What Is a Stablecoin? The Backbone of Modern Digital Finance

Key Takeaways

- Stablecoins bridge traditional finance and blockchain, combining the reliability of fiat with the efficiency of digital assets.

- They serve as the foundation of liquidity in crypto markets, powering trading, lending, and payments across DeFi and centralized exchanges.

- Fiat-backed Stablecoins like USDT and USDC dominate due to trust and accessibility, while crypto-backed and algorithmic models push decentralization and innovation.

- Their success depends on trust, transparency, and regulation — clear audits, strong reserves, and global legal frameworks ensure long-term stability.

- Risks remain, including depegging events, regulatory uncertainty, and centralization, but continuous improvements strengthen the ecosystem.

- As adoption grows, Stablecoins are poised to become the digital foundation of global money, shaping how value moves across borders, platforms, and economies.

Stablecoins are reshaping the future of digital finance. This article explores how they bring stability to the volatile crypto market, bridge traditional finance with blockchain, and make global payments faster and more accessible. By understanding what Stablecoins are and how they work, you’ll see why they’ve become the foundation of the modern digital economy.

What’s Stablecoin?

In the fast-moving world of cryptocurrency, prices rise and fall within minutes. Bitcoin can gain thousands of dollars in a single day, and lose them just as quickly. Amid this volatility, stablecoins emerged as a quiet revolution.

A stablecoin is a type of digital currency created to hold steady in value, usually by being tied to a real-world asset such as the U.S. dollar, the euro, or even gold. Its mission is to blend the speed and transparency of blockchain with the stability of traditional finance. Unlike Bitcoin or Ethereum, whose prices fluctuate constantly, a Stablecoin aims to stay around one fixed value, most commonly one U.S. dollar.

For beginners, understanding what a Stablecoin is means understanding how trust, technology, and money meet in the digital age. Stablecoins make it possible to send funds instantly across borders, trade safely without exposure to wild swings, and use crypto as a reliable medium of exchange. In short, they are the foundation of today’s digital economy, connecting banks, blockchains, and billions of people worldwide.

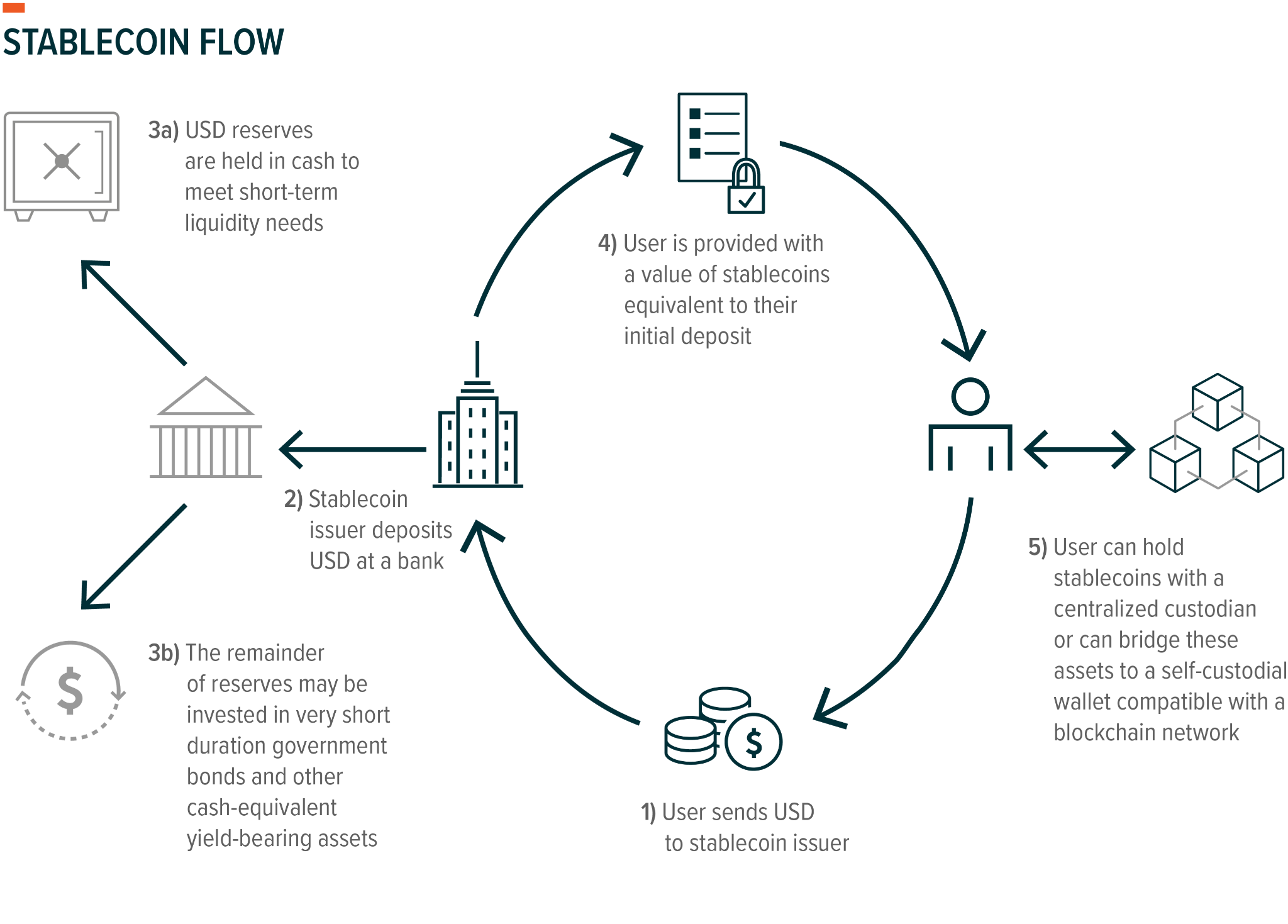

How Stablecoins Work: The Mechanism Behind Stability

To grasp the importance of a stablecoin, it’s essential to understand how it maintains its steady value in a market built on volatility. While most cryptocurrencies swing wildly in price, a Stablecoin is engineered to remain firm, usually at one U.S. dollar. It achieves this stability through carefully designed mechanisms that balance trust, liquidity, and technology.

At its core, a Stablecoin relies on collateral or algorithmic control to preserve its peg. The most common model is fiat-backed, where every digital token represents one unit of real-world currency held in reserve. When users purchase a Stablecoin, the issuer locks an equal amount of cash or government securities in custody. When they redeem it, that collateral is released. This direct link between circulation and backing keeps the value anchored.

Other Stablecoins use crypto assets as collateral. Platforms such as MakerDAO allow users to deposit cryptocurrencies like Ethereum to mint Stablecoins such as DAI. Because the value of crypto can fluctuate sharply, these systems require more collateral than the Stablecoin issued, often 150% or higher. If the market falls, automated liquidations maintain solvency and protect the peg.

A more experimental category is the algorithmic stablecoin, which depends on smart contracts that adjust supply according to demand. When prices rise above one dollar, the system issues new tokens to cool the market. When they fall, it removes tokens from circulation. The idea mimics monetary policy but in a decentralized way. However, without solid reserves, this model can unravel during crises, as the TerraUSD collapse once proved.

Each approach carries its own risks and trade-offs, yet they share one mission: to give digital money the stability of fiat currency with the flexibility of blockchain. This balance has made Stablecoins the cornerstone of the modern crypto economy.

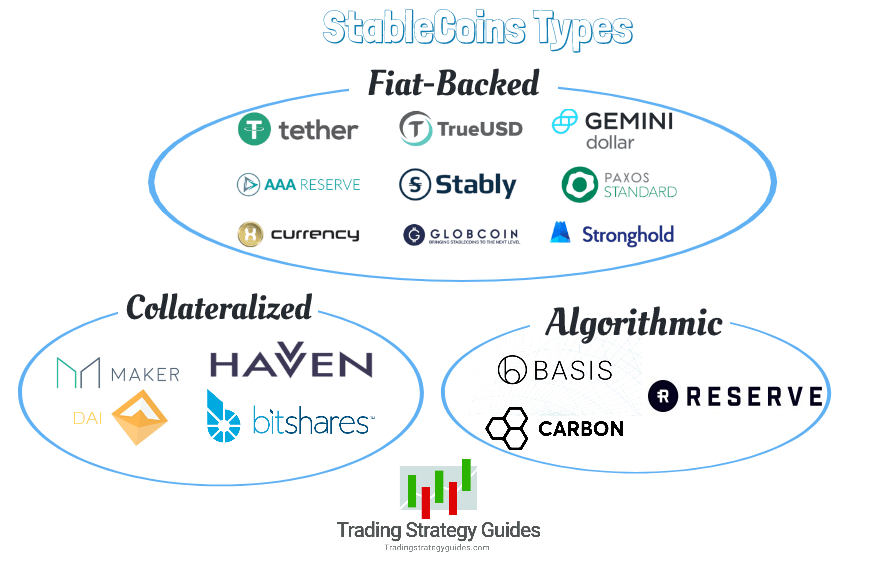

Main Types of Stablecoins

Every stablecoin promises one thing: stability. Yet behind that promise lie very different architectures, philosophies, and levels of risk. Understanding how each type works is the key to knowing which ones truly deserve trust and long-term adoption.

Fiat-Backed Stablecoins

This is the powerhouse of the market, the backbone of global liquidity. A fiat-backed Stablecoin maintains its value through reserves of traditional currency such as U.S. dollars or euros held in regulated banks. For every digital coin issued, there’s a matching dollar sitting in custody.

Tether (USDT) and USD Coin (USDC) dominate this category. Tether fuels trading on nearly every exchange, while USDC, managed by Circle and Coinbase, has earned institutional credibility through transparency and audited reserves.

The strength of this model lies in its simplicity: it’s as stable as the money backing it. Yet it comes at a cost: centralization. Users must trust the issuer’s integrity, regulation, and disclosure practices. When done right, fiat-backed Stablecoins offer the most practical bridge between traditional finance and the blockchain economy.

Crypto-Backed Stablecoins

For those who value decentralization, crypto-backed stablecoins embody the spirit of Web3. Instead of relying on banks, they lock cryptocurrencies into smart contracts as collateral. Because crypto assets can swing in price, these systems use over-collateralization to stay solvent, often holding $150 or more for every $100 worth of Stablecoin issued.

Let’s take DAI from MakerDAO as an example, a Stablecoin that perfectly illustrates how this model works. Users deposit assets like ETH or wrapped Bitcoin, mint DAI against them, and manage collateral ratios through autonomous protocols. When markets crash, liquidations are triggered automatically to protect the peg.

This design removes human trust from the equation. Everything runs on code, transparent and verifiable. Yet its complexity can intimidate newcomers, and in extreme volatility, liquidation risks remain real.

Algorithmic Stablecoins

Then come the risk-takers, the algorithmic stablecoins. Instead of collateral, these rely on smart contracts to balance supply and demand. When a coin trades above one dollar, new tokens are minted to push the price down. When it falls below one dollar, tokens are removed from circulation to lift it back up.

The concept is elegant but fragile. The collapse of TerraUSD (UST) in 2022 exposed the weakness of relying purely on market confidence. Once trust breaks, the system can spiral into a “death loop” of panic and devaluation. Still, the innovation continues. New hybrids like FRAX combine algorithms with partial reserves to create more resilient models.

Algorithmic Stablecoins represent the frontier of innovation, daring and experimental, still searching for a sustainable balance.

To sum up what we’ve just explored, let’s look at the table below, it helps visualize the distinctions between each Stablecoin model.

Type of Stablecoin | Backing Mechanism | Examples | Decentralization Level | Core Strengths | Key Weaknesses |

| Fiat-Backed | Real-world currency held in banks or Treasuries | USDT, USDC, TUSD | Low | High stability, massive liquidity, easy redemption | Centralized control, regulatory risk |

| Crypto-Backed | Crypto assets locked in smart contracts | DAI, sUSD | Medium–High | Transparent, decentralized, fully on-chain | Complex management, risk of liquidation |

| Algorithmic | Supply adjusts automatically via smart contracts | FRAX, UST (defunct) | High | Scalable, capital-efficient, decentralized design | Fragile during confidence loss, depegging risk |

Each model reflects a different vision of digital money. Fiat-backed Stablecoins deliver global trust and usability. Crypto-backed Stablecoins preserve the decentralized ideal. Algorithmic Stablecoins push innovation into uncharted territory. Together, they form the living spectrum of stability, the heartbeat of the Stablecoin economy.

Why Stablecoins Matter in the Modern Financial Landscape

The strength of a Stablecoin lies in what it enables: fast transactions, deep liquidity, and global access to digital dollars. It is more than a tool for traders; it forms the core of the new financial infrastructure. Stablecoins give markets structure, allow businesses to transact freely, and help individuals in unstable economies preserve their wealth.

The Core of Market Liquidity

Every major crypto exchange depends on Stablecoins. They anchor trading pairs, keep capital circulating, and ensure instant transactions. Today, more than 70% of all crypto trades use Stablecoins as the settlement currency. When volatility rises, traders shift into Stablecoins to lock in profits or wait for new opportunities. When confidence returns, that same liquidity powers the next wave of growth.

Stablecoins are the heartbeat of digital markets: steady, reliable, and always active. They keep exchanges fluid, markets open, and value constantly moving.

A New Era of Global Payments

Stablecoins have transformed how money moves around the world. What once took several days through banks now happens in seconds. A freelancer in Vietnam can receive payment from a client in London instantly. A small business in Mexico can settle with suppliers in Japan without facing banking delays or excessive fees.

This is a new level of financial connectivity driven by blockchain technology. It is faster, simpler, and accessible to anyone with a smartphone and an internet connection.

The Gateway to DeFi and Web3

Stablecoins are the foundation of decentralized finance. They serve as the unit of account for lending, staking, and yield farming on platforms like Aave, Compound, and Curve. For many users, Stablecoins are the first step into Web3: familiar in value, yet powered by blockchain.

They make decentralized systems practical. Transactions are predictable, returns are measured in stable units, and users can navigate DeFi without worrying about wild price swings. This balance between stability and innovation is what keeps Web3 growing.

Protection in an Unstable World

In economies struggling with inflation, Stablecoins offer a form of protection. In Argentina, Turkey, and several African nations, people turn to USDT or USDC to secure their savings and preserve purchasing power. They can store, send, and spend digital dollars freely, without relying on local banks or restrictive regulations.

For many, a Stablecoin represents freedom: control over money, access to a global marketplace, and a shield against economic uncertainty.

Stablecoins have become one of the defining innovations of modern finance. They bring stability to volatility, accessibility to finance, and trust to the digital economy. They are not a trend in crypto; they are its foundation.

The Economic Role and Future of Stablecoins

Stablecoins have grown from a trading tool into a core layer of modern finance. They connect banks, exchanges, and digital platforms into one seamless system. Fast, transparent, and programmable, Stablecoins are shaping how money moves in the digital world.

A New Financial Infrastructure

Stablecoins work as digital settlement rails. They let money travel instantly and across borders without friction. A company can send funds to suppliers worldwide in seconds. A freelancer can get paid directly, without banks or middlemen. This is real financial efficiency: faster, cheaper, and global.

Payment giants now use Stablecoins in daily operations. Visa and PayPal settle transactions with USDC on blockchain networks. What used to take days now happens in moments. Stablecoins are building the rails for a unified digital economy where value flows as easily as data.

The Engine of On-Chain Finance

In decentralized finance, stablecoins are the lifeblood of liquidity. They are used for lending, staking, trading, and savings across platforms like Aave, Compound, and Curve. Every loan, swap, and yield strategy relies on Stablecoins to hold steady value.

Funds and institutions use them as well. Hedge funds move assets between exchanges with Stablecoins. Businesses hold them as cash reserves. They offer the speed of crypto and the reliability of fiat, turning digital assets into practical tools for real finance.

The Path to Institutional Use

Clearer regulations are helping Stablecoins reach a new stage. The EU’s MiCA framework and the U.S. Clarity Act set the ground for trusted issuers. With transparency and compliance, Stablecoins gain credibility among banks and corporations.

Big names are already building their own versions. JP Morgan runs JPM Coin, PayPal issues PYUSD, and Circle expands USDC into new regions. These projects show one direction: Stablecoins becoming part of everyday financial systems, from payroll to trade settlement.

The Road Ahead

By the end of this decade, Stablecoins could rival traditional payment networks in scale. Their future depends on three key pillars: regulation, scalability, and interoperability. Stronger rules build trust, efficient blockchains reduce costs, and cross-chain systems create a true global network.

Next-generation Stablecoins will move across multiple chains, support various currencies, and include built-in safeguards. They will integrate directly into digital wallets, e-commerce, and enterprise systems.

Stablecoins represent the next chapter of money: stable, borderless, and programmable. They blend the security of traditional finance with the agility of blockchain, creating a faster, more inclusive world economy.

Risks and Challenges of Stablecoins

Every stablecoin carries risks. To stay stable, it must balance trust, liquidity, and technology in real time. The table below summarizes the five main risks that shape a stablecoin’s credibility: from regulation and reserve transparency to technology and control.

Category | Description | Impact on Stability | Examples / Notes |

| Regulation | Uneven global rules; new frameworks still forming | Slows adoption and increases compliance pressure | MiCA (EU), Clarity Act (US) |

| Reserves & Transparency | Weak or unclear backing damages confidence | Peg can slip if reserves aren’t fully audited | USDC gains trust through monthly attestations |

| Depegging | Market stress or liquidity loss breaks the peg | Triggers panic and short-term price drops | TerraUSD collapse (2022), USDC depeg (2023) |

| Centralization | Issuers control reserves and user accounts | Reduces autonomy, raises censorship risk | DAI offers a decentralized alternative |

| Security | Smart contract flaws or bridge attacks | Can cause liquidity loss or halted transactions | Demands audits and active on-chain monitoring |

FAQs

1. What is Stablecoin?

A Stablecoin is a digital currency pegged to stable assets like the U.S. dollar or gold to maintain consistent value.

2. How are Stablecoins used?

They are used for trading, payments, remittances, and as collateral in decentralized finance (DeFi).

3. Are Stablecoins safe?

Safety depends on the issuer’s transparency and reserves. Regulated Stablecoins like USDC are considered more reliable.

4. What causes a Stablecoin to lose its peg?

A depeg can happen when reserves are insufficient, demand drops sharply, or market panic spreads.

5. What is the future of Stablecoins?

They are expected to integrate deeper into global finance, working alongside banks, fintechs, and central bank digital currencies (CBDCs).

Conclusion

Stablecoins now stand at the center of digital finance. They connect crypto with real-world money, power DeFi, and make global payments instant. Stability, transparency, and speed are what keep them growing. With clear regulation and stronger technology, Stablecoins will continue shaping how value moves across borders and platforms.

The next wave of innovation will focus on interoperability, compliance, and everyday use. As more banks, fintechs, and users join in, Stablecoins are set to become the digital standard of modern money: steady, accessible, and universal.