Vitalik Buterin Defends Ethereum’s 45-Day Staking Exit Queue Amid Galaxy Digital Criticism

Ethereum co-founder Vitalik Buterin is pushing back after weeks of criticism about the network’s lengthy staking exit queue, insisting the design protects the chain’s security despite growing comparisons to faster competitors like Solana.

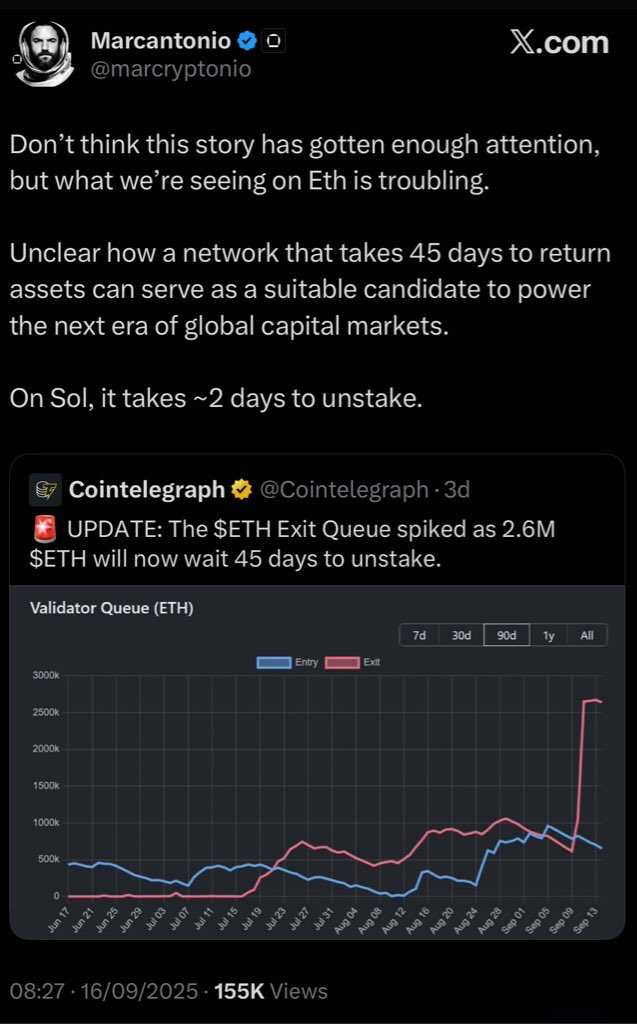

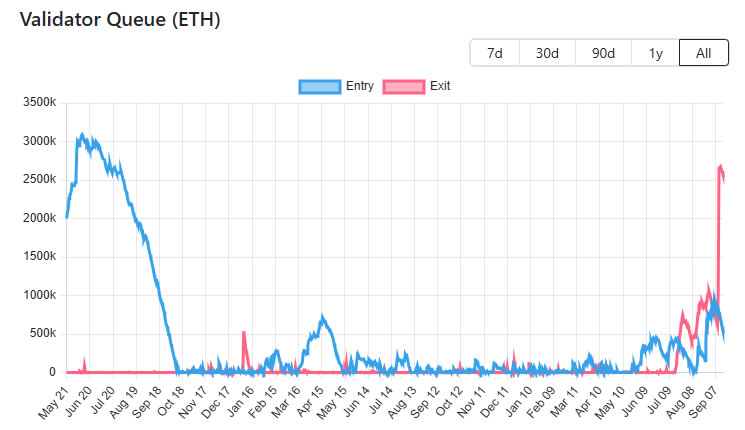

- Ethereum’s staking exit queue hit 45 days, prompting industry debate.

- Galaxy Digital’s head of DeFi called the delay “troubling,” then deleted the posts.

- Buterin likens staking to a “solemn duty,” where friction deters reckless exits.

- Over 35.6M ETH (30% of supply) remains staked, showing network strength.

- Critics and Ethereum advocates sparred on X, highlighting the ETH vs. SOL rivalry.

Ethereum’s staking exit queue has surged to about 45 days, sparking heated discussions across the crypto community. After Galaxy Digital’s head of DeFi Michael Marcantonio publicly labeled the delay “troubling” and compared it to Solana’s two-day unstaking period, the debate intensified. Marcantonio later deleted his posts, but not before igniting a firestorm of opinions about Ethereum’s staking design.

Responding on X, Vitalik Buterin defended the protocol’s architecture, framing staking as a long-term commitment: “Unstaking from Ethereum is more like a soldier deciding to quit the army. Friction in quitting is part of the deal. An army cannot hold together if any percent of it can suddenly leave at any time.” Buterin admitted that the current design isn’t perfect but warned that reducing the exit delay would weaken network trust for validators who aren’t consistently online.

Despite the chatter, Ethereum’s fundamentals remain solid. The network boasts over a million active validators and 35.6 million ETH staked—nearly 30% of total supply—underscoring broad confidence in the protocol’s security and reliability. The exit queue, while lengthy, is partly driven by institutional staking demand, with 512,000 ETH in the entry queue as of this week, a two-year high.

The controversy has exposed sharp divisions in the industry. Former Consensys product manager Jimmy Ragosa and Ethereum educator Anthony Sassano criticized Galaxy Digital for spreading “relentless ETH FUD,” with some saying they’ll reconsider business with the firm. Crypto lawyer Gabriel Shapiro argued the deleted posts inadvertently strengthened Ethereum’s image, while Solana supporters, like Mike Dudas, defended Galaxy, claiming Solana offers a more efficient path for capital markets.

Although the exit queue has eased slightly in recent days, with some withdrawals linked to the Kiln Finance exploit, it remains elevated at roughly 2.5 million ETH. Meanwhile, Galaxy Digital continues its Solana expansion, having recently purchased $1.5 billion worth of SOL and tokenized its shares on the Solana blockchain.

Final Thought

Buterin’s measured response underscores Ethereum’s focus on long-term security over convenience. While competitors like Solana tout faster exits, Ethereum’s staking model aims to protect the chain from sudden validator exits and maintain decentralized stability—a tradeoff the community continues to debate as institutional interest grows.