What is COW Protocol? Key Features & Advantages

What is Cow Protocol?

Cow Protocol is a DEX Aggregator running on the Ethereum platform, consisting of CowSwap, CowDAO, and other tools that help group orders together and match them using a method called Coincidence of Wants (CoW). For orders that don’t have enough liquidity, it sends them through Cow to a decentralized exchange (DEX) that offers the best price for execution. This way, the protocol makes sure users always get the most favorable deal.

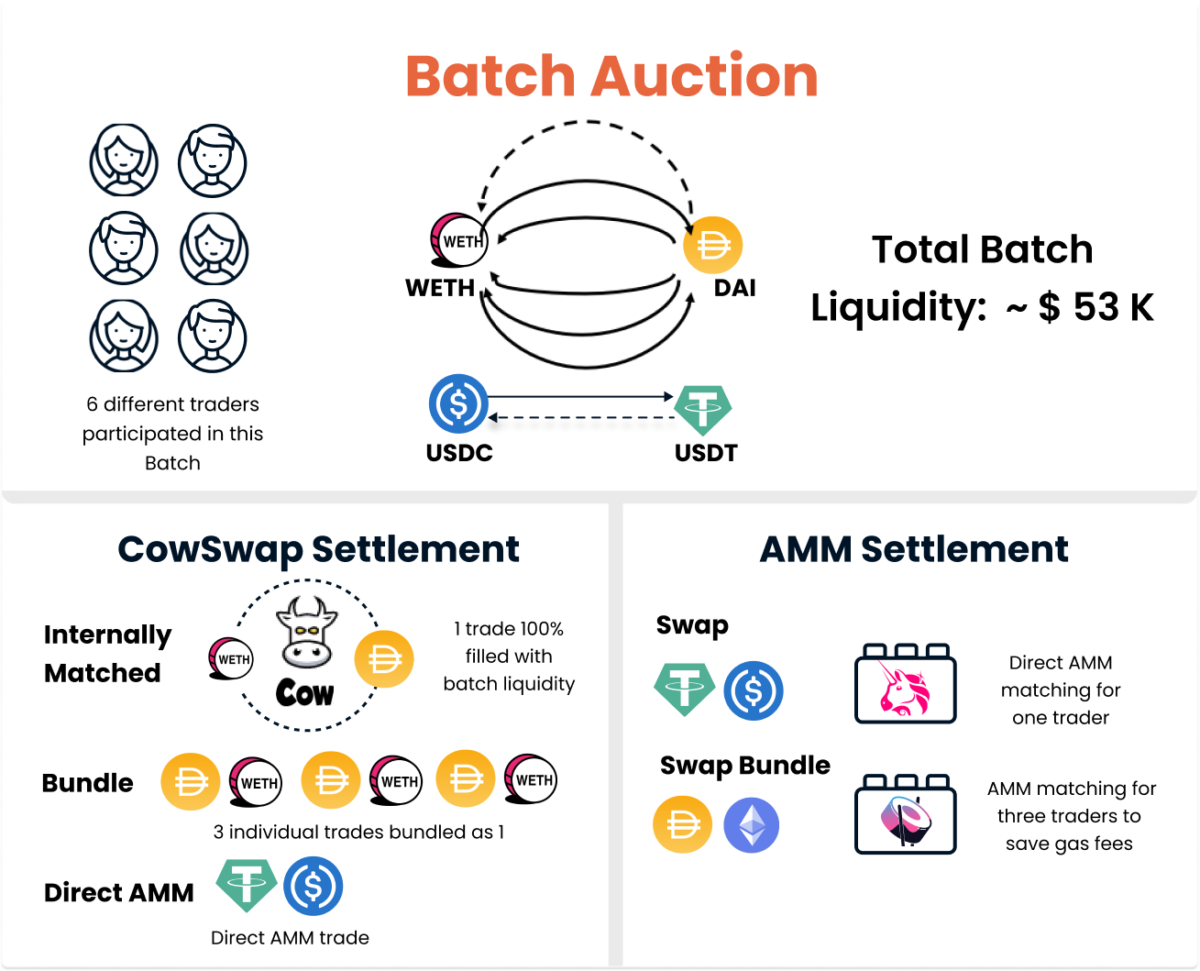

The Coincidence of Wants (CoW) works like this: when you and another trader each have something the other wants, your trade happens directly between you without relying on an Automated Market Maker (AMM). This means you skip extra fees and slippage. Only the parts of the trade that can’t be matched with other CowSwap users get routed to the underlying AMM.

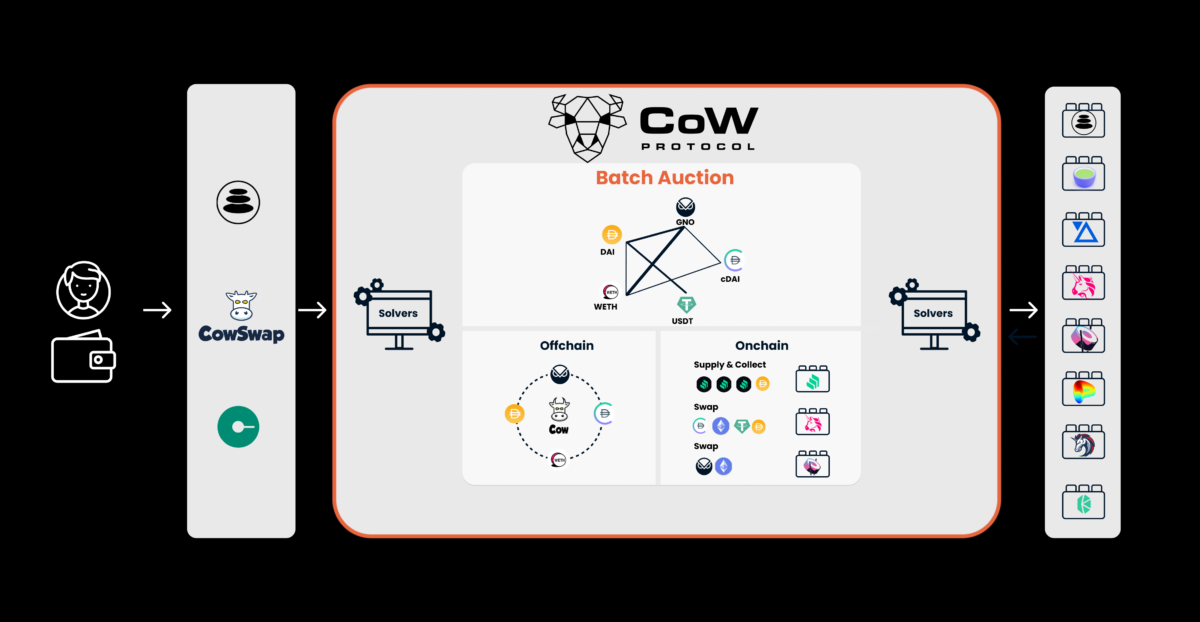

Model of COW

One of the standout features of the Cow Protocol is CowSwap. It’s a DEX aggregator and the first trading interface built on the CoW protocol. It officially kicked off on April 28, 2021, and lets you buy and sell tokens using gasless orders. These orders are settled directly between users or routed to any available liquidity source on the chain.

Almost everything on the Cow Protocol runs through CowDAO. CowDAO is a group made up of developers, traders, market makers, and a bunch of other community members who are all on the same page with its vision. The Cow Protocol tech creates a network that makes peer-to-peer order matching smooth and efficient.

How Cow Protocol Works

Orders get grouped together into batches—usually, a new batch starts every 30 seconds. These batches are then put up for auction, and the highest bid wins the right to process them. The folks taking part in the Cow auction are called Solvers. They manage the transaction batches by matching orders directly between users, and any leftover liquidity that doesn’t get matched is sent to the DEX offering the best price.

What It Takes to Be a Solver

Oh, and good news for users: canceling or placing an order? No fees at all. Keeps things smooth and easy. Right now, the protocol isn’t making any cash—Solvers get to keep all the transaction fees for themselves.

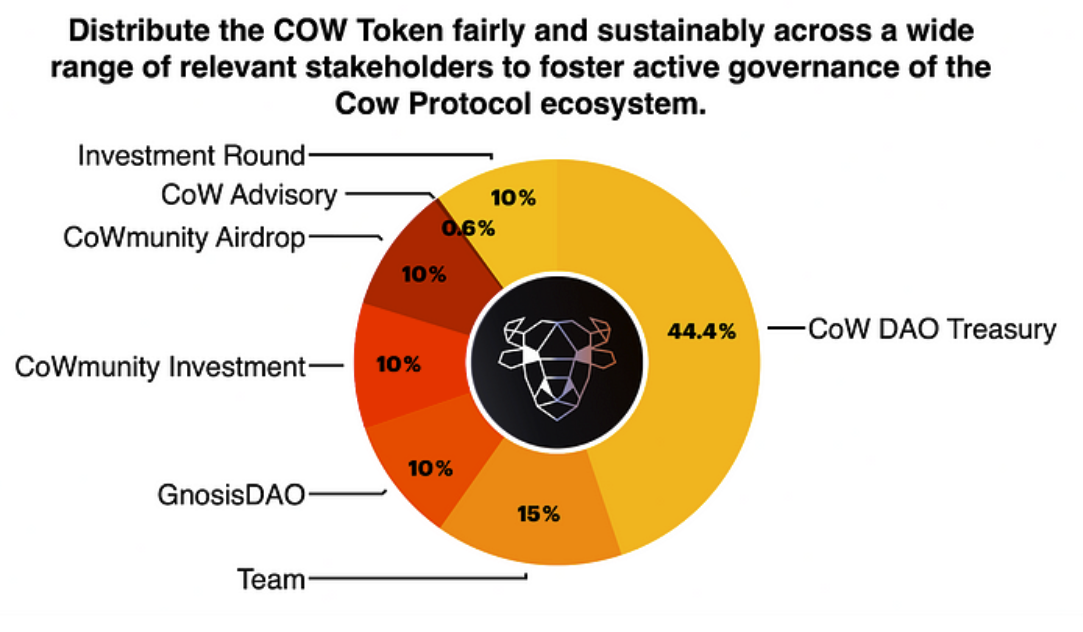

COW Protocol Tokenomics

COW Protocol Tokenomic. Source: kervecapital.com

Conclusion

Cow Protocol brings a pretty solid product to the table, but snagging a juicy slice of the pie from big players like 1Inch, Matcha, and the rest? Yeah, that’s still a tough nut to crack. Still, Cow’s got a steady crew of users who keep coming back. On the project side, though, the protocol hasn’t started raking in any revenue yet.

Hope this write-up’s given you some useful insights!