Weekly Crypto Recap: Bitcoin Hits $125K, ETFs Surge

A Week of Breakouts and Record-Breaking Momentum

In this weekly Bitcoin ETF inflows recap, the crypto market exploded. Total capitalization jumped from $3.86 trillion to $4.22 trillion, a 9.3% gain that broke July’s record high. This surge followed the Federal Reserve’s confirmed 50bps rate cut and softer CPI data at 2.4% YoY, both signaling easing inflation and renewed risk appetite.

Bitcoin (BTC) led the charge, hitting a new all-time high of $125,500 before closing at $123,941.05, up 7.8% weekly with $1.2 billion ETF inflows. Metaplanet added 5,419 BTC worth $632 million to its treasury, reinforcing corporate adoption. Ethereum (ETH) climbed to $4,538.63, gaining 5.6% for the week after the Fusaka upgrade launched on Holesky testnet, with mainnet activation expected in early December.

Altcoins followed with strong rotations. Solana (SOL) reached $233.06, up 6.4%, boosted by the Alpenglow upgrade and TVL above $13 billion. XRP closed at $2.9790, rising 2.1% after news of SWIFT pilot integrations. BNB hit $1,179.55, up 8.9%, setting a new ATH as BNB Chain recorded 56.4 million monthly active users, surpassing Solana in TVL.

Trading volume averaged $187.87 billion daily, a 58% increase. The CMC Crypto Fear and Greed Index rose from 39 to 59, reflecting a shift from fear to confidence as liquidations dropped to $162 billion mid-week.

October officially arrived. Bitcoin’s ATH, Grayscale’s multi-crypto ETF approval, and Vanguard’s shift toward crypto access fueled optimism. Hyperliquid cut 45% of its HYPE supply, Plasma debuted at a $15B valuation with $2B liquidity, and Token2049 in Singapore drew over 25,000 attendees. Stablecoin supply grew to $300 billion, and coins continued exiting exchanges, reinforcing bullish conviction.

Analysis of Crypto Total Market Cap and Indices

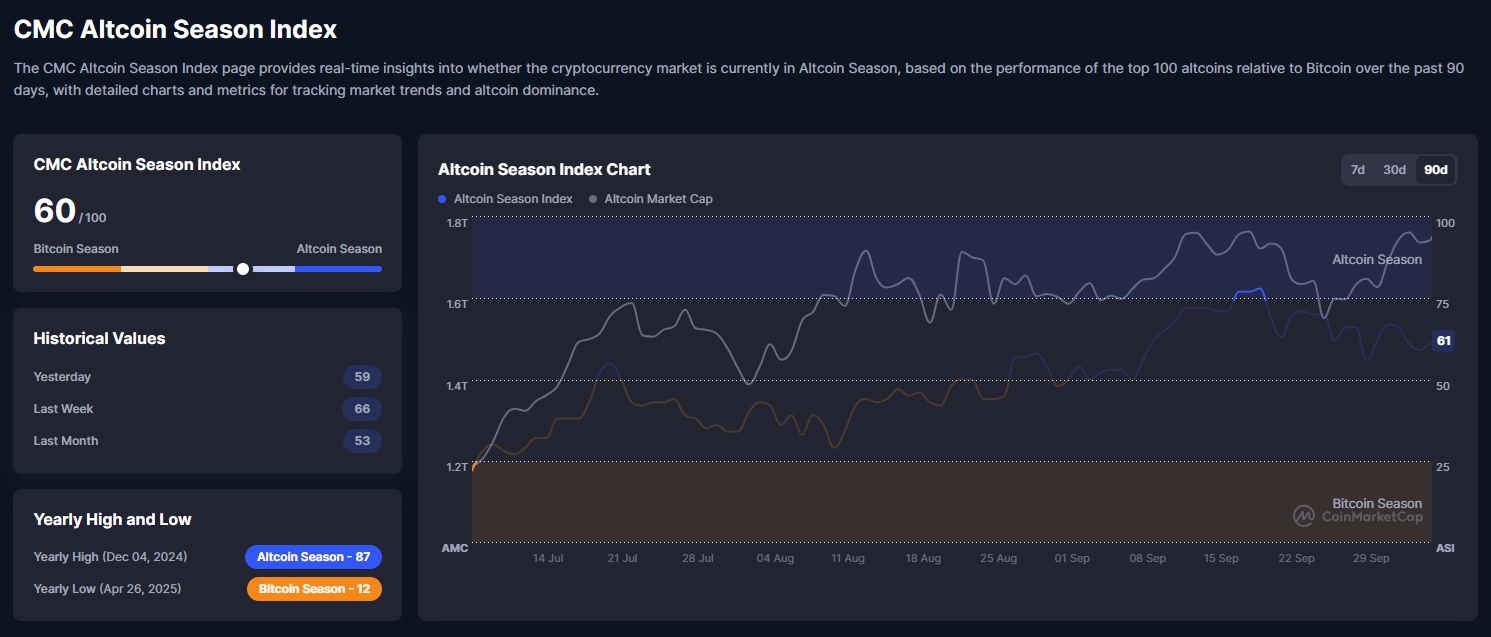

From the CoinMarketCap overview (Image 1: Total cap $4.22T, volume $187.87B, Fear & Greed 59, Altcoin Index 61), the rally is clear. Market cap surged past $4.2T with volume confirmation, showing strong conviction.

The total market cap rose 0.35% daily. BTC gained 0.21%, ETH 0.01%, BNB 1.2%, SOL 0.98%, while XRP dipped 0.95%. Bitcoin dominance slipped to 56.8%, allowing altcoins to capture 43.2% market share. This rotation pattern mirrors late 2021 cycles.

The 30-day chart shows a sharp recovery from $3.97T to $4.22T. The market bounced off the 50-day MA at $4.05T and built new support near $4.1T. Ethereum’s share expanded to 18%, Solana’s to 3.2%, and XRP held 1.3%. RSI for total cap sits at 62, near overbought, though stablecoin growth to $300B cushions risk.

The CMC Crypto Fear and Greed Index is now at 59, showing a clear recovery from fear territory. The chart (Image 2) highlights steady improvement with yesterday at 58, last week at 39, and last month at 41, reflecting a rapid sentiment shift fueled by ETF approvals and Bitcoin’s new all-time high. Over the past year, the index has ranged between 15 at the lows and 88 at the highs, placing the current level in a balanced growth zone. Key components such as momentum increasing by 20 percent and social volume up 25 percent continue to support the bullish trend. Historically, neutral readings in September have often preceded around 25 percent gains in October, suggesting strong continuation ahead.

The CMC Altcoin Season Index is now at 60 out of 100, confirming the ongoing strength of altcoins. The chart (Image 3) shows yesterday at 59, last week at 66, and last month at 53, indicating steady resilience despite a slight pullback from last week’s peak. The rise in altcoin market capitalization, driven by Solana and BNB, reinforces this momentum. Historically, when the index moves above 60, rallies tend to extend for several weeks, mirroring the strong performances seen in the 2021 cycle.

Technical Analysis and Outlook for Key Tokens

As of October 6, 2025, technical analysis shows the cryptocurrency market entering a bullish continuation phase, with major tokens breaking key resistance levels amid strong volatility. The Fear and Greed Index at 59 reflects a balance between optimism and caution, supported by the Fed’s rate cuts and steady geopolitical conditions. Bitcoin’s dominance at 56.8 percent allows altcoins to rotate upward, while the Altcoin Season Index at 60 points to ongoing outperformance across the broader market. This section analyzes BTC, ETH, SOL, and XRP, focusing on price action, RSI, moving averages, trading volume, and pattern formations, with scenarios guided by historical trends and on-chain data..

For Bitcoin (BTC/USDT on Binance, Image 4), currently trading at $123,482.32, up 0.37 percent, the setup remains firmly bullish. The daily chart shows a strong ascending channel that began in February 2025, with support at $115,000 holding through multiple retests. The price continues to form higher highs from July’s $96,000, staying well above the 50-day moving average at $118,000, which now acts as a dynamic support following the recent all-time high of $125,500.

A clear bullish flag has formed after the September rally, where teal zones mark support near $120,000 and resistance aligns around the upper boundary. Volume remains strong on upward moves, the RSI at 58 confirms healthy momentum without entering overbought territory, and Bollinger Bands are widening, signaling growing volatility. The MACD crossover is positive, while on-chain data shows record BTC outflows from exchanges, reinforcing the bullish structure.

Scenarios:

- Uptrend: A move above $124,000 could target $130,000 to $135,000, echoing the 2021 ATH extension of +50 percent, with NUPL at 0.58 indicating room for growth.

- Downtrend: A break below $118,000 may lead to retests at $115,000 (200-day MA) or even $110,000, with open interest near $40B posing short-term liquidation risk.

- Sideways: Consolidation between $118,000 and $124,000 remains likely, with moderate volatility of 4–6 percent and potential 10 percent swings during unlock periods.

- Bias: Strongly bullish, with MVRV at 2.8 suggesting Bitcoin is still undervalued relative to its on-chain metrics.

For Ethereum (ETH/USDT on Binance, Image 5), the daily chart shows the price at $4,538.03, down 0.33 percent, continuing its steady climb within an established uptrend channel. ETH remains well supported above $4,400 after the Fusaka upgrade, with the rising trendline from $3,800 still intact. The 50-day moving average at $4,450 provides reliable support, while the price action forms an ascending triangle — buy zones near $4,400 and profit-taking around recent highs.

Trading volume confirms buyer strength, the RSI at 55 signals neutral-to-bullish momentum, and the MACD maintains an upward crossover. Bollinger Bands are widening, reflecting renewed volatility similar to 2021 phases when ETH posted 40 percent rallies. On-chain fundamentals remain strong, with 30 million ETH staked and total value locked (TVL) at $46 billion.

Outlook:

- Uptrend: A breakout above $4,600 could push ETH toward $4,800–$5,200, supported by ETF inflows and an improving ETH/BTC ratio from 0.037 to 0.085, implying potential prices near $12,000.

- Downtrend: A dip below $4,400 may send prices toward $4,200, with volatility reaching 58 percent and pressure on DeFi assets.

- Sideways: Consolidation between $4,400 and $4,600 likely if macro conditions pause momentum.

Bias: Bullish, supported by Ethereum’s strong utility, staking growth, and expanding institutional interest.

Solana (SOL/USDT on Binance, Image 6: Daily chart at $228.56 +1.85%, rising channel since March). SOL breaks $225 resistance, support at $215, buy at lows, RSI 62 strong, MACD bullish, Bands expanding. TVL $14B, users 1.1M.

Scenarios:

- Uptrend above $230 to $250-$270, ETF/Alpenglow, 2021 parallels.

- Downtrend under $215 to $200, high volatility ±9%.

- Sideways $215-$230 if BTC caps.

- Bias: Bullish, ecosystem edges.

XRP (XRP/USDT on Binance, Image 7: Daily chart at $2.9697 -0.33%, descending triangle breakout). XRP nears $3.00 resistance, $2.80 support, RSI 52 neutral, volume rising. ODL $1.4B.

Outlook:

- Uptrend above $3.00 to $3.30-$3.60, SWIFT/ETF.

- Downtrend sub-$2.80 to $2.60.

- Sideways low vol awaiting.

- Bias: Neutral-bullish, volume key.

Technicals indicate rally extension, entries at supports for Q4.

Institutional Inflows: Accelerating Amid ATHs

Institutional inflows surged to $1.2 billion this week, marking the longest positive streak since July. Bitcoin captured $800 million, while Ethereum added $400 million, signaling strong confidence from large investors. BlackRock contributed $400 million across BTC and ETH products, and Fidelity added $300 million, pushing ETF revenues to $260 million annualized.

Corporate adoption continued as Metaplanet acquired 5,419 BTC worth $632 million, expanding its treasury position. On-chain data shows over 550,000 BTC now held in ETFs, while Bitwise reported a fourfold increase in mining-linked exposure. These trends align with technical breakouts and RSI-supported entry levels.

Vanguard is evaluating the introduction of crypto trading, marking a notable shift from its previous stance. Coinbase CEO Brian Armstrong highlighted that new structural bills are close to passage, a move that could unlock significant institutional capital. According to Crypto.news, these steady inflows provide a cushion against volatility and point to sustained demand heading into Q4.

Macroeconomic Backdrop: Easing Signals Fuel Rally

The Federal Reserve’s 50 basis point rate cut and a CPI reading of 2.4 percent, below expectations, boosted market confidence and lifted the odds of continued easing to 80 percent. Unemployment held at 4.1 percent, with wage growth moderating, easing concerns over stagflation.

In Asia, China’s latest stimulus measures fueled equity gains, while the U.S. Dollar Index (DXY) dropped to 97, signaling weaker dollar momentum. Gold climbed to $3,550, and Michael Saylor reiterated Bitcoin’s growing strength as a superior hedge.

Bitcoin reached its new all-time high following the Fed’s policy shift, maintaining a 0.75 correlation with the Nasdaq, underscoring synchronized optimism across risk assets. Polymarket data shows the odds of a U.S. government shutdown falling to 77 percent, further calming sentiment. Despite global turbulence, crypto continues to stand out as a hedge, with stablecoin supply surpassing $300 billion, reinforcing liquidity across the ecosystem.

Policy Wins: Milestones Enhance Legitimacy

Trump’s American Bitcoin Fund made its debut on Nasdaq with a $30 million listing, marking another milestone for crypto’s entry into mainstream finance. The SEC approved Grayscale’s multi-crypto ETF, while a U.S. court confirmed that Bored Ape NFTs are not securities, further clarifying regulatory boundaries.

In global developments, Kazakhstan partnered with Solana and Mastercard to launch the Evo stablecoin, and Naver acquired full control of Upbit, strengthening South Korea’s position as a key crypto hub. SWIFT expanded its XRP pilot program with settlement potential reaching $5 trillion, and Google’s Layer 1 platform surpassed 600,000 users.

Meanwhile, the UK–U.S. digital asset task force advanced cooperation efforts, and the EU accelerated progress on the digital euro. New projects gained momentum, including the Shiba Inu stablecoin and WLFI USD1 launching on Aptos on October 6. The week’s highlight, Token2049 in Singapore, attracted over 25,000 attendees, while MoonPay introduced AI-powered payment tools.

Together, these milestones reinforced confidence in the $4.22 trillion digital asset class, solidifying its legitimacy in both regulatory and institutional circles.

Ethereum’s Resurgence and Flippening Debate

ETH $4,538 holds $4,400, Fusaka Holesky, mainnet December. ETF $400M, staking 30M. Lee $8,000 Q4 treasury. ETH/BTC 0.037 to 0.09 ($11K ETH). Lubin flippening utility; Chainlink $1.4M; TRON $650B. PSE privacy 2026.

Bitcoin’s 4-Year Cycle: ATH Signals Peak Phase

Hougan ETF taming, polls 62% intact. Chart: halving surge, Q3 consolidation, Q4 ATH $140K-150K. Supply cuts like Hyperliquid 45% HYPE.

Other News: Funding, Launches, and Incidents

Gemini $5B IPO; Polymarket $10B raise; Shibarium patch $2.4M hack; Solana Alpenglow 40% congestion cut; Jupiter $130M TVL; Ordinals soft forks; Base 1.3M trades. Aster $680M airdrop October 14; Solstice SLX farming; USDD 8% hold-earn; MetaMask $30M LINEA; Sonic wedge; Privacy coins ZEC/DASH/XMR strong; Hypurr NFTs $68.9K floor; Plasma $XPL $15B val $2B liquidity; China’s CNH stablecoin; Tether USA₮; presales BlockchainFX/Pepeto/BullZilla. Zerohash $104M, OranjeBTC Brazil. UXLINK $11.3M hack, pre-announcement probes. Kresus smart wallets, Mini Apps. BNB Chain 56.4M MAU.

Conclusion: Momentum Builds for Q4 Explosion

The crypto market ended the week on a strong note, with total capitalization climbing to $4.22 trillion and Bitcoin reaching a new all-time high of $125,500. Institutional inflows of $1.2 billion, Ethereum’s advance following the Fusaka upgrade, and Solana’s rapid ecosystem growth continued to reinforce investor confidence. Despite short-term volatility and a few security incidents, on-chain indicators such as rising stablecoin supply above $300 billion and record exchange outflows show a healthy and resilient market foundation.

With October in full swing, the outlook for the final quarter of 2025 remains firmly bullish. Analysts expect Bitcoin to approach $150,000 before year-end, while altcoins may see gains between 20 and 50 percent as the Altcoin Season Index stabilizes near 60. Institutional participation, growing ETF revenues, and major project launches like Aster DEX and Plasma signal a maturing cycle driven by innovation, liquidity, and sustained global adoption.