VC Roundup: Big money, few deals as crypto venture funding dries up

- Crypto venture funding in November remained weak, with only 57 disclosed rounds.

- Overall dollar totals were supported by a few large raises, notably Revolut’s $1B and Kraken’s $800M.

- Deal activity concentrated in CeFi, DeFi, and NFT–GameFi sectors.

- Notable funding rounds: Ostium $24M, Axis $5M, PoobahAI $2M.

- Analysts warn that low deal volume may hinder long-term innovation, since downturns are typically when strong investments are made.

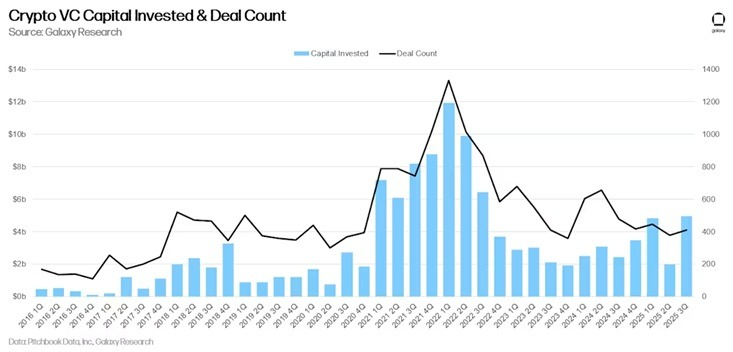

Venture capital investment in the cryptocurrency sector showed continued weakness in November, continuing a pattern that has persisted through late 2025. While aggregate funding totals were bolstered by a handful of headline raises, the number of distinct deals remained low. Data from RootData reported 57 disclosed funding rounds in November — one of the weakest monthly tallies this year. This contrast between dollar volume and deal frequency echoes trends seen earlier in the year and in the third quarter, when Galaxy Digital recorded $4.65 billion in total funding but noted that capital flowed mainly to larger, established firms rather than early-stage startups.

Market concentration and sector focus

The November funding landscape was marked by concentration: a small set of large raises accounted for a meaningful portion of total capital deployed. Among these were major corporate and late-stage transactions such as Revolut’s $1 billion funding and Kraken’s $800 million round ahead of its expected public listing. RootData’s sector breakdown shows most November deals occurring in centralized finance (CeFi), decentralized finance (DeFi), and NFT–GameFi verticals. This pattern suggests both investor caution and a preference for more mature or revenue-generating projects.

Industry participants note that reduced deal flow during downturns can have structural consequences. Sarah Austin, co-founder of the real-world-asset gaming platform Titled, told Cointelegraph that limited investment in tougher market conditions reduces the number of companies that can develop through to later stages, depriving the ecosystem of opportunities typically discovered during bear markets.

Notable rounds in November

Ostium, a decentralized perpetuals protocol founded by former Harvard classmates, secured $24 million in new funding to expand its onchain perpetuals offering into non-crypto markets such as equities, commodities, indexes and currencies. The capital is earmarked for strengthening the protocol’s smart contract infrastructure, pricing oracles, and liquidity engines to support higher trading volumes and broader asset coverage. Investors in the round included General Catalyst, Jump Crypto, Susquehanna International Group and angel backers from Bridgewater, Two Sigma and Brevan Howard. Ostium’s strategy centers on enabling self-custodial access to perpetual markets tied to real-world assets.

Axis, an onchain revenue and yield protocol, closed a $5 million private round led by Galaxy Ventures. Axis plans to build transparent onchain yield infrastructure that offers exposure to Bitcoin, gold and U.S. dollar-denominated returns. The round also included participation from OKX Ventures, Maven 11 Capital, CMS Holdings and FalconX. Axis reported that roughly $100 million of private capital has already been deployed through its beta platform to stress-test the protocol’s engine, highlighting investor interest in infrastructure that can deliver predictable, onchain yield.

PoobahAI, a Texas-based startup focused on no-code tooling for tokenized Web3 networks and AI agents, raised $2 million in seed funding. The company’s platform aims to let creators, teams and businesses build onchain systems and deploy AI agents without writing code. The seed round was led by FourTwoAlpha, a venture firm with prior early-stage investments in Ethereum and Cosmos. PoobahAI positions itself at the intersection of Web3 and AI, a space that investors increasingly view as a growth opportunity for composable, decentralized applications.

Implications and outlook

The November funding pattern — fewer deals but some large raises — underscores a selective investment environment. Venture capitalists appear focused on later-stage or capital-intensive opportunities, while early-stage activity has slowed. This can have several implications for the industry: slower formation and scaling of startups, reduced experimentation, and greater emphasis on projects that demonstrate clear revenue models or enterprise use cases.

At the same time, historical patterns suggest that market downturns can create favorable conditions for investors who remain active, as valuations compress and stronger teams become available. The current environment may therefore present opportunities for patient investors and founders who can demonstrate resilience and clear product-market fit.

Final thought

November’s crypto VC data highlights a bifurcated market: abundant capital concentrated in a few headline deals, and limited activity across the broader startup ecosystem. While this selective deployment reflects investor caution, it also raises concerns about the long-term pipeline of innovation. The coming quarters will show whether funding activity broadens again or whether concentration persists, potentially reshaping which categories and teams lead the next growth phase.