Weekly Crypto Recap Sep 22–29: Bitcoin Steady, Ethereum Gains

Introduction: A Week of Rebounds and Cautious Optimism

We will see Weekly Crypto Recap Sep 22–29, with total capitalization rising from $3.7T to $3.86T (+1.9%) despite volatility. Gains were fueled by institutional inflows, regulatory clarity, and easing U.S. shutdown fears (Polymarket odds down to 77%). Bitcoin held steady at $111,846 (+1.8% weekly), Ethereum advanced to $4,117 (+3.2%), while altcoins followed: Solana $210 (+5.1%), XRP $2.86 (+3.7%), and BNB $1,010 (+4.5%).

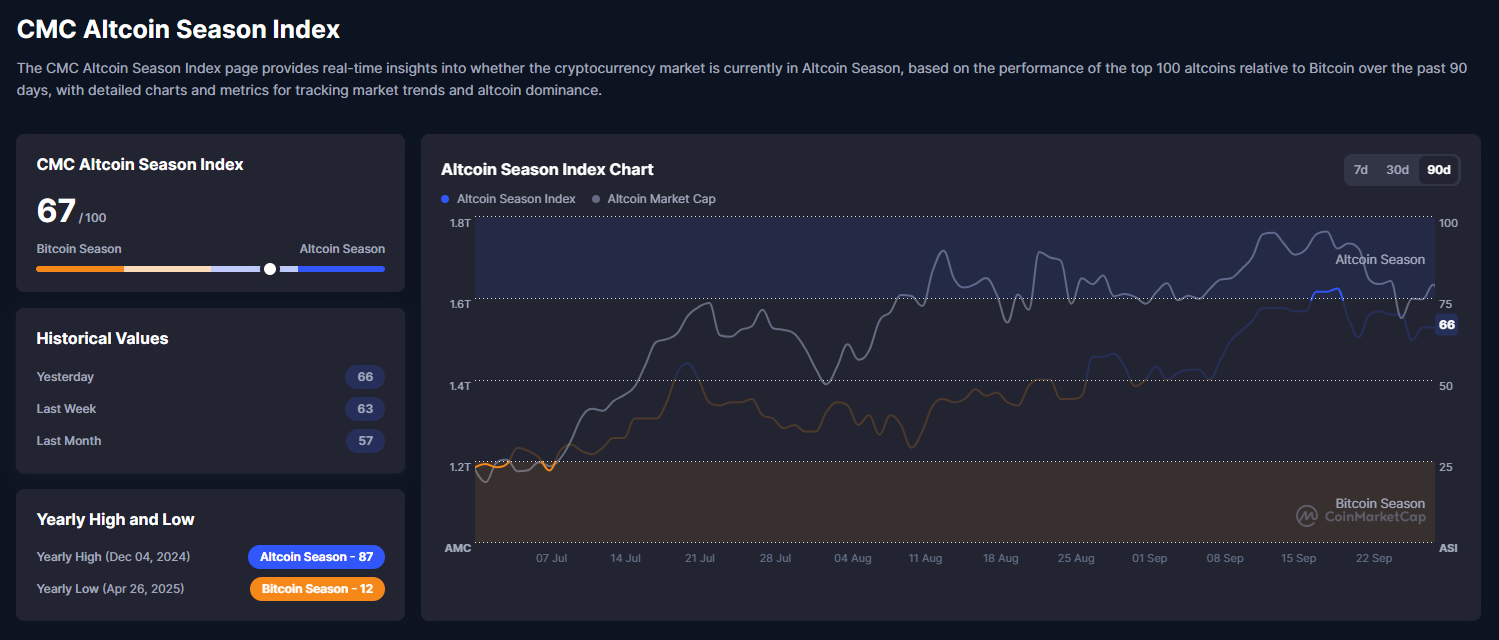

Trading volume averaged $119.02 billion, showing opportunistic dip-buying. Meanwhile, the Fear and Greed Index slipped to 39, reflecting caution after $1.8 billion in liquidations and hotter CPI data (2.6% vs 2.5% forecast), which cut Fed rate-cut odds to 75% for 50bps. Key themes included a cooling altcoin season with the index at 66, institutional accumulation like BlackRock’s $262.7 million BTC buy and Fidelity’s $178 million ETH addition, and project milestones such as Solana’s Alpenglow upgrade and Ripple’s RLUSD stablecoin launch. Regulatory progress, including UK-U.S. taskforce alignment and EU digital-euro advances, added tailwinds, while hacks like UXLINK’s $11.3 million loss and security probes into pre-announcement trading highlighted risks.

This week’s action defied “Red September” expectations, where historical data shows average -5% returns, instead echoing 2021’s late-month bounces driven by policy clarity. On-chain metrics supported the uptick: stablecoin volumes surpassed Visa’s Q1 at $6 trillion, ETH stablecoin supply hit $165 billion ATH, and whale sell-offs of 147,000 BTC were offset by treasury additions like Metaplanet’s 5,419 BTC ($632 million). Emerging trends like China’s first CNH stablecoin and Tether’s USA₮ launch signaled stablecoin innovation, while presales for BlockchainFX, Pepeto, and BullZilla drew attention. Geopolitical factors, including U.S.-China tech spats, reinforced crypto’s hedge appeal, though Nasdaq correlations (0.7) amplified equity sell-offs. With $3.2 billion in unlocks ahead, volatility persists, but reduced leverage (OI at $36 billion) mitigates cascades. Analysts from FxPro noted the market’s “fear of calm,” but fundamentals like ETF net +$57 billion YTD for BTC suggest dip-buying opportunities.

From the CoinMarketCap overview (Image 1: Crypto Market Overview dashboard displaying total cap at $3.86T, volume $119.02B, Fear & Greed at 39, Altcoin Season Index at 66, and CoinMarketCap 20 Index at $244.25 +2.47%), the recovery is evident: the cap line rebounds from early-week lows near $3.7T, with volume spikes on up days confirming buyer conviction.

Analysis of Crypto Total Market Cap and Indices

CoinMarketCap data shows market cap at $3.86T (+0.68% daily), erasing mid-week losses from a $3.65T dip. Volume rose 5% to $119.02B, below August highs but signaling renewed demand. BTC dominance slipped to 57.5%, giving alts 42.5%—a setup for rotation reminiscent of 2021. The 30-day chart forms a V-shape, with the $3.75T 50-day MA holding as support.

Historical September weakness (-4.8% average) makes this performance notable, with volume profiles showing accumulation at lows. Ethereum’s 17.5% share expanded on staking inflows, while SOL’s 3% grew on TVL hits $13 billion+. Risks include overextension—cap RSI at 58—but stablecoin market cap at $187 billion provides liquidity buffer.

The Fear & Greed Index stands at 39, down from 47, showing caution after mid-week lows. Historical swings, high at 88, low at 15, frame this as a fear-driven opportunity. Social buzz dropped 10% while volatility rose 15%, yet past September “Fear” levels often preceded 20–40% October rallies.

The CMC Altcoin Season Index at 67/100 (Image 3: Altcoin Season Index chart at 67, historical: yesterday 66, last week 63, last month 57) indicates sustained alt strength, up from 57, though off peaks. The blue line surges with alt cap, showing 12% outperformance vs. BTC over 90 days. Breaches of 65 historically extend for weeks, positioning for reignition if BTC holds.

Technical Analysis and Outlook for Key Tokens

The technical analysis of the cryptocurrency market as of September 29, 2025, highlights a recovery phase amid corrective volatility, with major tokens displaying resilience at key supports while facing resistance from recent highs. Market sentiment, per the Fear and Greed Index at 39, leans toward fear, influenced by macro data like CPI surprises and shutdown risks, yet the Altcoin Season Index at 67 suggests ongoing rotations providing relative strength to alternatives. Bitcoin’s dominance at 57.5% allows for alt outperformance if it consolidates. This section reviews setups for BTC, ETH, SOL, and XRP, emphasizing price patterns, RSI/moving averages, volume, and formations, with scenarios backed by history and on-chain insights.

Bitcoin trades at $112,164, holding an ascending channel since February. Support at $108K cushioned September’s dip, while resistance looms at the $112.5K 50-day MA after rejection at $116K. RSI sits near neutral with bullish divergence, and Bollinger Bands are tightening for a likely breakout.

If BTC clears $112.5K, targets extend to $116K–$118K, echoing post-September rallies in 2021. A drop below $108K risks testing $105K–$100K. Base case: sideways between $108K–$112K until Fed updates. Bias: cautiously bullish with fair value near MVRV 2.5.

Ethereum trades at $4,142, holding trendline support near $4,100 after retreating from highs. RSI at 48 edges toward oversold, while contracting Bollinger Bands signal a potential breakout. On-chain, staking tops 29M ETH and gas fees rose 12%.

A push above $4,200 opens the way to $4,500–$4,800, while a drop under $4,100 risks $3,800. Neutral–bullish bias, supported by ETF inflows and DeFi demand..

Solana trades at $210, consolidating above $205 support within a rising channel since March. RSI at 55 shows momentum intact, and TVL has surpassed $13B with over 1M daily users.

A break above $215 could extend toward $230–$250, while losing $205 risks $190. Bias: bullish, with upgrades driving adoption.

XRP trades at $2.87, ranging between $2.70–$2.95 in low volume. RSI at 45 signals neutrality, while ODL flows reach $1.3B daily.

A close above $2.95 targets $3.20–$3.50; below $2.70 risks $2.50. Bias: neutral until volume returns.

Institutional Inflows: Buffering Dips

Inflows slowed to $720 million, BTC $420 million, ETH $300 million, streak intact. BlackRock $262.7M BTC, Fidelity $178M ETH, treasuries like Metaplanet 5,419 BTC ($632M). Bitwise 3.5x mining buys, on-chain ETF 520K BTC. Aligns with supports, RSI neutrality entries.

Macroeconomic Backdrop: CPI Weighs Sentiment

CPI 2.6% YoY hotter, core 3.2%, cuts to 75% 50bps. Unemployment 4.2%, wages 0.4%, stagflation fears, S&P -0.8%, DXY 98.2. China’s stimulus indirect lift, tariffs gold $3,500, Saylor BTC hedge. BTC channel holds on CPI.

Policy Wins: Clarity Boosts

Trump’s American Bitcoin $30M Nasdaq. SEC staking non-securities, Shiba Inu stablecoin. Pakistan 5 exchanges, Brazil 2% BTC reserves ($7.4B). SWIFT XRP trials $5T, Google’s L1 500K users. UK-U.S. taskforce, EU digital-euro.

Ethereum’s Resurgence and Flippening Debate

ETH $4,117 holds $4K, ETF $300M, staking 29M. Lee $8,000 Q4 treasury. ETH/BTC 0.037 to 0.09 ($11K ETH). Lubin flippening utility; Chainlink $1.3M; TRON $620B.

Bitcoin’s 4-Year Cycle: Dips in Trend

Hougan ETF damping, polls 62% intact. Chart: halving surge, Q3 dip, Q4 $140K-150K.

Other News: Funding and Hacks

Gemini $5B IPO; Polymarket $10B; Shibarium patch $2.4M hack; Ethereum PSE privacy; Solana Firedancer 35% fees; Jupiter $120M TVL; Ordinals forks; Base 1.2M trades. Zerohash $104M, OranjeBTC Brazil.

Conclusion: Rebound Foundations Laid

The week closed at $3.86T with institutions buffering dips. If BTC holds $112K, targets shift to $116K+, while ETH eyes $4,500, SOL $230, and XRP $3.20. With FOMC decisions and major unlocks ahead, volatility remains, but resilient fundamentals and inflows lay the groundwork for Q4 opportunities.