When “Stable” Isn’t Safe: Lessons from USDe $20B collapse

Key Takeaway

The USDe $20B collapse revealed how quickly synthetic stability can turn into systemic shock , and how leverage, yield, and confidence intertwine in crypto markets.

- High yield means high exposure. Every extra % of return hides layers of leverage, derivatives, or liquidity risk.

- Leverage multiplies emotion. Gains and losses accelerate together — precision matters more than speed.

- Synthetic stability is fragile. When trust and liquidity diverge, even “stable” assets can collapse in minutes.

- Discipline beats excitement. Calm, structured investors outlast markets driven by greed or fear.

- Survival defines success. Consistent 20% growth across a decade outweighs one explosive bull run that ends in ruin.

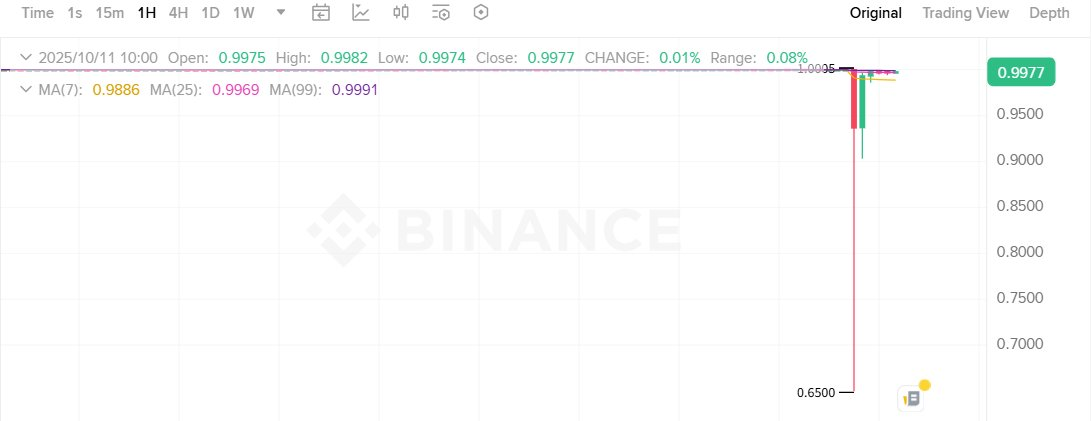

We all know the story — the USDe $20B collapsed. In just 40 minutes, over 19 billion dollars vanished as USDe lost its peg on Binance, exposing how fragile synthetic stability can become when yield and leverage collide. The event became a defining moment, revealing how quickly confidence transforms into crisis in the digital financial system.

In the latest article, we explored how the collapse unfolded through funding mechanics, recursive lending, and unchecked optimism. This time, we focus on what truly matters: principles for staying resilient in turmoil, discipline for protecting capital amid volatility, and a clear mindset for navigating uncertainty before the next storm arrives.

The $20 Billion Wake-Up Call

October 10–11, 2025 became one of the most turbulent chapters in crypto history. A sudden announcement from Washington imposing a 100% tariff on Chinese imports set off a chain reaction that shook global markets. Stocks fell, volatility surged, and within hours, digital assets were pulled into a storm.

At the center was USDe, the synthetic stablecoin developed by Ethena Labs. As prices whiplashed across exchanges, its peg on Binance slipped to 0.65 dollars. In less than 40 minutes, 1.7 million traders were liquidated and 19.3 billion dollars disappeared. Bitcoin dropped below 110,000 dollars, Ethereum slid under 3,700, and altcoins across the board plunged under extreme selling pressure.

The shock exposed the scale of leverage woven through the market. Recursive lending unraveled, funding rates turned negative, and market makers scrambled to unwind massive positions. Within an hour, the market’s layer of stability peeled away, revealing a landscape driven by raw leverage, human emotion, and the thin line between profit and collapse.

What followed was more than a price correction, it was a chain reaction of liquidations, a stress test for synthetic stability, and a harsh lesson in how leverage multiplies risk faster than most realize.

Understanding What a Stablecoin Really Is

To draw real lessons from the $20 billion liquidation, it helps to start with a clear view of what a stablecoin represents. It functions as a digital financial instrument powered by code, liquidity, and collective trust.

A traditional bank deposit operates within a structured system. In the United States, the FDIC covers up to 250,000 dollars per depositor, ensuring protection even during financial stress. In crypto, transactions move instantly through smart contracts that execute without delay, creating both efficiency and exposure.

Banks maintain capital buffers and face continuous audits under defined regulations. Stablecoin protocols, by contrast, evolve in faster environments where innovation and risk often travel together.

When an investor allocates 100,000 dollars into a stablecoin, the act reflects confidence: in the system’s design, in its liquidity, and in the people maintaining its stability. That confidence forms the foundation of value in digital finance.

Two Faces of Stability and Why They Matter

The word “stablecoin” covers two completely different systems, each built for a distinct purpose.

Type | Goal | Backing | Yield | Suitable For |

| Payment Stablecoins | Preserve value and enable transfers | U.S. dollars and Treasuries | 0–5% | General users |

| Synthetic or Yield-Bearing Stablecoins | Create returns through strategy | Crypto assets and derivatives | 10–50% | Experienced investors |

USDe belonged to the second group. It operated as a yield-driven instrument built on trading mechanics and market hedging, offering impressive returns during calm conditions. Yet many holders approached it as a basic payment token, using it for collateral and savings.

This mismatch between design and perception set the stage for one of the largest chain reactions in crypto history, where innovation met misunderstanding and leverage turned stability into volatility.

The Illusion of Safe Yield

Every product in finance balances risk and reward along the same curve.

- USDC and USDT offer modest yield with minimal exposure.

- USDe delivers higher returns built on market mechanics and derivatives.

- Recursive USDe lending multiplies both yield and leverage to extreme levels.

During the USDe surge, investors embraced “looping,” a strategy that turned ordinary returns into astonishing gains. By depositing USDe as collateral, borrowing more, and repeating the cycle, yields expanded from 12% to nearly 50%. Each loop added momentum, creating the feeling of effortless growth.

The system thrived until a single drop in price broke its rhythm. When USDe slipped to 0.65 dollars on Binance, positions across lending protocols unwound in unison. A chain of liquidations swept through Aave, Morpho, and Binance, erasing billions within minutes.

The event served as a reminder of the rule markets never forget: leverage magnifies everything: profit, loss, and emotion.

Lessons From the $20 Billion Liquidation

The USDe $20B collapse became a clear demonstration of how reward, risk, and leverage move together. It showed how a strategy that looks efficient in growth can turn into a collapse mechanism once confidence weakens.

Case Study: The $100,000 Loop

An investor begins with 100,000 USDT and joins the looping trend. They convert it to USDe, deposit it, borrow again, and repeat the process several times. After four rounds, total deposits reach 270,000 USDe while total debt climbs to 205,000 USDT. The position promises a 22% annual return but carries 2.7x leverage.

Then the market shifts. When USDe loses 35% of its value, the collateral ratio drops from 133% to 86%. Automated liquidation engines respond instantly, closing the position within seconds.

Each cycle of borrowing and reinvestment magnifies both potential gain and potential loss. The system rewards precision but punishes excess. The USDe $20B collapse liquidation reminded every trader that in leveraged markets, growth without control eventually meets its limit.

High Yield Always Means High Risk

Every return carries a cost. Yield is never free; it comes from exposure: leverage, derivatives, or liquidity. The higher the gain, the closer you stand to the edge.

A few simple comparisons show the spectrum clearly:

- USDC / USDT: Lower yield, lower exposure, backed by dollars and Treasuries.

- USDe and synthetic models: Larger gains, greater risk, powered by trading strategies and market swings.

- Recursive lending (looping): Yield multiplied through borrowed capital, stacking reward and liquidation pressure together.

When Treasury bonds pay 4–5% and a protocol offers 15–50%, the difference isn’t efficiency; it’s risk. Every extra point of return comes from somewhere, usually deeper leverage or thinner liquidity.

Spotting the Red Flags Early

Smart investors sense risk before it rises. Markets always leave traces: patterns, tone shifts, and momentum changes revealing where pressure builds. Reading those signals early keeps portfolios steady when others chase yield.

Unrealistic Yield

Every number tells a story. Promises of 20%, 30%, or 50% yearly returns show how much risk fuels those gains. Yield grows from leverage, derivatives, or limited liquidity. Bigger rewards come with thinner safety margins.

Complex Mechanics

Clarity creates strength. A solid protocol explains its process in simple terms—source of yield, flow of capital, distribution of risk. Long technical layers and jargon often hide fragility ready to crack under stress.

Opaque Reserves

Transparency earns trust. Open audits, real collateral data, and live reporting inspire confidence during volatility. Hidden figures and delayed updates create confusion, and confusion feeds uncertainty.

Hidden Leverage

Leverage magnifies movement in every direction. Yield farming, looping, and recursive lending multiply exposure at high speed. Each turn of leverage pushes traders closer to the edge, where precision decides survival.

Blind Confidence

Euphoria blinds awareness. When profits fill every feed and communities celebrate guaranteed returns, curiosity fades. Conviction grows through data and constant questioning, not emotion. Awareness becomes the sharpest protection in heated markets.

Spotting these signs demands rhythm and discipline. Skilled investors read liquidity, sentiment, and market flow before the crowd reacts. When turbulence hits, they are already positioned for stability.

Core Survival Principles for Crypto Investors

Fast markets reward clarity and control. Every cycle introduces new players and narratives, yet the foundations of resilience stay constant. Capital grows when structure, preparation, and discipline align.

Diversify Wisely

Balance builds endurance. Exposure spread across assets, platforms, and strategies allows movement through volatility with confidence. A well-diversified portfolio transforms turbulence into opportunity.

Understand Leverage

Leverage expands every result. Each borrowed dollar increases the weight of both reward and exposure. Testing positions with 30–50% market shifts clarifies true capacity and strengthens decision-making.

Maintain Liquidity

Liquidity ensures flexibility. Keeping 20–30% of total assets in readily tradable holdings such as USDC or fiat creates space for action during volatility. The liquid reserve becomes the gateway to new entries when markets reset.

Act Before Pressure Builds

Timing defines success. Preparing exit levels, collateral ratios, and backup plans in advance transforms uncertainty into control. When the wave arrives, execution replaces hesitation.

Learn From History

Every era follows a familiar rhythm. Luna in 2022, FTX in 2022, USDe in 2025—each event reflected ambition running ahead of balance. Experience turns those stories into tools for foresight.

Readiness forms the core of long-term strength. Investors who prepare, observe, and adjust with purpose navigate volatility with confidence and stay aligned through every phase of the market.

FAQs

1. What caused the USDe $20B collapse?

A mix of over-leverage, negative funding rates, and Binance oracle errors triggered a 40-minute liquidation wave that erased $19.3 billion.

2. How is USDe different from USDT or USDC?

USDe is a synthetic stablecoin backed by crypto assets and derivatives, not by cash or Treasuries like USDT and USDC.

3. Can a collapse like this happen again?

Yes — any yield-bearing or synthetic stablecoin relying on market mechanics faces similar risks if liquidity breaks.

4. What’s the main lesson for investors?

High yield always equals high risk. In crypto, survival and discipline matter more than speed or short-term gains.

Final Lesson: Survival Over Profit

Every market cycle honors endurance. Consistent 20% growth over ten years outperforms a brief surge that burns out after four. Wealth compounds through time, patience, and protection, not through speed.

- When the next high-yield stablecoin appears, take a breath and question the foundation.

- Who holds the collateral?

- Where does the yield truly come from?

- How does the system behave when liquidity thins?

These questions separate resilience from exposure. They decide who navigates the correction and who becomes part of the aftermath.

In crypto and traditional finance alike, lasting strength comes from staying prepared, maintaining discipline, and building systems able to weather any storm. Survival remains the highest form of success.