins within which delta-neutral stability operates.

USDe emerged from the episode intact yet transformed. It became an example of both innovation and vulnerability, reminding the market that advanced design still relies on execution, speed, and confidence.

Lessons from the Collapse

The events of October 10, 2025 became a turning point for synthetic finance. They showed how precision in design can create strength but also tension. USDe stayed intact after the shock, yet the experience changed how DeFi views stability built on market balance.

1. Yield Always Carries Exposure

Returns came from traders paying funding fees during bullish periods. When sentiment shifted, those payments stopped and costs appeared. Stability supported by external market behavior lasts only while that behavior remains favorable. Yield must move in step with risk, never ahead of it.

2. Stability Depends on Market Flow

USDe’s structure worked when liquidity was deep and futures traded smoothly. As soon as order books thinned, hedging lost precision. The lesson is clear: market depth, not collateral size, anchors value. Speed and execution determine security.

3. Infrastructure Determines Outcome

The short oracle delay on Binance turned an isolated imbalance into a systemwide jolt. Reliable data and execution are as vital as financial logic. One technical lapse can move faster than any recovery mechanism.

4. Transparency Builds Trust, Liquidity Holds It

On-chain data confirmed Ethena’s collateral strength and helped calm users. Visibility restored belief, but liquidity restored function. A stable system needs both—the clarity to prevent panic and the depth to absorb pressure.

5. Endurance Outweighs Precision

Mathematical balance can achieve perfection for a moment, but endurance sustains confidence over time. A resilient protocol anticipates friction and keeps running. Wider hedging access, quicker oracles, and flexible reserves give stability its real foundation.

The Future of Synthetic Stability

After the turmoil of October 2025, USDe entered a new stage. The collapse did not erase its structure; it revealed where the design must evolve. What happens next will decide whether Ethena can transform a moment of weakness into lasting strength.

The team is already reshaping the system. A wider range of collateral and additional hedging venues are being integrated to prevent liquidity strain. Oracle infrastructure is undergoing upgrades to reduce data delays across exchanges. The reserve fund is expanding with more liquid stablecoins to enhance redemption flexibility. Each adjustment strengthens the link between market behavior and system response.

Restoring confidence will take time, though the foundation remains sound. A synthetic dollar operating fully on-chain still fills a gap that traditional stablecoins cannot. It allows liquidity to move freely within DeFi while maintaining stability through precision rather than regulation.

If Ethena succeeds in building an adaptive version of USDe, the project could set a new standard for synthetic assets: transparent, programmable, and resilient through volatility. The goal has shifted from holding a peg to proving endurance.

The coming months will show whether USDe can grow from innovation into permanence. Achieving that transition would not only rebuild trust but also redefine how decentralized finance understands stability.

FAQs

1. What makes USDe different from traditional stablecoins like USDC or USDT?

USDe mirrors the value of the U.S. dollar through a delta-neutral strategy rather than fiat reserves. It uses crypto assets such as ETH and BTC combined with short futures positions to maintain balance. This structure allows it to operate fully on-chain without dependence on banks or regulators.

2. How does USDe generate yield?

Yield comes from funding payments in perpetual futures markets. When funding rates stay positive, short positions earn fees from leveraged traders. These earnings flow to holders of sUSDe, the staked version of USDe.

3. Why did USDe lose its peg in October 2025?

The loss occurred during a period of extreme volatility after a 100% U.S.–China tariff announcement. Funding rates turned negative, liquidity tightened, and a delayed Binance oracle created temporary mispricing that triggered mass liquidations.

4. Did the system remain solvent during the crash?

Yes. On-chain data confirmed that all collateral positions stayed covered. The issue came from price execution and data delays rather than loss of reserves.

5. What improvements are being made to prevent a similar event?

Ethena is widening collateral sources, adding multiple hedging venues, upgrading oracles, and expanding its reserve fund with liquid stablecoins. These steps aim to make USDe more adaptive and reduce stress when volatility increases.

6. What does the future look like for USDe?

Ethena continues refining its model to create a stronger, faster, and more resilient synthetic dollar. If successful, USDe could become a reference for stable assets that combine transparency, yield, and long-term stability within decentralized finance.

Conclusion

The story of USDe is more than a single market event. It marks a stage in DeFi’s evolution, where technology begins to carry the same responsibility once held by traditional finance. Ethena built a system that aimed to merge precision with independence, and the October crash proved how fine that balance can be.

Each correction since then has moved USDe closer to maturity. The design continues to evolve, now focused on resilience, liquidity depth, and execution speed. Whether it regains full trust or not, its experiment has already advanced how crypto understands stability.

In time, USDe may be remembered less for its fall than for what followed — a shift from engineering perfection to building systems that can breathe with the market. Stability, in the world of DeFi, will always belong to those who can adapt faster than the storm.