Vietnam Central Bank Sees 20% Credit Growth, Crypto Surge

Key Takeaways

- Credit Growth Target: Vietnam’s central bank expects credit expansion of around 20% in 2025, with further interest rate cuts likely.

- Legal Framework: The government legalized crypto in June, distinguishing between tokenized assets and cryptocurrencies, while banning fiat-backed stablecoins under a pilot program.

- APAC Leadership: Vietnam ranks fourth globally in crypto adoption, part of a region that posted 69% annual growth in crypto transaction volumes.

- National Blockchain: NDAChain, a layer-1 system with 49 nodes, underpins digital identity and public records, blending decentralization with regulation.

- Future Hub: With a young population and regulatory clarity, Vietnam is emerging as a potential crypto hub for Southeast Asia.

Credit Growth Outlook and Monetary Policy in Vietnam

Vietnam is positioning itself at the center of Asia’s digital economy. The State Bank of Vietnam (SBV), the country’s central bank, announced that it expects credit growth of around 20% in 2025. The bank said that further cuts to interest rates will be necessary to stimulate economic growth and offset the impact of new tariffs imposed by the United States. Deputy Governor Pham Thanh Ha made the remarks Friday, noting that maintaining liquidity is crucial as Vietnam enters a new phase of financial modernization.

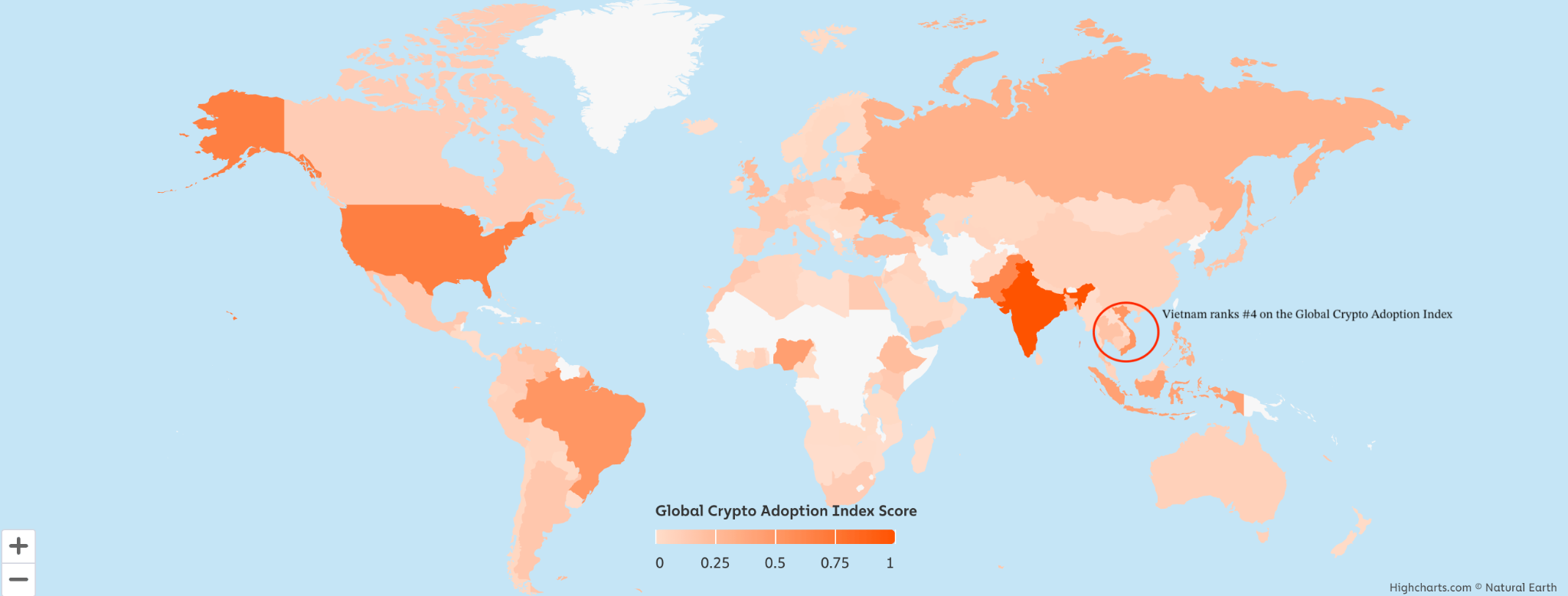

This growth outlook comes during a period of rapid crypto adoption across the nation. According to Chainalysis, Vietnam ranks fourth globally on its 2025 Global Crypto Adoption Index and is among the leaders in the Asia-Pacific region. The central bank’s push for credit expansion could channel additional liquidity into digital asset markets, further intertwining traditional finance with the crypto economy.

Vietnam’s government took a decisive regulatory step in June by legalizing cryptocurrencies under a new framework. The law distinguishes between crypto assets such as Bitcoin and Ether, and virtual assets that represent tokenized products in the real world. However, authorities placed restrictions on issuing fiat-backed stablecoins and onchain securities. These limitations fall under the country’s five-year sandbox program, launched in September, which aims to test regulatory approaches without fully liberalizing the sector.

The government’s balanced strategy reflects its ambition to embrace new technologies while safeguarding financial stability. By setting clear rules, Vietnam central bank signals that it intends to encourage innovation without creating systemic risks that unchecked crypto issuance could pose.

Vietnam Central Bank’s Role in Asia-Pacific Crypto Adoption

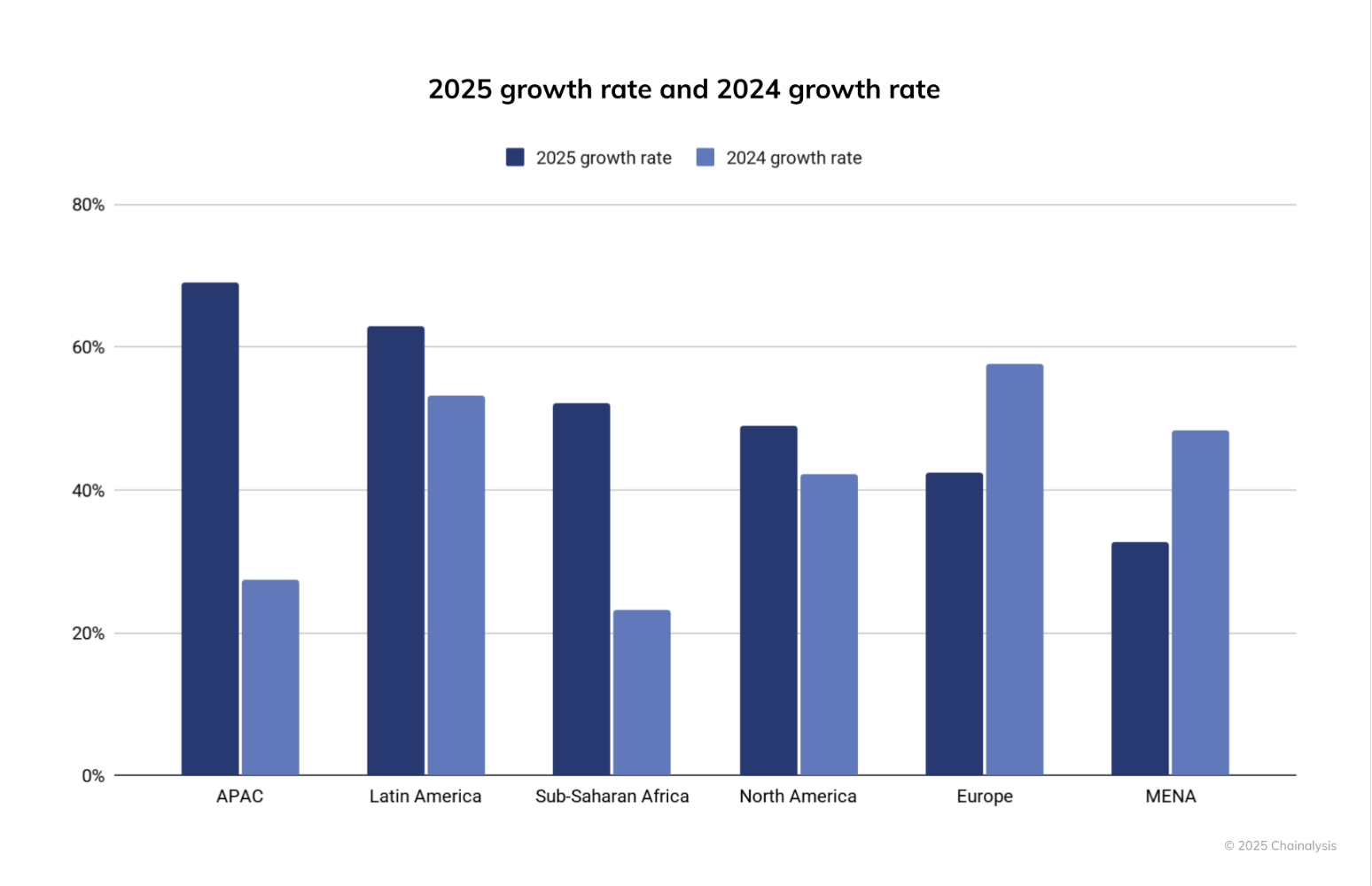

Vietnam central bank’s rise as a crypto hub is part of a broader Asia-Pacific trend. Chainalysis data shows that APAC leads all other regions in global crypto adoption, with nine of the top twenty countries in its 2025 index based in the region. Transaction volumes across APAC climbed from $1.4 trillion to $2.3 trillion in just one year, representing 69% growth. India, Pakistan, and Vietnam were the main drivers of this surge.

The government has also advanced its digital infrastructure. In July, it launched NDAChain, a national blockchain network designed to serve as the foundation for digital identity, public records, and interactions with the online economy. NDAChain currently operates with 49 nodes managed by a mix of private and public institutions.

The system blends permissioned and decentralized structures, giving Vietnam both control and resilience. According to Nguyen Huy, head of technology at the National Data Association, the network is designed to protect sensitive information by distributing data across multiple nodes instead of concentrating it on centralized servers. This structure reduces the risk of cyberattacks while providing a regulated environment for blockchain-based services.

The combination of legal recognition of cryptocurrencies, strong adoption rates, and the rollout of a national blockchain positions Vietnam as a frontrunner for digital transformation in Southeast Asia. With a young population that is both technologically savvy and financially active, the country has the demographic momentum to reinforce its status as a regional leader in crypto innovation.